Answered step by step

Verified Expert Solution

Question

1 Approved Answer

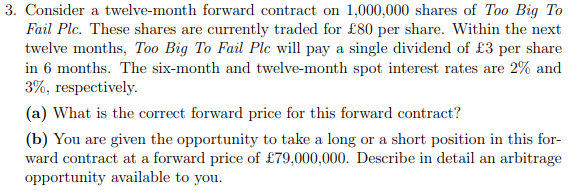

Consider a twelve-month forward contract on 1,000,000 shares of Too Big To Fail Plc. These shares are currently traded for 80 per share. Within the

Consider a twelve-month forward contract on 1,000,000 shares of Too Big To Fail Plc. These shares are currently traded for 80 per share. Within the next twelve months, Too Big To Fail Plc will pay a single dividend of 3 per share in 6 months. The six-month and twelve-month spot interest rates are 2% and 3%, respectively. (a) What is the correct forward price for this forward contract? (b) You are given the opportunity to take a long or a short position in this forward contract at a forward price of 79,000,000. Describe in detail an arbitrage opportunity available to you

Consider a twelve-month forward contract on 1,000,000 shares of Too Big To Fail Plc. These shares are currently traded for 80 per share. Within the next twelve months, Too Big To Fail Plc will pay a single dividend of 3 per share in 6 months. The six-month and twelve-month spot interest rates are 2% and 3%, respectively. (a) What is the correct forward price for this forward contract? (b) You are given the opportunity to take a long or a short position in this forward contract at a forward price of 79,000,000. Describe in detail an arbitrage opportunity available to you Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started