Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a one-sided search model with a two-rung job ladder. Let u, denote the unemployment rate at time t. The remaining of labour force

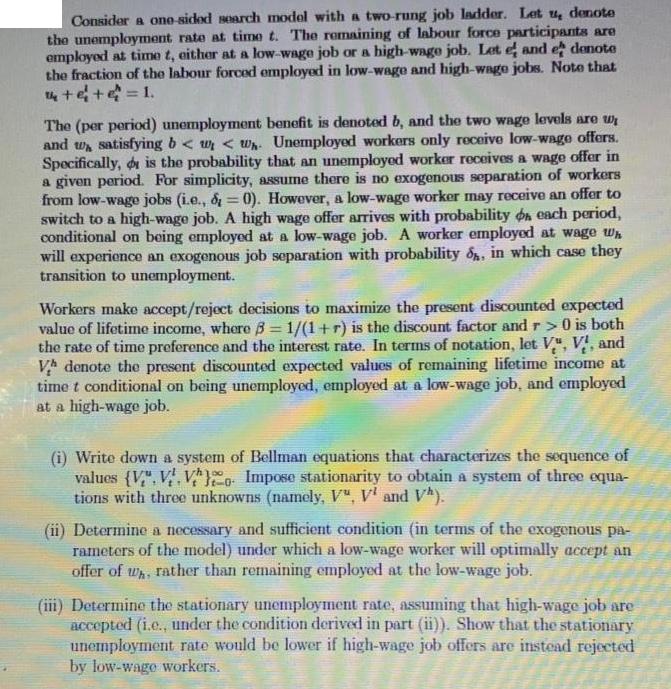

Consider a one-sided search model with a two-rung job ladder. Let u, denote the unemployment rate at time t. The remaining of labour force participants are employed at time t, either at a low-wage job or a high-wage job. Let e and et denote the fraction of the labour forced employed in low-wage and high-wage jobs. Note that ++ = 1. The (per period) unemployment benefit is denoted b, and the two wage levels are w and w satisfying b < 0 is both the rate of time preference and the interest rate. In terms of notation, let V, V, and V denote the present discounted expected values of remaining lifetime income at time t conditional on being unemployed, employed at a low-wage job, and employed at a high-wage job. (i) Write down a system of Bellman equations that characterizes the sequence of values (V. V. V. Impose stationarity to obtain a system of three equa- tions with three unknowns (namely, V, V and V). (ii) Determine a necessary and sufficient condition (in terms of the exogenous pa- rameters of the model) under which a low-wage worker will optimally accept an offer of wh, rather than remaining employed at the low-wage job. (iii) Determine the stationary unemployment rate, assuming that high-wage job are accepted (i.e., under the condition derived in part (ii)). Show that the stationary unemployment rate would be lower if high-wage job offers are instead rejected by low-wage workers.

Step by Step Solution

★★★★★

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

employed in a lowwage job or employed in a highwage job The model analyzes the probability that a lowwage worker will reject an offer for a higherpaying job Heres a breakdown of the relevant concepts ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started