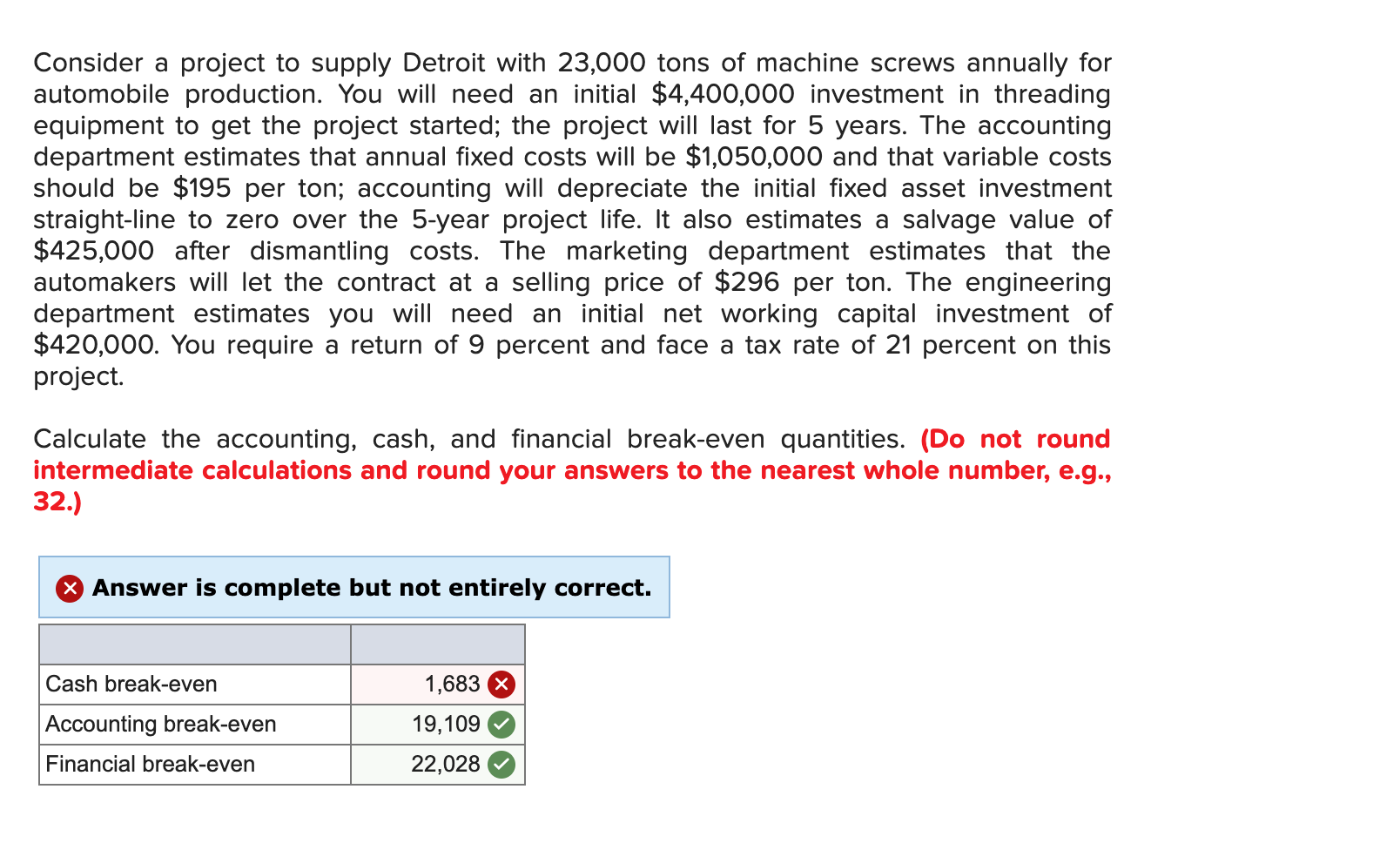

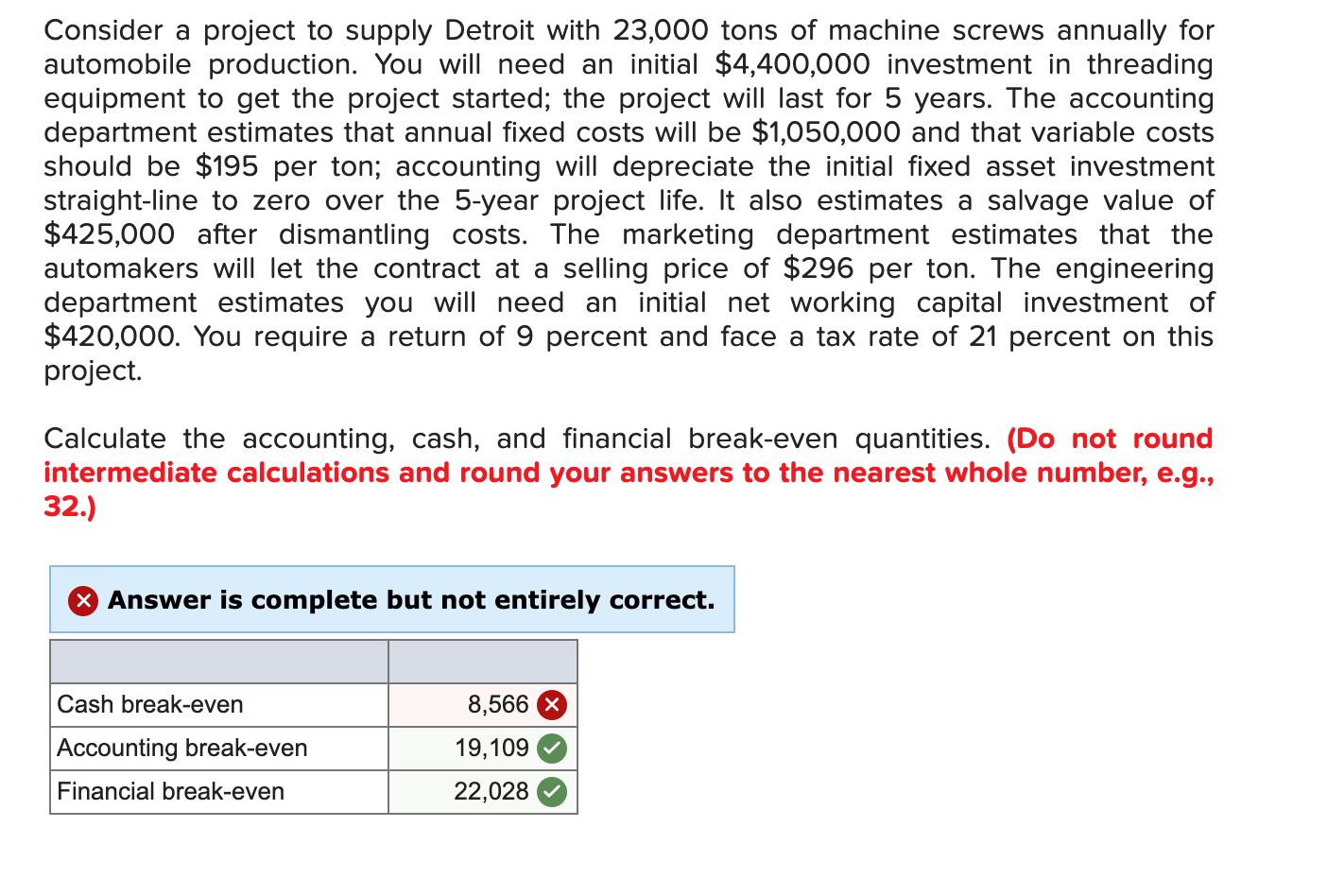

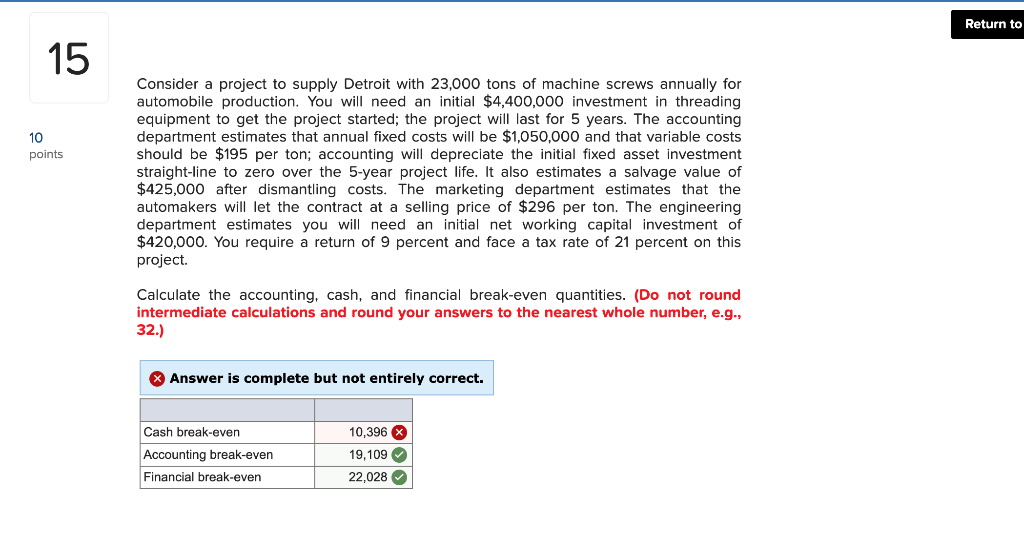

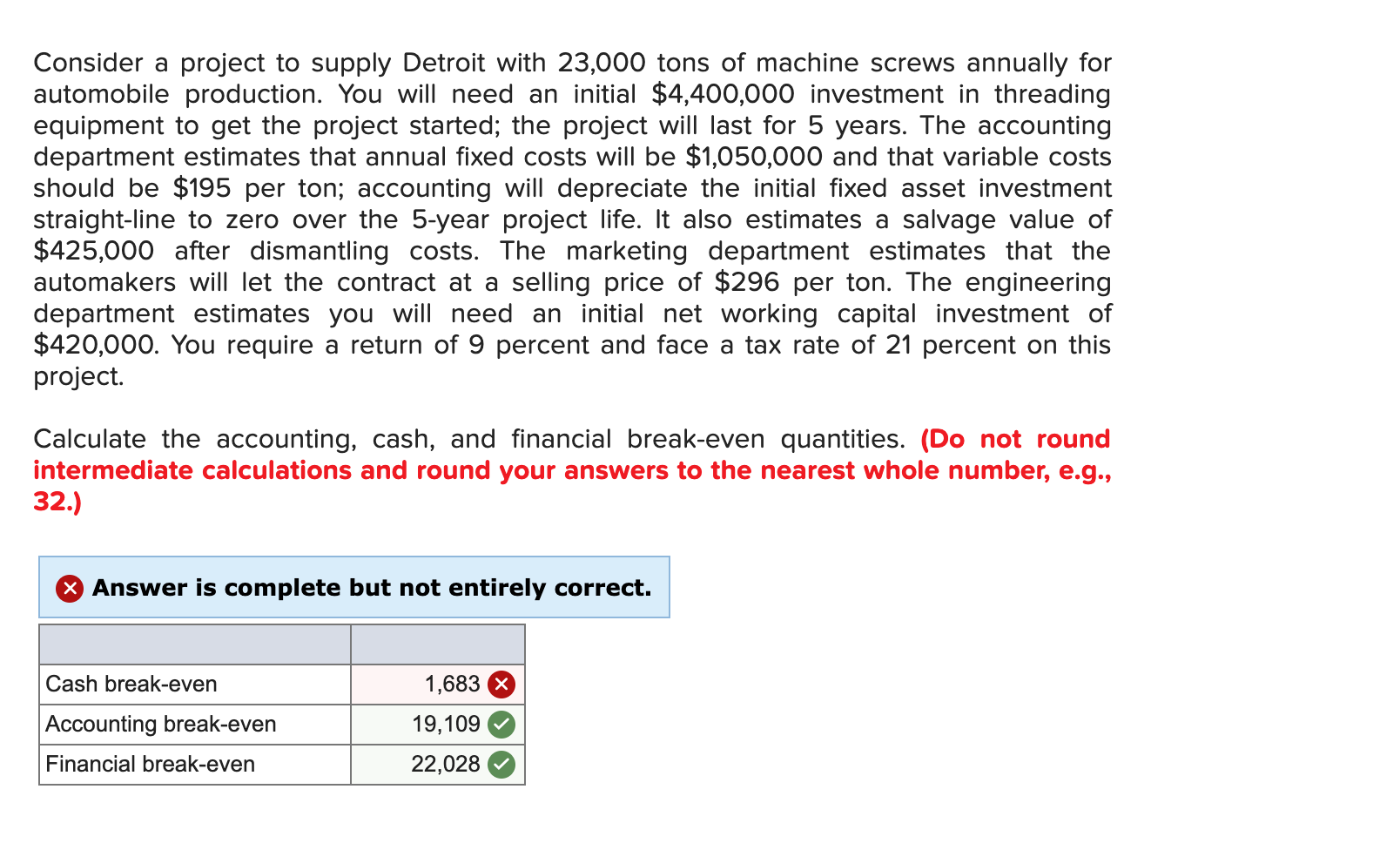

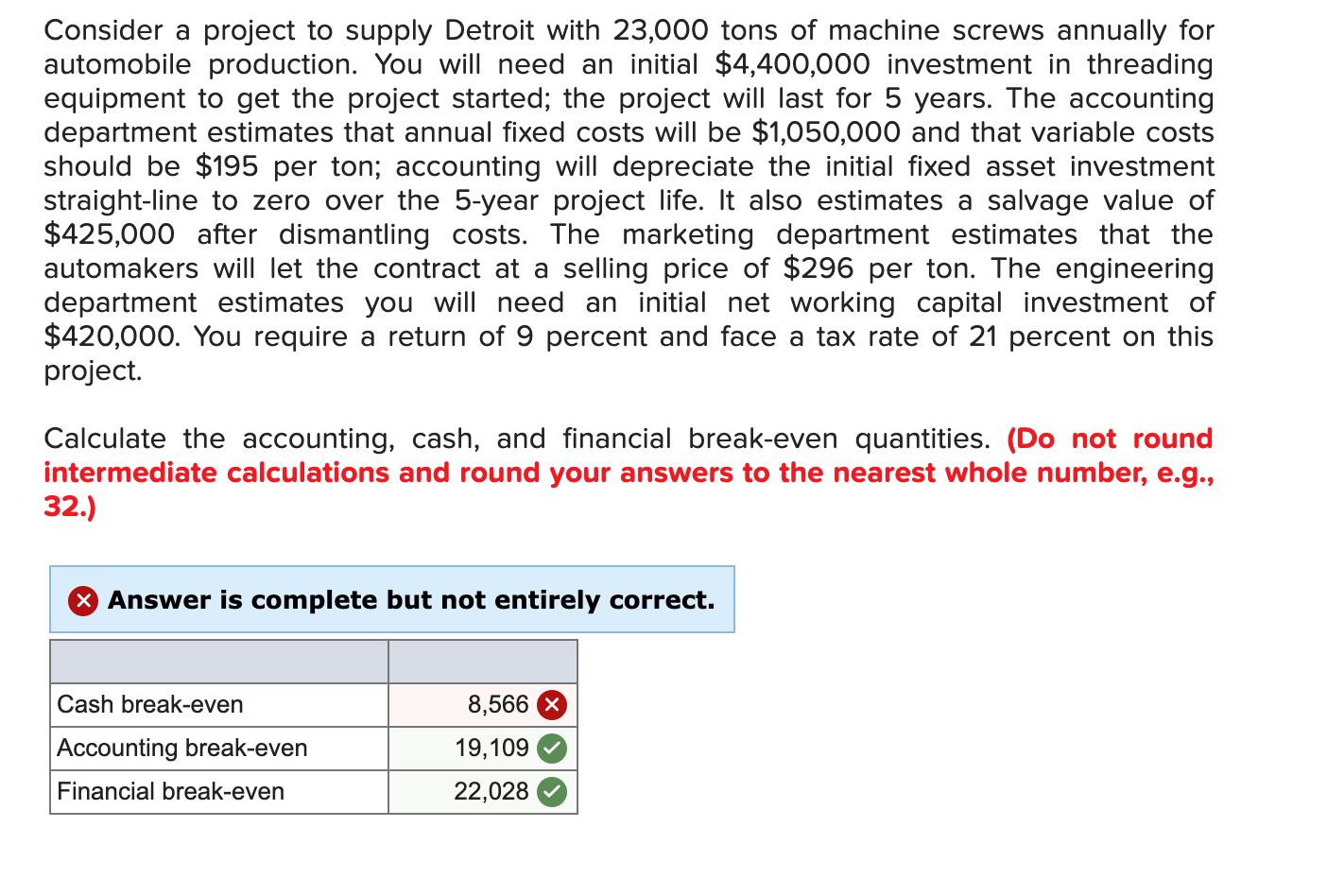

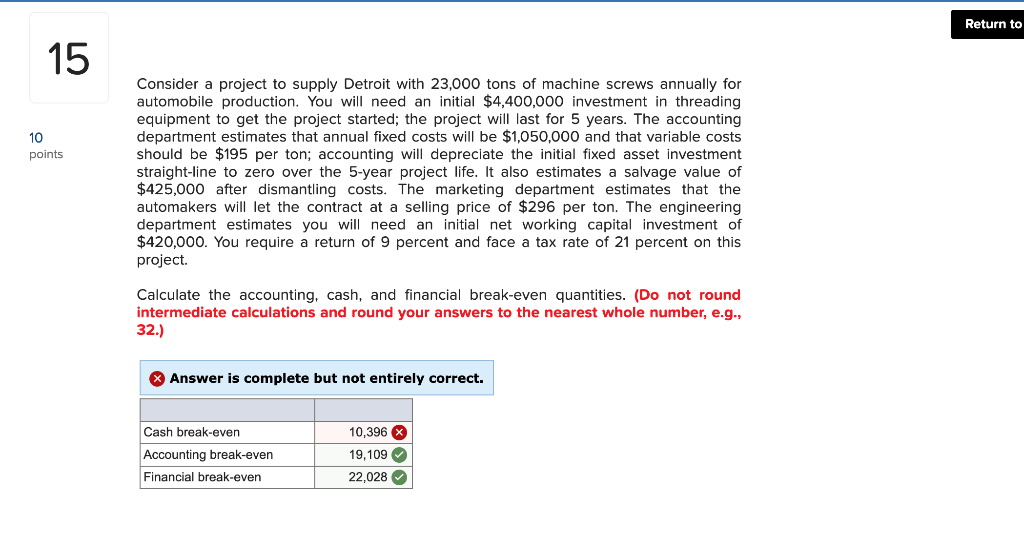

Consider a project to supply Detroit with 23,000 tons of machine screws annually for automobile production. You will need an initial $4,400,000 investment in threading equipment to get the project started; the project will last for 5 years. The accounting department estimates that annual fixed costs will be $1,050,000 and that variable costs should be $195 per ton; accounting will depreciate the initial fixed asset investment straight-line to zero over the 5-year