Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a situation wherein a farmer takes a short position in 4 wheat futures contracts. It is done in order to hedge against the

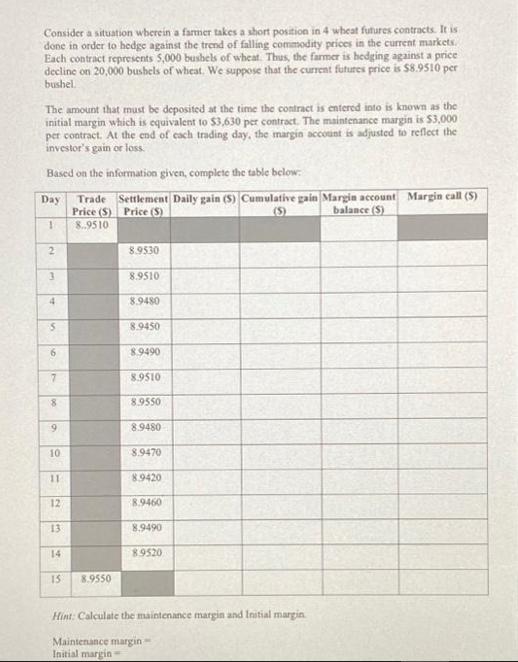

Consider a situation wherein a farmer takes a short position in 4 wheat futures contracts. It is done in order to hedge against the trend of falling commodity prices in the current markets. Each contract represents 5,000 bushels of wheat. Thus, the farmer is hedging against a price decline on 20,000 bushels of wheat. We suppose that the current futures price is $8.9510 per bushel. The amount that must be deposited at the time the contract is entered into is known as the initial margin which is equivalent to $3,630 per contract. The maintenance margin is $3,000 per contract. At the end of each trading day, the margin account is adjusted to reflect the investor's gain or loss. Based on the information given, complete the table below: Trade Settlement Daily gain (5) Cumulative gain Margin account Margin call (5) Price (S) Price (S) (5) balance (S) 8.9510 Day 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 8.9550 8.9530 8.9510 8.9480 8.9450 8.9490 8.9510 8.9550 8.9480 8.9470 8.9420 8.9460 8.9490 8.9520 Hint: Calculate the maintenance margin and Initial margin Maintenance margin- Initial margin-

Step by Step Solution

★★★★★

3.59 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started