Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a stock that will have dividend growth rates in the next three periods of 10%, 14%, and 3%, respectively. The third growth rate

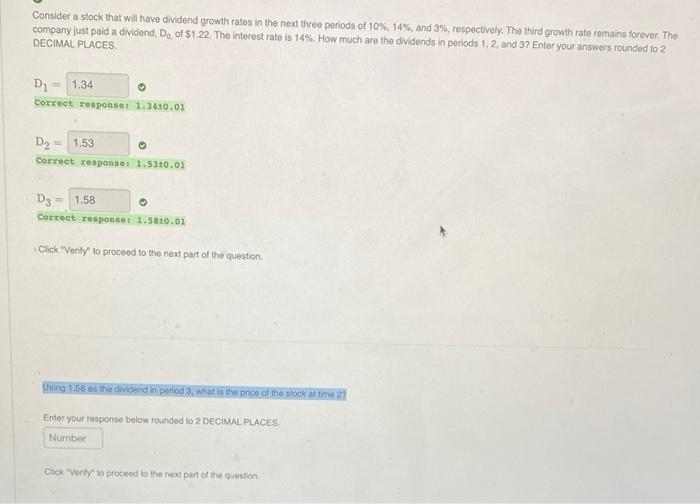

Consider a stock that will have dividend growth rates in the next three periods of 10%, 14%, and 3%, respectively. The third growth rate remains forever. The company just paid a dividend, Do, of $1.22. The interest rate is 14%. How much are the dividends in periods 1, 2, and 37 Enter your answers rounded to 2 DECIMAL PLACES. = D 1.34 Correct response: 1.3410.01 D2 1.53 Correct response: 1.5310.01 D3 1.58 Correct response: 1.5810.01 O Click "Verify" to proceed to the next part of the question. Using 1.58 as the dividend in period 3, what is the price of the stock at time 22 Enter your response below rounded to 2 DECIMAL PLACES. Number Click "Verity to proceed to the next part of the question.

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Dividend paid D0122 Growth rate g110 Growth rate g214 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started