Answered step by step

Verified Expert Solution

Question

1 Approved Answer

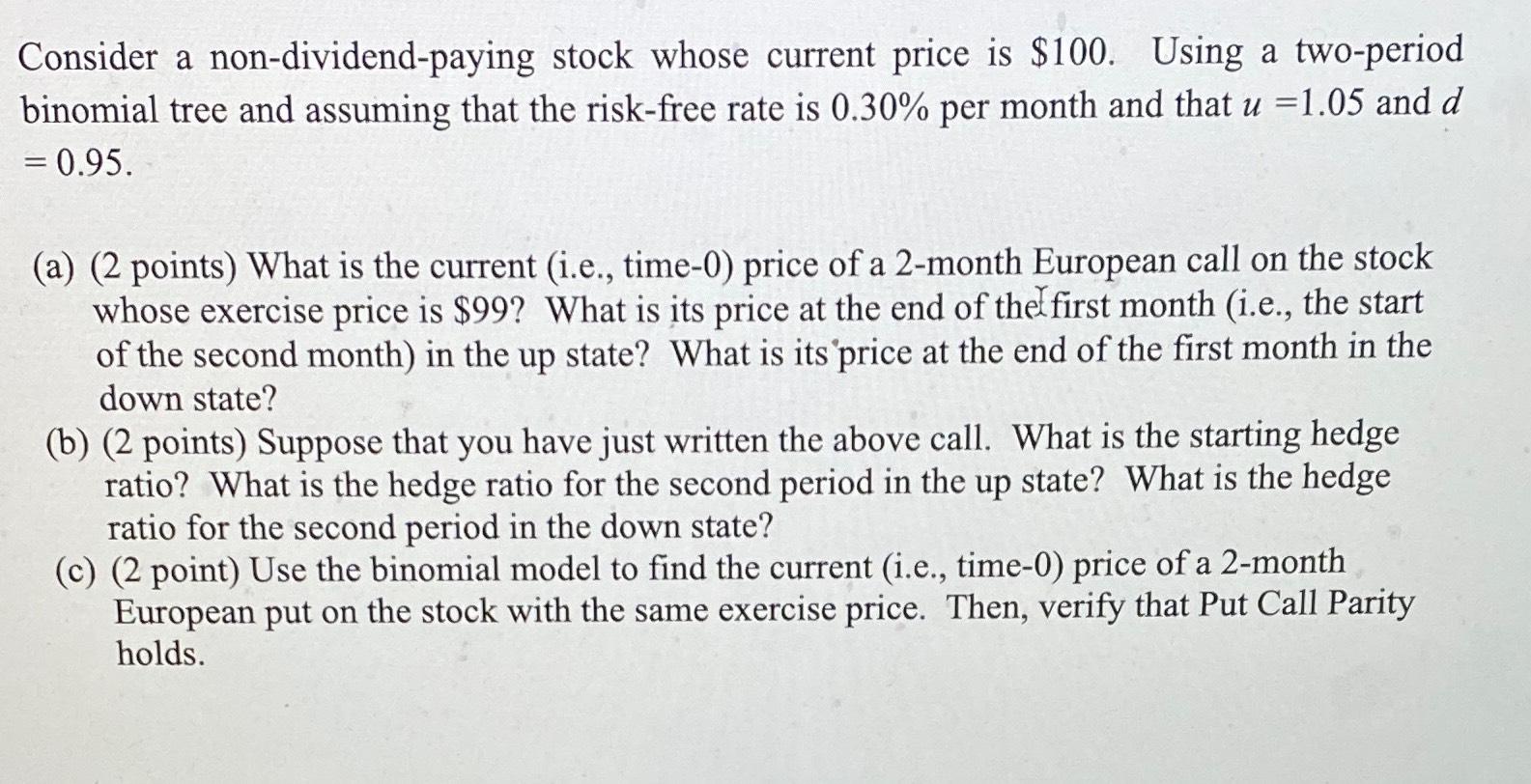

Consider a non - dividend - paying stock whose current price is $ 1 0 0 . Using a two - period binomial tree and

Consider a nondividendpaying stock whose current price is $ Using a twoperiod binomial tree and assuming that the riskfree rate is per month and that and

a points What is the current ie time price of a month European call on the stock whose exercise price is $ What is its price at the end of the first month ie the start of the second month in the up state? What is its price at the end of the first month in the down state?

b points Suppose that you have just written the above call. What is the starting hedge ratio? What is the hedge ratio for the second period in the up state? What is the hedge ratio for the second period in the down state?

c point Use the binomial model to find the current ie time price of a month European put on the stock with the same exercise price. Then, verify that Put Call Parity holds.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started