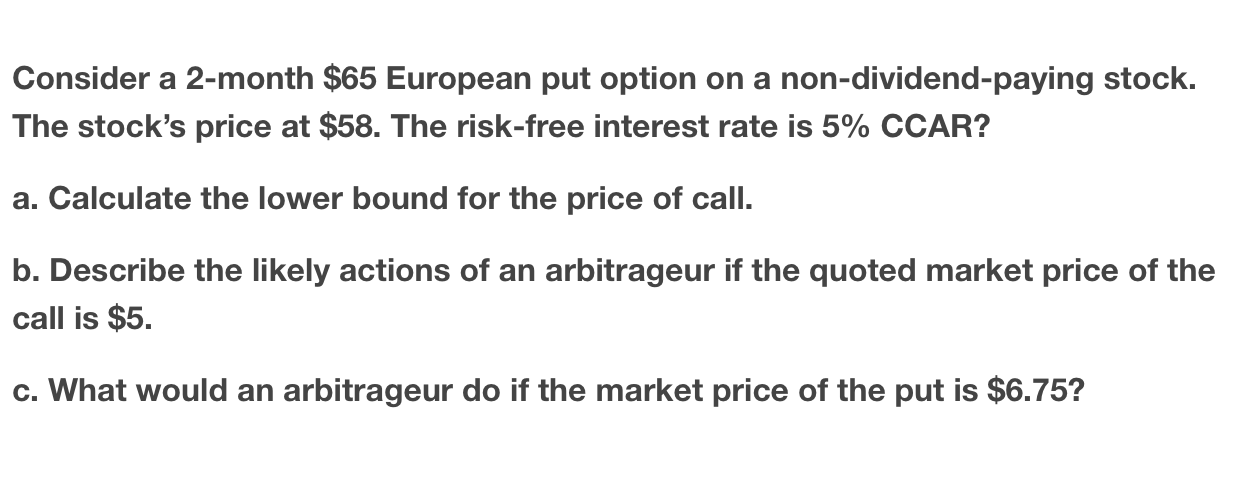

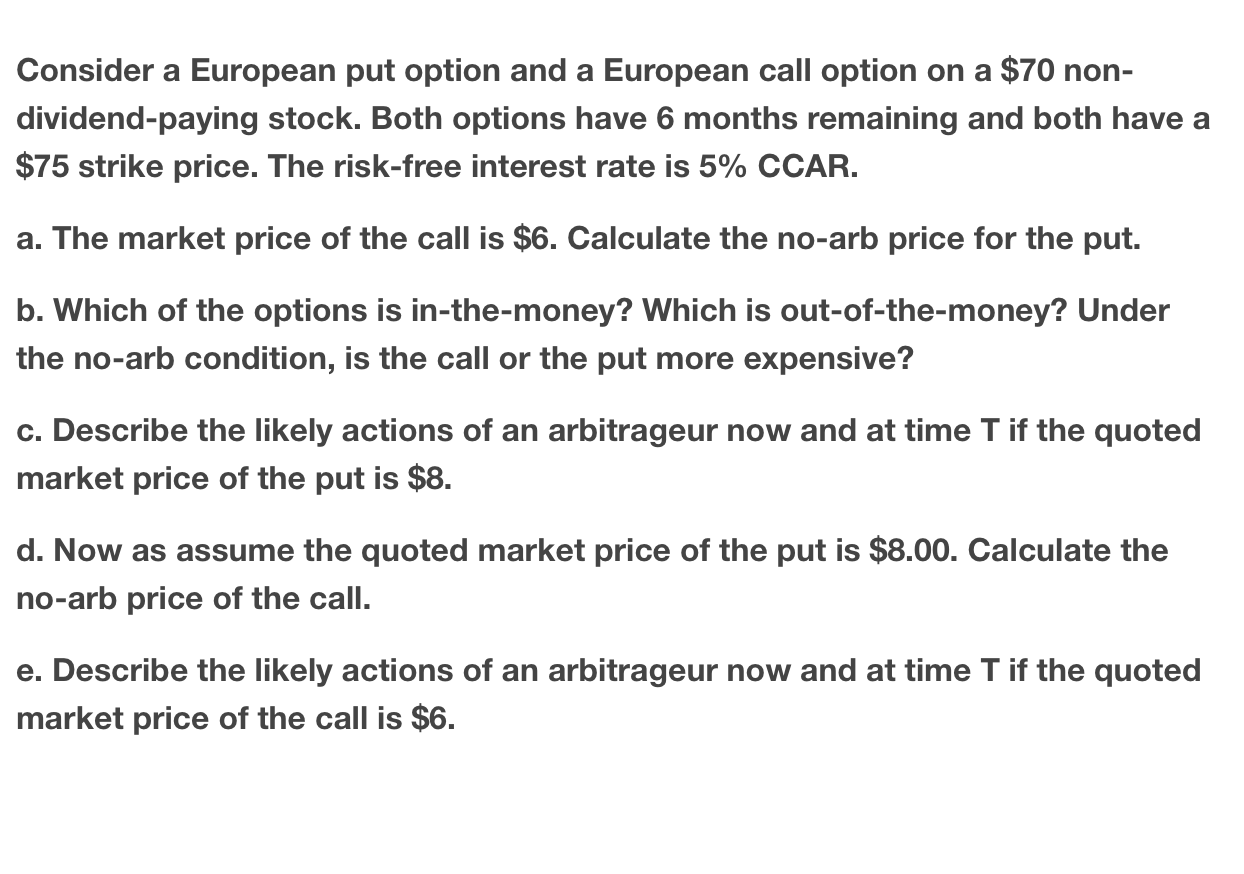

Consider a six-month $75 European call option on a non-dividend stock when the stock price is $80 and the risk-free interest rate is 10% CCAR. a. Calculate the lower bound for the price of call. b. Describe the likely actions of an arbitrageur if the quoted market price of the call is $8. c. What would an arbitrageur do if the market price of the call is $9 ? Consider a 2-month $65 European put option on a non-dividend-paying stock. The stock's price at $58. The risk-free interest rate is 5% CCAR? a. Calculate the lower bound for the price of call. b. Describe the likely actions of an arbitrageur if the quoted market price of the call is $5. c. What would an arbitrageur do if the market price of the put is $6.75 ? Consider a European put option and a European call option on a $70 nondividend-paying stock. Both options have 6 months remaining and both have a $75 strike price. The risk-free interest rate is 5% CCAR. a. The market price of the call is $6. Calculate the no-arb price for the put. b. Which of the options is in-the-money? Which is out-of-the-money? Under the no-arb condition, is the call or the put more expensive? c. Describe the likely actions of an arbitrageur now and at time T if the quoted market price of the put is $8. d. Now as assume the quoted market price of the put is $8.00. Calculate the no-arb price of the call. e. Describe the likely actions of an arbitrageur now and at time T if