Answered step by step

Verified Expert Solution

Question

1 Approved Answer

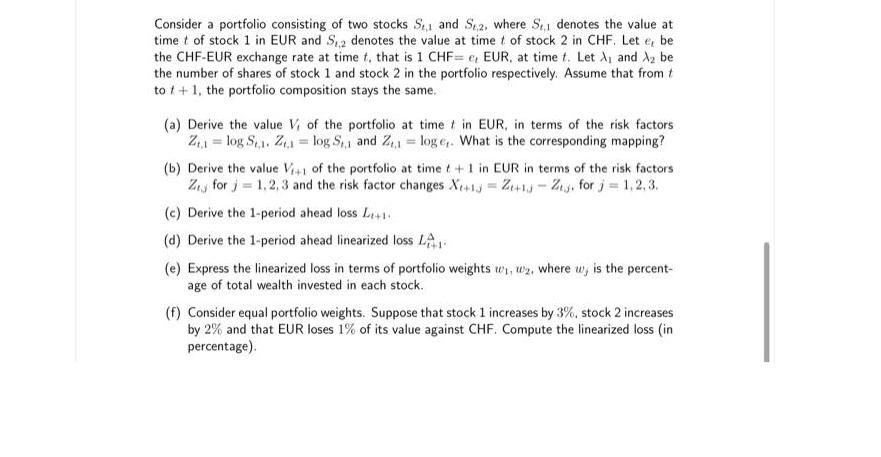

Consider a portfolio consisting of two stocks S1 and S2, where S, denotes the value at time t of stock 1 in EUR and

Consider a portfolio consisting of two stocks S1 and S2, where S, denotes the value at time t of stock 1 in EUR and S,2 denotes the value at time t of stock 2 in CHF. Let e, be the CHF-EUR exchange rate at time t, that is 1 CHF= e, EUR, at time f. Let A and be the number of shares of stock 1 and stock 2 in the portfolio respectively. Assume that from t to + 1, the portfolio composition stays the same. (a) Derive the value V, of the portfolio at time in EUR, in terms of the risk factors Zt1 = log St,. Z,1 = log S,1 and 2,1 = loge,. What is the corresponding mapping? (b) Derive the value V+1 of the portfolio at time t + 1 in EUR in terms of the risk factors Z for j = 1,2,3 and the risk factor changes X+13=Z+Ztj. for j = 1,2,3. (c) Derive the 1-period ahead loss L+1 (d) Derive the 1-period ahead linearized loss L (e) Express the linearized loss in terms of portfolio weights , 2, where w, is the percent- age of total wealth invested in each stock. (f) Consider equal portfolio weights. Suppose that stock 1 increases by 3%, stock 2 increases by 2% and that EUR loses 1% of its value against CHF. Compute the linearized loss (in percentage).

Step by Step Solution

★★★★★

3.36 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a The value of the portfolio at time t in EUR can be derived as follows Vt 1 S11 2 S22 Using the nat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started