Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a mixed-income housing development in the City of Stoughton, WI. You are interested in setting aside 50% of the building for workforce housing.

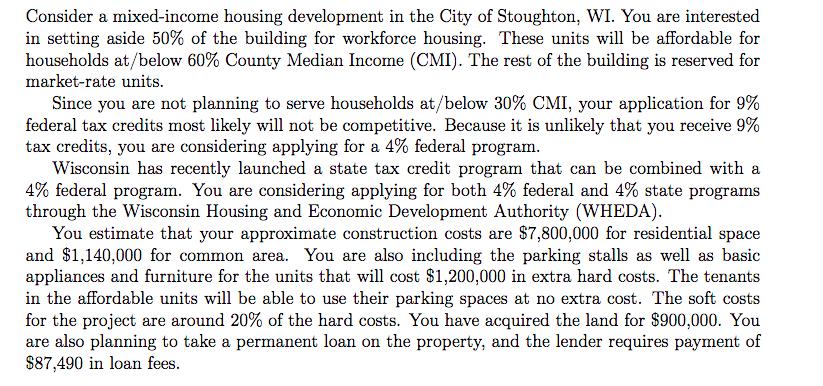

Consider a mixed-income housing development in the City of Stoughton, WI. You are interested in setting aside 50% of the building for workforce housing. These units will be affordable for households at/below 60% County Median Income (CMI). The rest of the building is reserved for market-rate units. Since you are not planning to serve households at/below 30% CMI, your application for 9% federal tax credits most likely will not be competitive. Because it is unlikely that you receive 9% tax credits, you are considering applying for a 4% federal program. Wisconsin has recently launched a state tax credit program that can be combined with a 4% federal program. You are considering applying for both 4% federal and 4% state programs through the Wisconsin Housing and Economic Development Authority (WHEDA). You estimate that your approximate construction costs are $7,800,000 for residential space and $1,140,000 for common area. You are also including the parking stalls as well as basic appliances and furniture for the units that will cost $1,200,000 in extra hard costs. The tenants in the affordable units will be able to use their parking spaces at no extra cost. The soft costs for the project are around 20% of the hard costs. You have acquired the land for $900,000. You are also planning to take a permanent loan on the property, and the lender requires payment of $87,490 in loan fees. 1. What are the hard costs of the project? What are the soft costs of the project? 3. What are the total construction costs? 4. Does the project pass at least one of the tests to qualify for Low Income Housing Tax Credits? Reminder: the set-aside tests require the development to set aside: 2. (a) 20% of units for households at/below 50% of CMI, or (b) 40% of units for households at/below 60% of CMI, or (c) 40% of units for households at an average CMI of 60% or less.

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

icon PAGE NO DATE Hard cose of the project 7800000 1140 00 1200 0...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started