Answered step by step

Verified Expert Solution

Question

1 Approved Answer

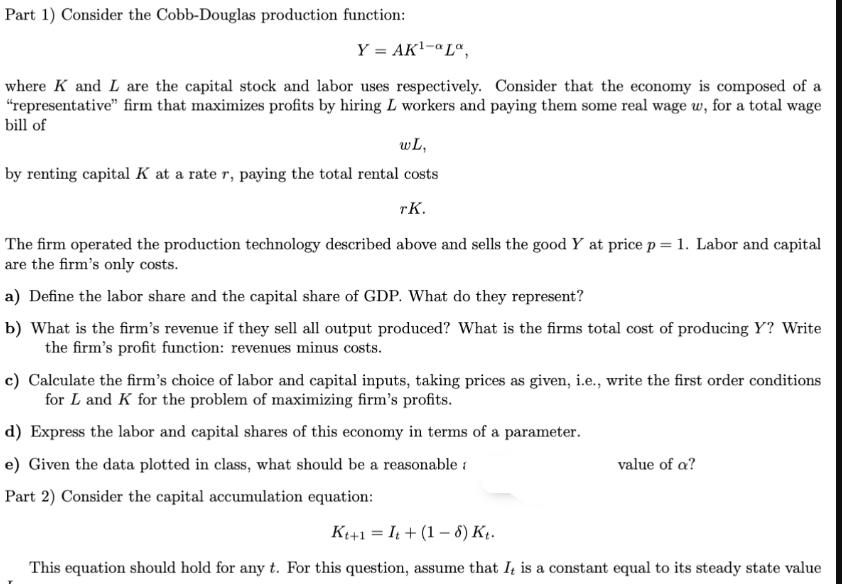

Part 1) Consider the Cobb-Douglas production function: Y = AK-aLa, where K and L are the capital stock and labor uses respectively. Consider that

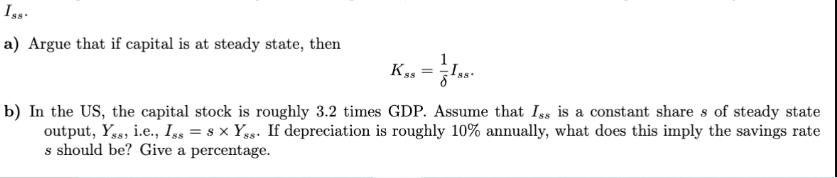

Part 1) Consider the Cobb-Douglas production function: Y = AK-aLa, where K and L are the capital stock and labor uses respectively. Consider that the economy is composed of a "representative" firm that maximizes profits by hiring L workers and paying them some real wage w, for a total wage bill of wL, by renting capital K at a rate r, paying the total rental costs TK. The firm operated the production technology described above and sells the good Y at price p = 1. Labor and capital are the firm's only costs. a) Define the labor share and the capital share of GDP. What do they represent? b) What is the firm's revenue if they sell all output produced? What is the firms total cost of producing Y? Write the firm's profit function: revenues minus costs. c) Calculate the firm's choice of labor and capital inputs, taking prices as given, i.e., write the first order conditions for L and K for the problem of maximizing firm's profits. d) Express the labor and capital shares of this economy in terms of a parameter. e) Given the data plotted in class, what should be a reasonable Part 2) Consider the capital accumulation equation: value of a? Kt+1 = It+ (1-6) Kt. This equation should hold for any t. For this question, assume that I, is a constant equal to its steady state value a) Argue that if capital is at steady state, then Kas = Iss. b) In the US, the capital stock is roughly 3.2 times GDP. Assume that Iss is a constant shares of steady state output, Yss, i.e., Iss = s x Yss. If depreciation is roughly 10% annually, what does this imply the savings rate s should be? Give a percentage.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The labor share of GDP represents the portion of total output or income that goes to labor while t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started