Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a small open economy with desired savings given by the function S(r) = 0.5(Y-G) + 100r, where Y is the home country's GDP

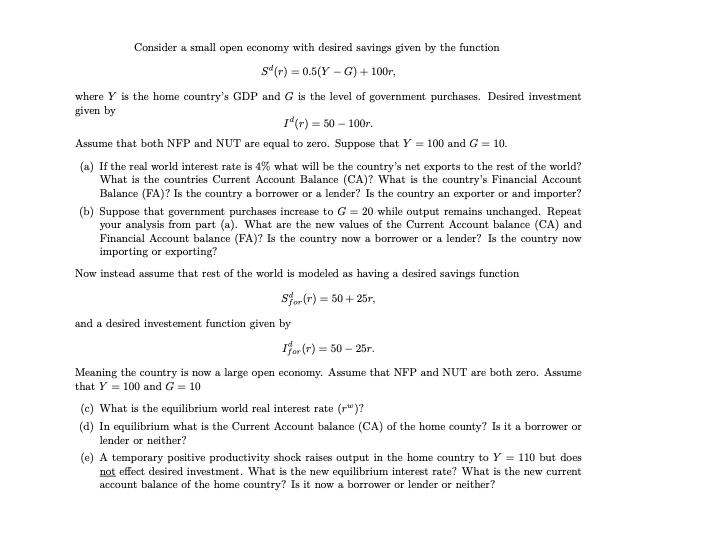

Consider a small open economy with desired savings given by the function S(r) = 0.5(Y-G) + 100r, where Y is the home country's GDP and G is the level of government purchases. Desired investment given by Id(r) = 50-100r. Assume that both NFP and NUT are equal to zero. Suppose that Y = 100 and G = 10. (a) If the real world interest rate is 4% what will be the country's net exports to the rest of the world? What is the countries Current Account Balance (CA)? What is the country's Financial Account Balance (FA)? Is the country a borrower or a lender? Is the country an exporter or and importer? (b) Suppose that government purchases increase to G = 20 while output remains unchanged. Repeat your analysis from part (a). What are the new values of the Current Account balance (CA) and Financial Account balance (FA)? Is the country now a borrower or a lender? Is the country now importing or exporting? Now instead assume that rest of the world is modeled as having a desired savings function Sor (r) = 50+25r, and a desired investement function given by Ifor (r) = 50-25r. Meaning the country is now a large open economy. Assume that NFP and NUT are both zero. Assume that Y= 100 and G = 10 (c) What is the equilibrium world real interest rate (r)? (d) In equilibrium what is the Current Account balance (CA) of the home county? Is it a borrower or lender or neither? (e) A temporary positive productivity shock raises output in the home country to Y = 110 but does not effect desired investment. What is the new equilibrium interest rate? What is the new current account balance of the home country? Is it now a borrower or lender or neither?

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started