Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a mean-variance portfolio framework. The market portfolio, M, has an expected return of 10% and a standard deviation of 20%. The risk-free rate

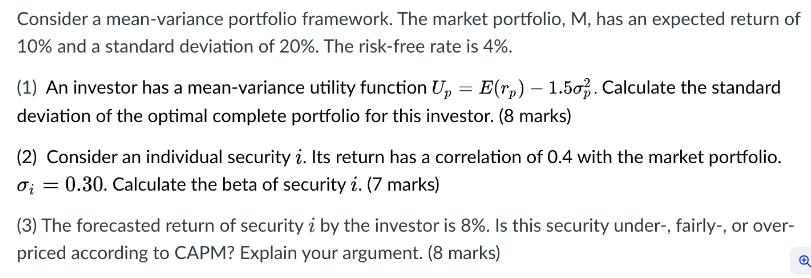

Consider a mean-variance portfolio framework. The market portfolio, M, has an expected return of 10% and a standard deviation of 20%. The risk-free rate is 4%. (1) An investor has a mean-variance utility function Up = E(rp) - 1.502. Calculate the standard deviation of the optimal complete portfolio for this investor. (8 marks) (2) Consider an individual security i. Its return has a correlation of 0.4 with the market portfolio. o = 0.30. Calculate the beta of security i. (7 marks) (3) The forecasted return of security i by the investor is 8%. Is this security under-, fairly-, or over- priced according to CAPM? Explain your argument. (8 marks)

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 To find the standard deviation of the optimal complete portfolio we need to solve for the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started