project life. It also estimates a salvage value of $425,000 after dismantling costs. The marketing department estimates that the automakers will let the contract at a selling price of $296 per ton. The engineering department estimates you will need an initial net working capital investment of $420,000. You require a return of 9 percent and face a tax rate of 21 percent on this project. Calculate the accounting, cash, and financial break-even quantities. (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) Answer is complete but not entirely correct. Cash break-even 1,683 Accounting break-even 19,109 Financial break-even 22,028 Consider a project to supply Detroit with 23,000 tons of machine screws annually for automobile production. You will need an initial $4,400,000 investment in threading equipment to get the project started; the project will last for 5 years. The accounting department estimates that annual fixed costs will be $1,050,000 and that variable costs should be $195 per ton; accounting will depreciate thee initial fixed asset investment straight-line to zero over the 5-year project life. It also estimates a salvage value of $425,000 after dismantling costs. The marketing department estimates that the automakers will let the contract at a selling price of $296 per ton. The engineering department estimates you will need an initial net working capital investment of $420,000. You require a return of 9 percent and face a tax rate of 21 percent on this project. Calculate the accounting, cash, and financial break-even quantities. (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) Answer is complete but not entirely correct. Cash break-even 8,566 Accounting break-even 19,109 Financial break-even 22,028 Return to 15 Consider a project to supply Detroit with 23,000 tons of machine screws annually for automobile production. You will need an initial $4,400,000 investment in threading equipment to get the project started; the project will last for 5 years. The accounting department estimates that annual fixed costs will be $1,050,000 and that variable costs should be $195 per ton; accounting will depreciate the initial fixed asset investment straight-line to zero over the 5-year project life. It also estimates a salvage value of $425,000 after dismantling costs. The marketing department estimates that the automakers will let the contract at a selling price of $296 per ton. The engineering department estimates you will need an initial net working capital investment of $420,000. You require a return of 9 percent and face a tax rate of 21 percent on this project 10 points Calculate the accounting, cash, and financial break-even quantities. (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32. Answer is complete but not entirely correct Cash break-even 10,396 Accounting break-even Financial break-even 19,109 22,028