Question

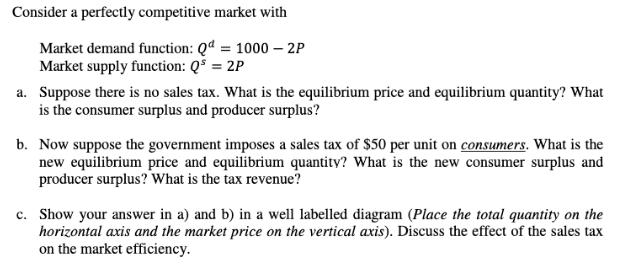

Consider a perfectly competitive market with Market demand function: Qd = 1000 - 2P Market supply function: Q* = 2P a. Suppose there is

Consider a perfectly competitive market with Market demand function: Qd = 1000 - 2P Market supply function: Q* = 2P a. Suppose there is no sales tax. What is the equilibrium price and equilibrium quantity? What is the consumer surplus and producer surplus? b. Now suppose the government imposes a sales tax of $50 per unit on consumers. What is the new equilibrium price and equilibrium quantity? What is the new consumer surplus and producer surplus? What is the tax revenue? c. Show your answer in a) and b) in a well labelled diagram (Place the total quantity on the horizontal axis and the market price on the vertical axis). Discuss the effect of the sales tax on the market efficiency.

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Microeconomics

Authors: Austan Goolsbee, Steven Levitt, Chad Syverson

1st Edition

978-1464146978, 1464146977

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App