Question: Consider a three-step binomial model. The stock prices S(n.j) and interest rates r(n, j) are shown in the two binomial pricing trees below. S(0,0)

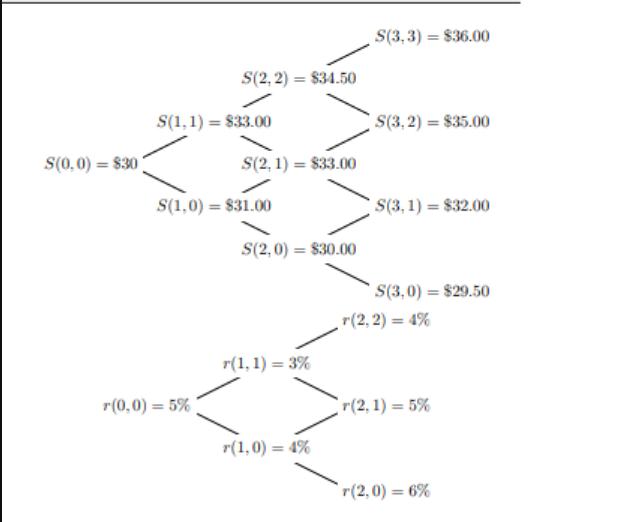

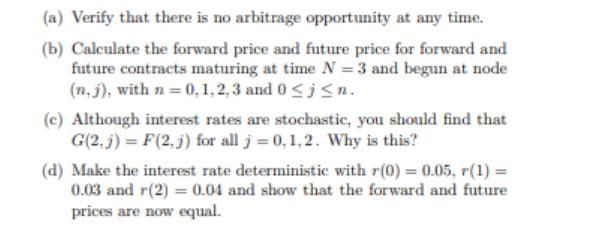

Consider a three-step binomial model. The stock prices S(n.j) and interest rates r(n, j) are shown in the two binomial pricing trees below. S(0,0) = 830) S(2, 2) = $34.50 S(1,1)= $33.00 r(0,0) = 5% S(2, 1) = $33.00 S(1,0) = $31.00 S(2,0) = $30.00 r(1,1)= 3% r(1,0) = 4% S(3, 3) = $36.00 S(3,2) = $35.00 S(3,1) = $32.00 S(3,0) = $29.50 r(2, 2) = 4% r(2, 1) = 5% r(2,0) = 6% (a) Verify that there is no arbitrage opportunity at any time. (b) Calculate the forward price and future price for forward and future contracts maturing at time N = 3 and begun at node (n.j), with n = 0, 1, 2, 3 and 0 jn. (c) Although interest rates are stochastic, you should find that G(2.j) = F(2.j) for all j= 0,1,2. Why is this? (d) Make the interest rate deterministic with r(0) = 0.05, r(1) = 0.03 and r(2)= 0.04 and show that the forward and future prices are now equal.

Step by Step Solution

There are 3 Steps involved in it

To determine whether there are arbitrage opportunities in this threestep binomial model we need to check if the noarbitrage condition holds The noarbi... View full answer

Get step-by-step solutions from verified subject matter experts