Question: Consider a traditional bank which offers checking, savings, CD (certificate of deposit) accounts to customers. To make it simple, let us assume that for

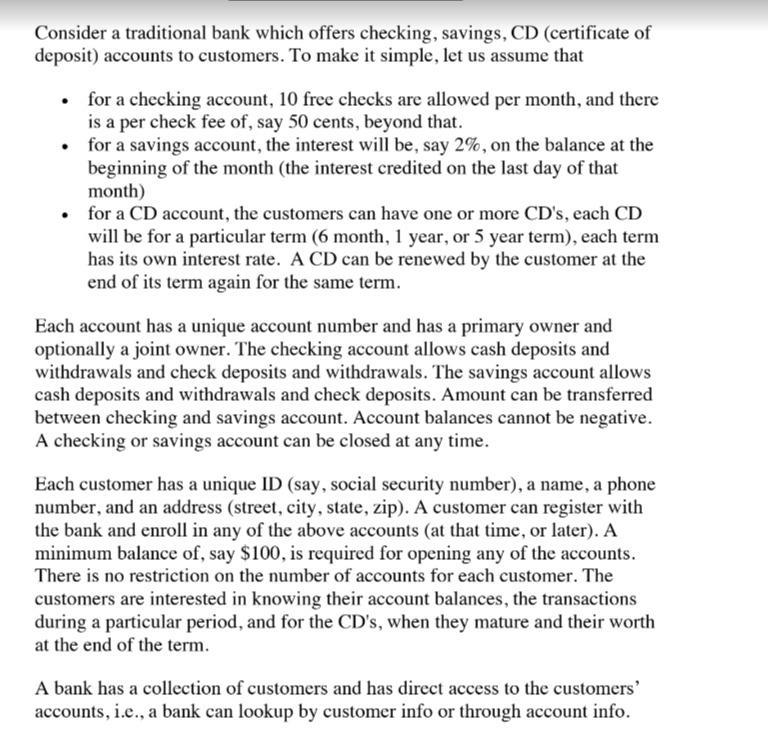

Consider a traditional bank which offers checking, savings, CD (certificate of deposit) accounts to customers. To make it simple, let us assume that for a checking account, 10 free checks are allowed per month, and there is a per check fee of, say 50 cents, beyond that. for a savings account, the interest will be, say 2%, on the balance at the beginning of the month (the interest credited on the last day of that month) for a CD account, the customers can have one or more CD's, each CD will be for a particular term (6 month, 1 year, or 5 year term), each term has its own interest rate. A CD can be renewed by the customer at the end of its term again for the same term. Each account has a unique account number and has a primary owner and optionally a joint owner. The checking account allows cash deposits and withdrawals and check deposits and withdrawals. The savings account allows cash deposits and withdrawals and check deposits. Amount can be transferred between checking and savings account. Account balances cannot be negative. A checking or savings account can be closed at any time. Each customer has a unique ID (say, social security number), a name, a phone number, and an address (street, city, state, zip). A customer can register with the bank and enroll in any of the above accounts (at that time, or later). A minimum balance of, say $100, is required for opening any of the accounts. There is no restriction on the number of accounts for each customer. The customers are interested in knowing their account balances, the transactions during a particular period, and for the CD's, when they mature and their worth at the end of the term. A bank has a collection of customers and has direct access to the customers' accounts, i.e., a bank can lookup by customer info or through account info. Part1 (40 points) Show the class diagram for the application (first, identify the classes, and then work out the relationships between them) Part2 (20 points) Show the activity diagram for a customer opening a savings account with the bank. The customer could be an existing customer or a new customer. Part3 (20 points) Show the sequence diagram for a customer enrolling in a 1 year CD with the bank. The customer could be an existing customer or a new customer. Part4 (20 points) Show the state diagram for a checking account balances. Identify the states for the checking account and map the transitions for all the possible actions.

Step by Step Solution

There are 3 Steps involved in it

Part ... View full answer

Get step-by-step solutions from verified subject matter experts