Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a single period model in a MM world: Executive Cheese currently has senior debt with a market value of $ 1 0 0 m

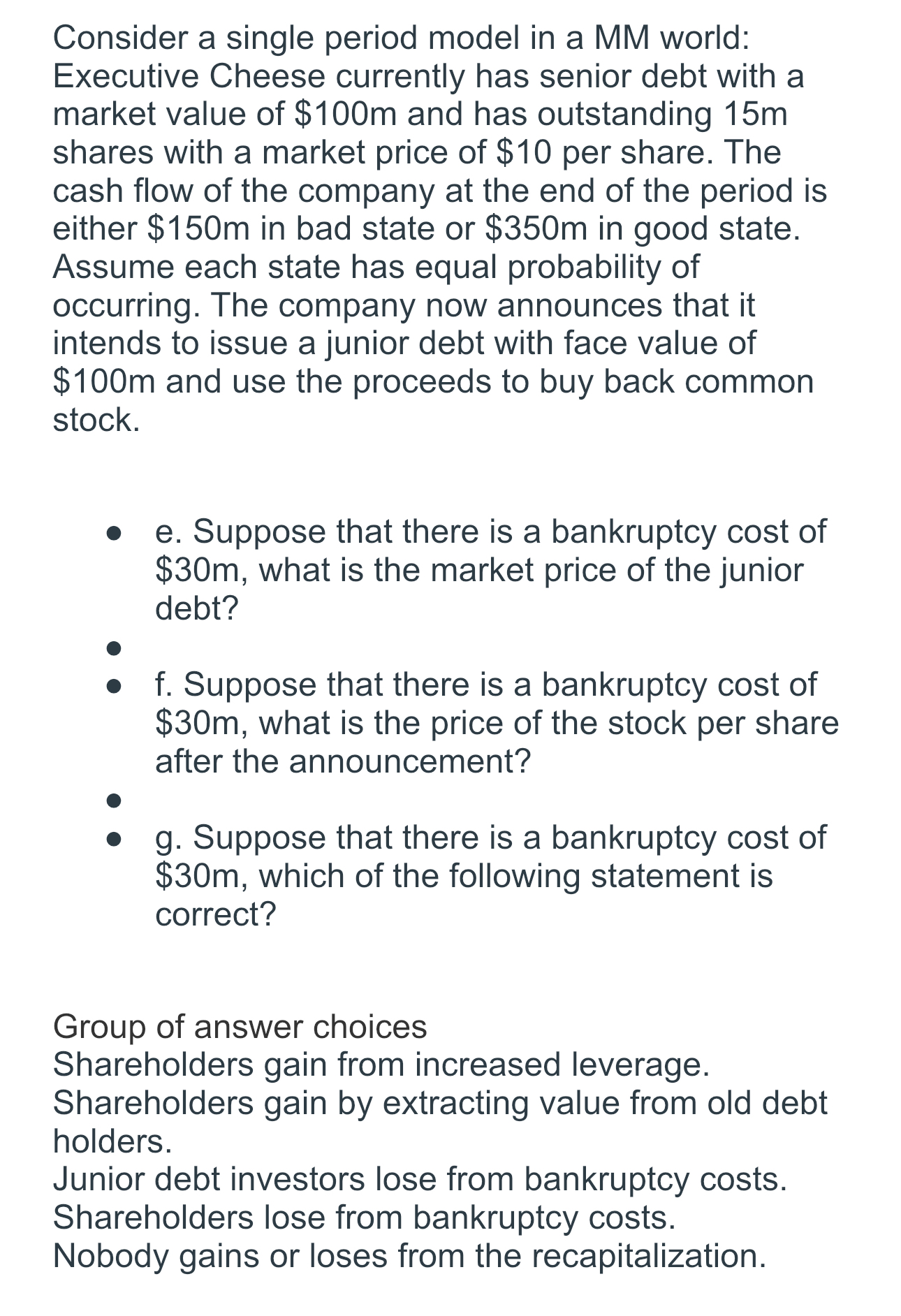

Consider a single period model in a MM world:

Executive Cheese currently has senior debt with a

market value of $ and has outstanding m

shares with a market price of $ per share. The

cash flow of the company at the end of the period is

either $ in bad state or $ in good state.

Assume each state has equal probability of

occurring. The company now announces that it

intends to issue a junior debt with face value of

$ and use the proceeds to buy back common

stock.

e Suppose that there is a bankruptcy cost of

$ what is the market price of the junior

debt?

f Suppose that there is a bankruptcy cost of

$ what is the price of the stock per share

after the announcement?

g Suppose that there is a bankruptcy cost of

$ which of the following statement is

correct?

Group of answer choices

Shareholders gain from increased leverage.

Shareholders gain by extracting value from old debt

holders.

Junior debt investors lose from bankruptcy costs.

Shareholders lose from bankruptcy costs.

Nobody gains or loses from the recapitalization.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started