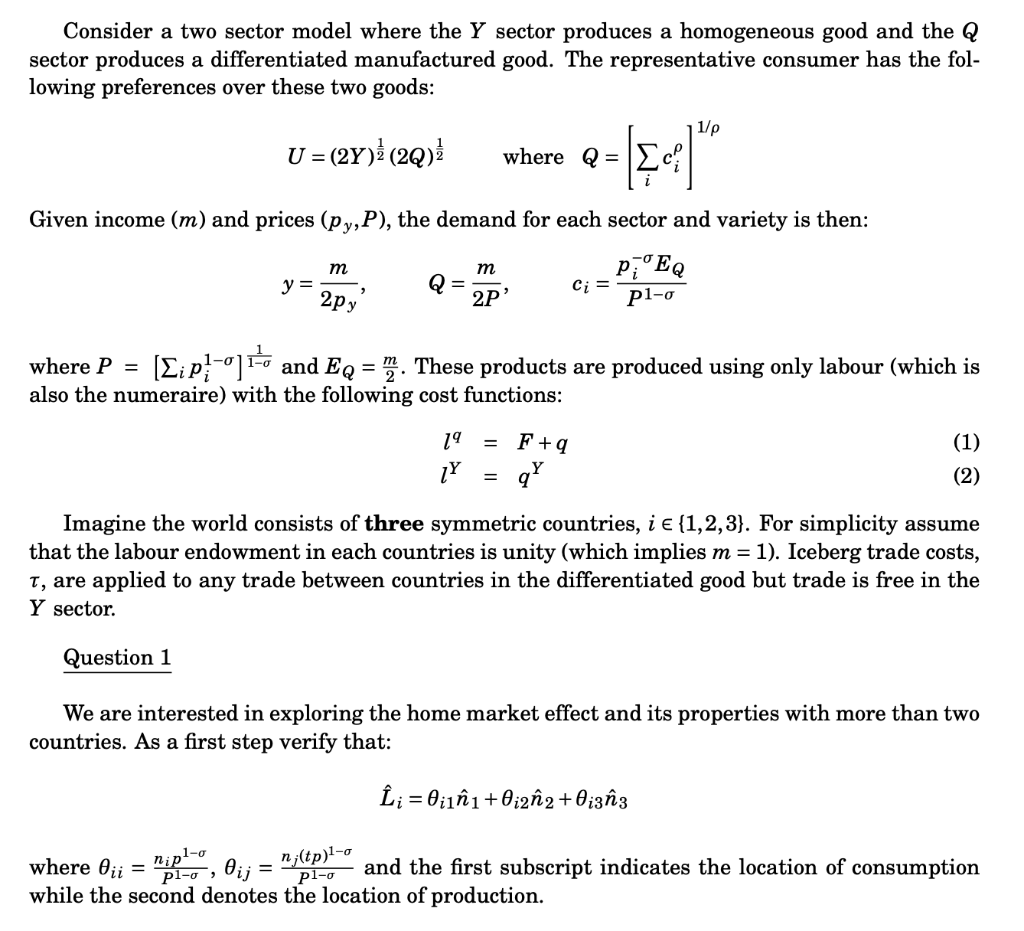

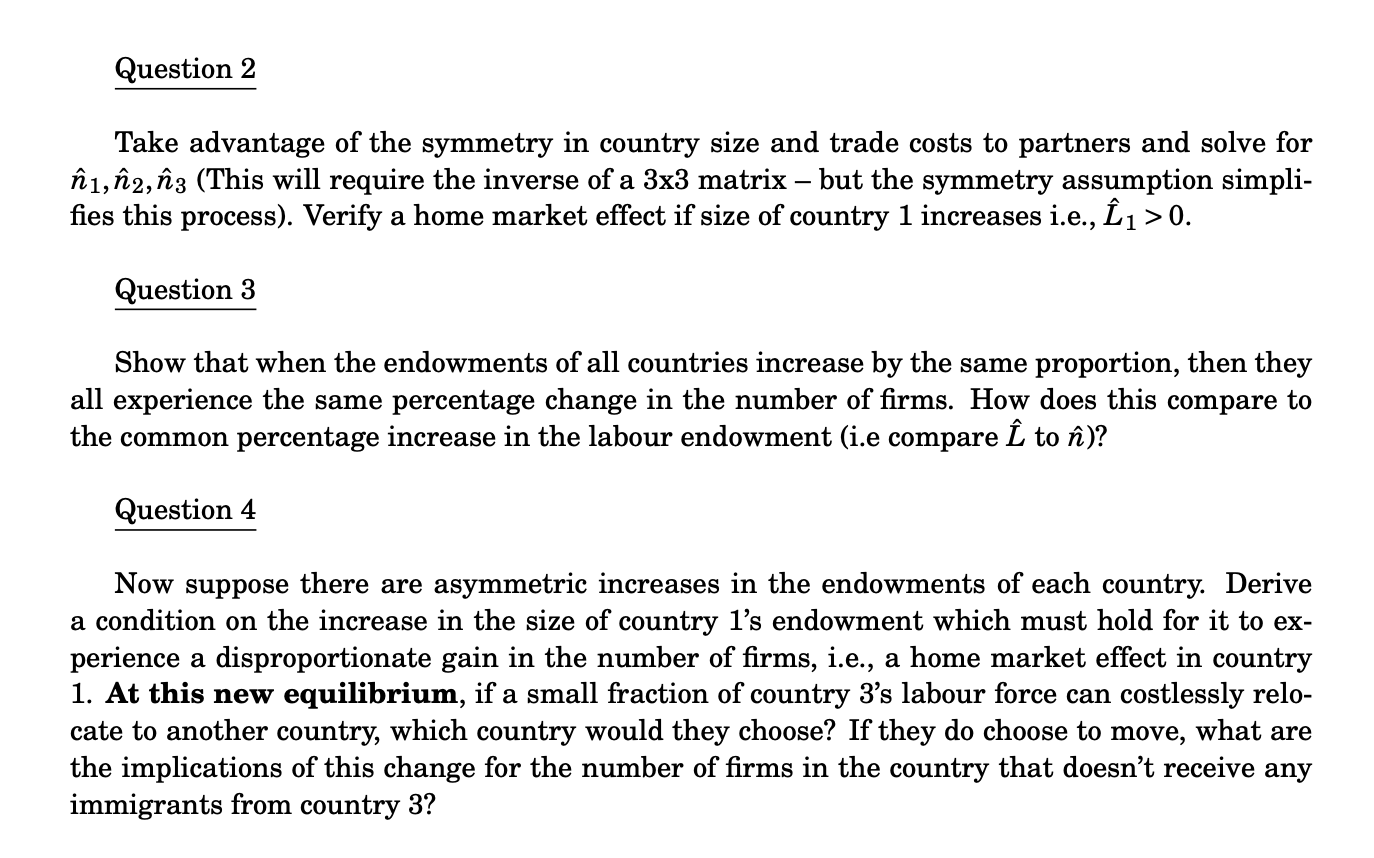

