Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a portfolio composed by a large number of stocks. In this portfolio, a. The total risk of the portfolio is always equal to zero.

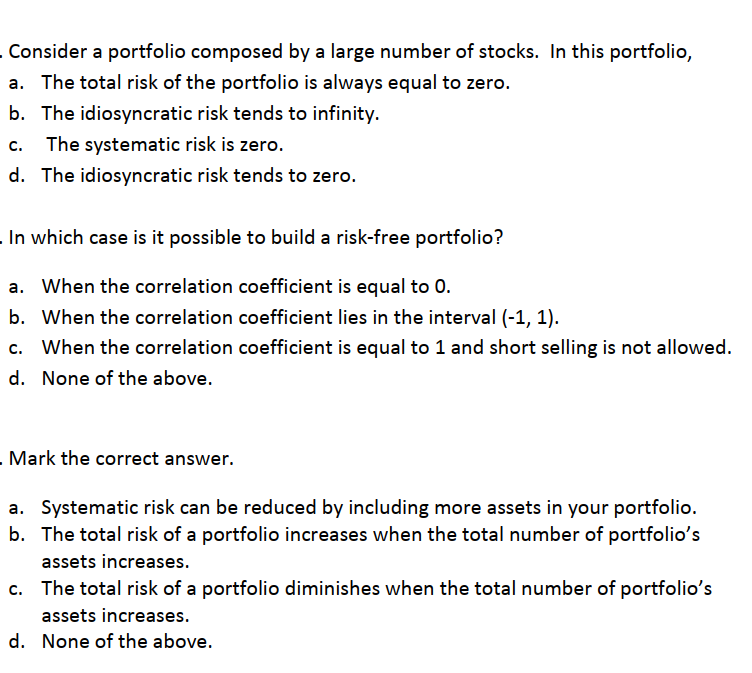

Consider a portfolio composed by a large number of stocks. In this portfolio, a. The total risk of the portfolio is always equal to zero. b. The idiosyncratic risk tends to infinity. c. The systematic risk is zero. d. The idiosyncratic risk tends to zero. In which case is it possible to build a risk-free portfolio? a. When the correlation coefficient is equal to 0 . b. When the correlation coefficient lies in the interval (1,1). c. When the correlation coefficient is equal to 1 and short selling is not allowed. d. None of the above. Mark the correct answer. a. Systematic risk can be reduced by including more assets in your portfolio. b. The total risk of a portfolio increases when the total number of portfolio's assets increases. c. The total risk of a portfolio diminishes when the total number of portfolio's assets increases. d. None of the above

Consider a portfolio composed by a large number of stocks. In this portfolio, a. The total risk of the portfolio is always equal to zero. b. The idiosyncratic risk tends to infinity. c. The systematic risk is zero. d. The idiosyncratic risk tends to zero. In which case is it possible to build a risk-free portfolio? a. When the correlation coefficient is equal to 0 . b. When the correlation coefficient lies in the interval (1,1). c. When the correlation coefficient is equal to 1 and short selling is not allowed. d. None of the above. Mark the correct answer. a. Systematic risk can be reduced by including more assets in your portfolio. b. The total risk of a portfolio increases when the total number of portfolio's assets increases. c. The total risk of a portfolio diminishes when the total number of portfolio's assets increases. d. None of the above Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started