Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a one step binomial model in which the share price of a company has a known price of So now (at time t

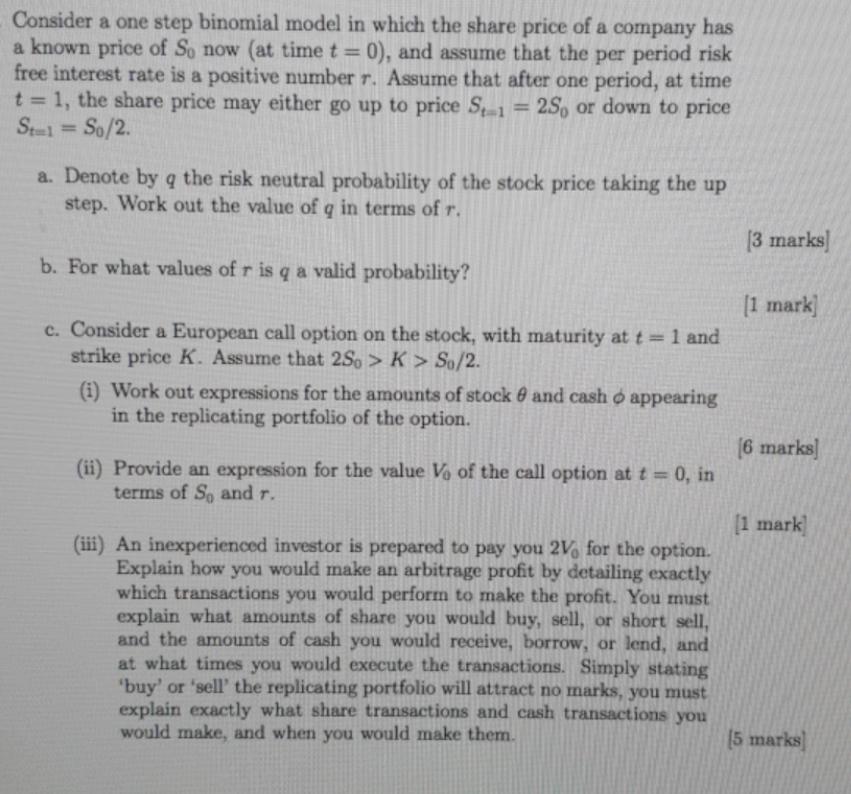

Consider a one step binomial model in which the share price of a company has a known price of So now (at time t = 0), and assume that the per period risk free interest rate is a positive number r. Assume that after one period, at time t = 1, the share price may either go up to price St1= 25o or down to price St=1=So/2. a. Denote by q the risk neutral probability of the stock price taking the up step. Work out the value of q in terms of r. b. For what values of r is q a valid probability? c. Consider a European call option on the stock, with maturity at t = 1 and strike price K. Assume that 2S > K > So/2. (i) Work out expressions for the amounts of stock and cash o appearing in the replicating portfolio of the option. (ii) Provide an expression for the value Vo of the call option at t = 0, in terms of S, and r. [3 marks] [1 mark] [6 marks] [1 mark] (iii) An inexperienced investor is prepared to pay you 2V for the option. Explain how you would make an arbitrage profit by detailing exactly which transactions you would perform to make the profit. You must explain what amounts of share you would buy, sell, or short sell, and the amounts of cash you would receive, borrow, or lend, and at what times you would execute the transactions. Simply stating 'buy' or 'sell' the replicating portfolio will attract no marks, you must explain exactly what share transactions and cash transactions you would make, and when you would make them. (5 marks)

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a In the onestep binomial model the riskneutral probability q is given by q 1 r S S S S2 where S is the stock price at time t 1 b For q to be a valid ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started