Answered step by step

Verified Expert Solution

Question

1 Approved Answer

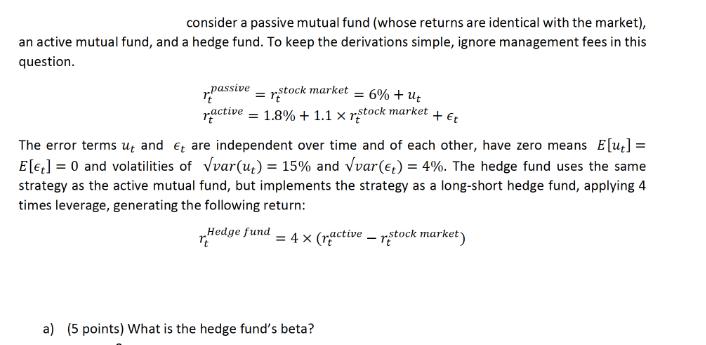

consider a passive mutual fund (whose returns are identical with the market), an active mutual fund, and a hedge fund. To keep the derivations

consider a passive mutual fund (whose returns are identical with the market), an active mutual fund, and a hedge fund. To keep the derivations simple, ignore management fees in this question. passive =rstock market = 6% + Ut ractive = 1.8% +1.1 X rstock market + Et The error terms u, and are independent over time and of each other, have zero means E[ut] = E[] = 0 and volatilities of var(u) = 15% and var(e) = 4%. The hedge fund uses the same strategy as the active mutual fund, but implements the strategy as a long-short hedge fund, applying 4 times leverage, generating the following return: Hedge fund TE = 4x (ractive - stock market) a) (5 points) What is the hedge fund's beta? b) (5 points) What is the hedge fund's volatility? c) (5 points) What is the hedge fund's alpha?

Step by Step Solution

★★★★★

3.61 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the hedge funds beta we need to determine the sensitivity of the hedge funds returns to the market returns The beta coefficient measure...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started