the quoted market price of the call is $6. Consider a six-month $75 European call option on a non-dividend stock when the stock price is $80 and the risk-free interest rate is 10% CCAR. a. Calculate the lower bound for the price of call. b. Describe the likely actions of an arbitrageur if the quoted market price of the call is $8. c. What would an arbitrageur do if the market price of the call is $9 ? Consider a 2-month $65 European put option on a non-dividend-paying stock. The stock's price at $58. The risk-free interest rate is 5% CCAR? a. Calculate the lower bound for the price of call. b. Describe the likely actions of an arbitrageur if the quoted market price of the call is $5. c. What would an arbitrageur do if the market price of the put is $6.75 ? Consider a European put option and a European call option on a $70 nondividend-paying stock. Both options have 6 months remaining and both have a $75 strike price. The risk-free interest rate is 5% CCAR. a. The market price of the call is $6. Calculate the no-arb price for the put. b. Which of the options is in-the-money? Which is out-of-the-money? Under the no-arb condition, is the call or the put more expensive? c. Describe the likely actions of an arbitrageur now and at time T if the quoted market price of the put is $8. d. Now as assume the quoted market price of the put is $8.00. Calculate the no-arb price of the call. e. Describe the likely actions of an arbitrageur now and at time T if the quoted market price of the call is $6