Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a stock, the current price (So) of which is $30. We model stock-price evolution using a Binomial model. In every three-month period, u

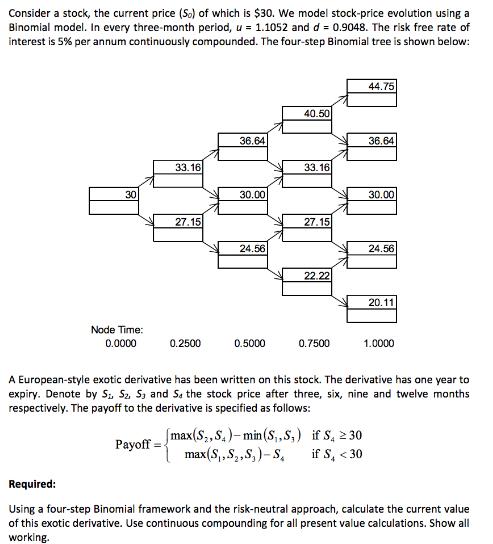

Consider a stock, the current price (So) of which is $30. We model stock-price evolution using a Binomial model. In every three-month period, u = 1.1052 and d = 0.9048. The risk free rate of interest is 5% per annum continuously compounded. The four-step Binomial tree is shown below: 30 Node Time: 0.0000 33.16 Payoff= 27.15 0.2500 36.64 30.00 24.56 0.5000 40.50 33.16 [max(S, S.)-min (S,S,) max(S, S, S.,)-S, 27.15 22.22 0.7500 44.75 36.64 if S, 230 if S < 30 30.00 24.56 A European-style exotic derivative has been written on this stock. The derivative has one year to expiry. Denote by S, S, S, and S, the stock price after three, six, nine and twelve months respectively. The payoff to the derivative is specified as follows: 20.11 1.0000 Required: Using a four-step Binomial framework and the risk-neutral approach, calculate the current value of this exotic derivative. Use continuous compounding for all present value calculations. Show all working.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the current value of the exotic derivative using the fourstep Binomial framework and the riskneutral approach we need to work backward th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started