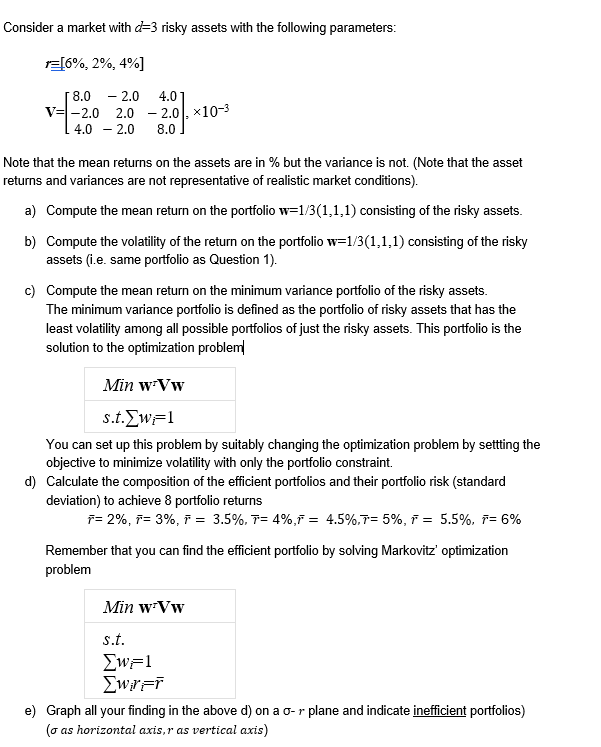

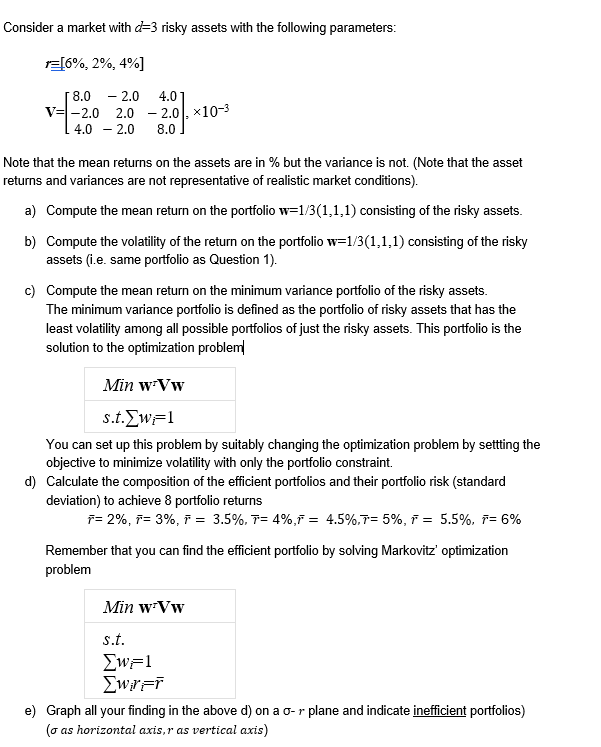

Consider a market with d=3 risky assets with the following parameters: [6%, 2%, 4%] 58.0 V=-2.0 [ 4.0 - 2.0 2.0 - 2.0 4.01 - 2.0, X10-3 8.0 ] Note that the mean returns on the assets are in % but the variance is not. (Note that the asset returns and variances are not representative of realistic market conditions). a) Compute the mean return on the portfolio w=1/3(1,1,1) consisting of the risky assets. b) Compute the volatility of the return on the portfolio w=1/3(1,1,1) consisting of the risky assets i.e. same portfolio as Question 1). c) Compute the mean return on the minimum variance portfolio of the risky assets. The minimum variance portfolio is defined as the portfolio of risky assets that has the least volatility among all possible portfolios of just the risky assets. This portfolio is the solution to the optimization problem Min wiVw s.t. Zw=1 You can set up this problem by suitably changing the optimization problem by settting the objective to minimize volatility with only the portfolio constraint. Calculate the composition of the efficient portfolios and their portfolio risk (standard deviation) to achieve 8 portfolio returns = 2%, F= 3%, F = 3.5%, 7= 4%,F = 4.5%, 1= 5%, F = 5.5%, = 6% d) Remember that you can find the efficient portfolio by solving Markovitz' optimization problem Min w Vw s.t. Xw1 wir Fr e) Graph all your finding in the above d) on a O-r plane and indicate inefficient portfolios) (o as horizontal axis, r as vertical axis) Consider a market with d=3 risky assets with the following parameters: [6%, 2%, 4%] 58.0 V=-2.0 [ 4.0 - 2.0 2.0 - 2.0 4.01 - 2.0, X10-3 8.0 ] Note that the mean returns on the assets are in % but the variance is not. (Note that the asset returns and variances are not representative of realistic market conditions). a) Compute the mean return on the portfolio w=1/3(1,1,1) consisting of the risky assets. b) Compute the volatility of the return on the portfolio w=1/3(1,1,1) consisting of the risky assets i.e. same portfolio as Question 1). c) Compute the mean return on the minimum variance portfolio of the risky assets. The minimum variance portfolio is defined as the portfolio of risky assets that has the least volatility among all possible portfolios of just the risky assets. This portfolio is the solution to the optimization problem Min wiVw s.t. Zw=1 You can set up this problem by suitably changing the optimization problem by settting the objective to minimize volatility with only the portfolio constraint. Calculate the composition of the efficient portfolios and their portfolio risk (standard deviation) to achieve 8 portfolio returns = 2%, F= 3%, F = 3.5%, 7= 4%,F = 4.5%, 1= 5%, F = 5.5%, = 6% d) Remember that you can find the efficient portfolio by solving Markovitz' optimization problem Min w Vw s.t. Xw1 wir Fr e) Graph all your finding in the above d) on a O-r plane and indicate inefficient portfolios) (o as horizontal axis, r as vertical axis)