Answered step by step

Verified Expert Solution

Question

1 Approved Answer

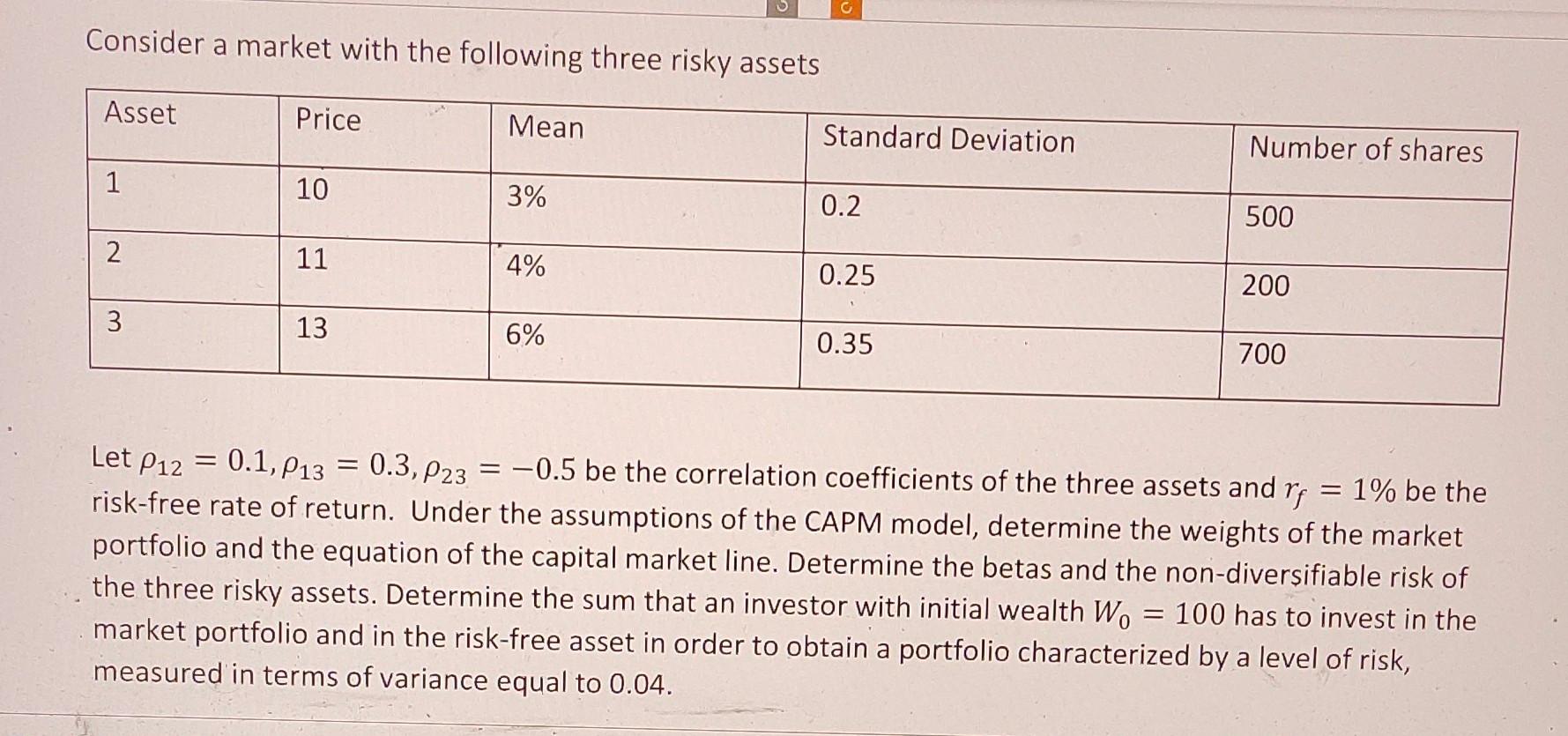

Consider a market with the following three risky assets Let 12=0.1,13=0.3,23=0.5 be the correlation coefficients of the three assets and rf=1% be the risk-free rate

Consider a market with the following three risky assets Let 12=0.1,13=0.3,23=0.5 be the correlation coefficients of the three assets and rf=1% be the risk-free rate of return. Under the assumptions of the CAPM model, determine the weights of the market portfolio and the equation of the capital market line. Determine the betas and the non-diversifiable risk of the three risky assets. Determine the sum that an investor with initial wealth W0=100 has to invest in the market portfolio and in the risk-free asset in order to obtain a portfolio characterized by a level of risk, measured in terms of variance equal to 0.04

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started