Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a simple, neoclassical, two-period macroeconomic world. Investors can't be fooled or ripped off, and the interest rate on either government bonds or on

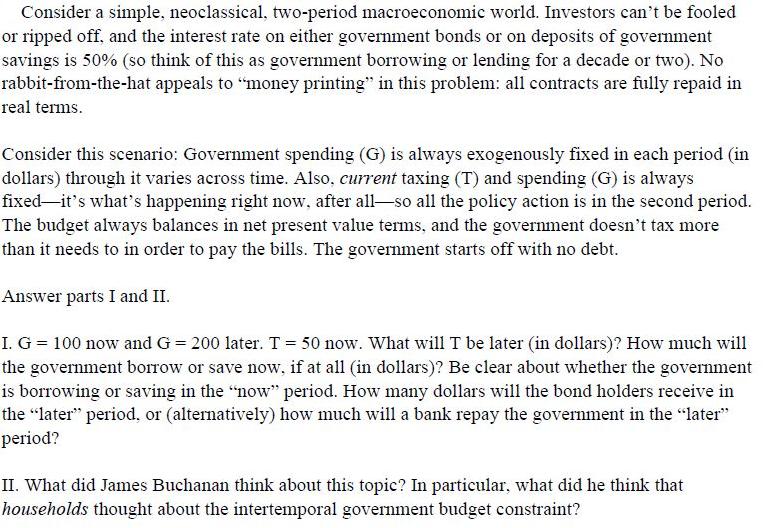

Consider a simple, neoclassical, two-period macroeconomic world. Investors can't be fooled or ripped off, and the interest rate on either government bonds or on deposits of government savings is 50% (so think of this as government borrowing or lending for a decade or two). No rabbit-from-the-hat appeals to "money printing" in this problem: all contracts are fully repaid in real terms. Consider this scenario: Government spending (G) is always exogenously fixed in each period (in dollars) through it varies across time. Also, current taxing (T) and spending (G) is always fixed-it's what's happening right now, after all-so all the policy action is in the second period. The budget always balances in net present value terms, and the government doesn't tax more than it needs to in order to pay the bills. The government starts off with no debt. Answer parts I and II. I. G = 100 now and G = 200 later. T = 50 now. What will I be later (in dollars)? How much will the government borrow or save now, if at all (in dollars)? Be clear about whether the government is borrowing or saving in the "now" period. How many dollars will the bond holders receive in the "later" period, or (alternatively) how much will a bank repay the government in the "later" period? II. What did James Buchanan think about this topic? In particular, what did he think that households thought about the intertemporal government budget constraint?

Step by Step Solution

★★★★★

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

I In this scenario government spending G is 100 now and will be 200 in the future Current tax revenue T is 50 To determine future tax revenue T we fir...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started