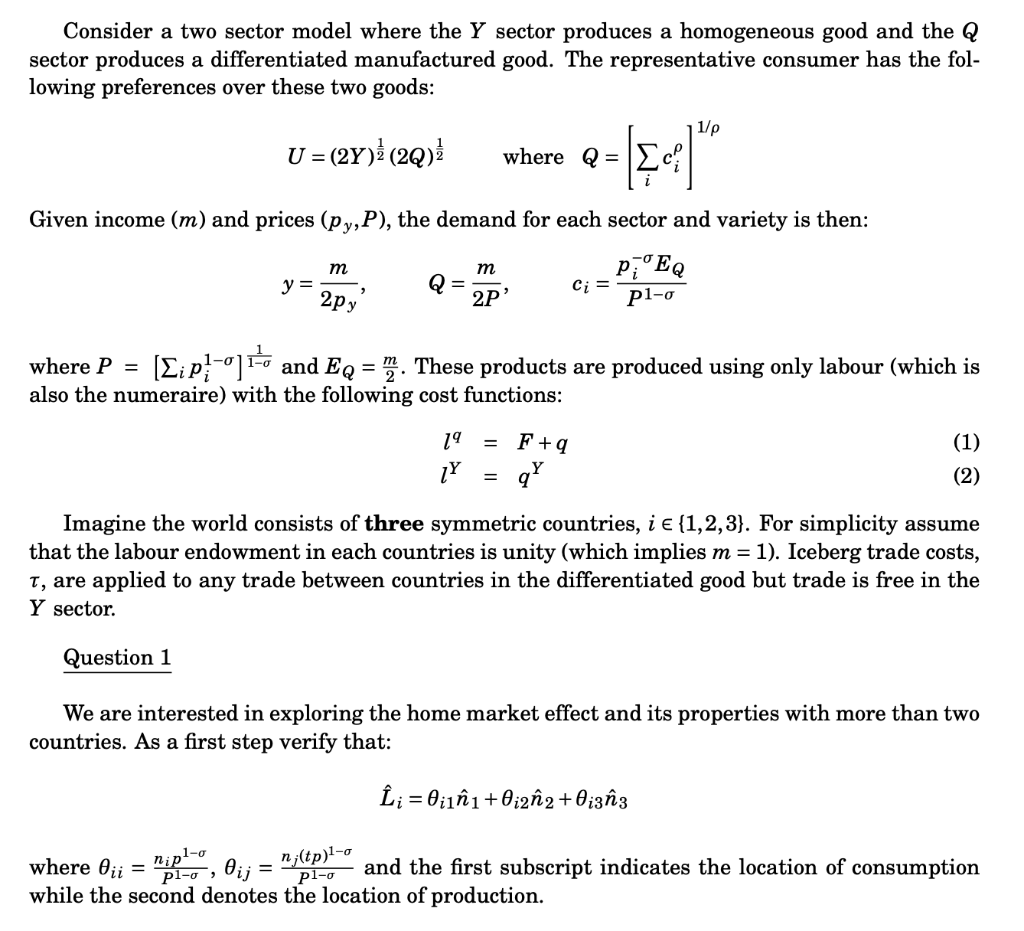

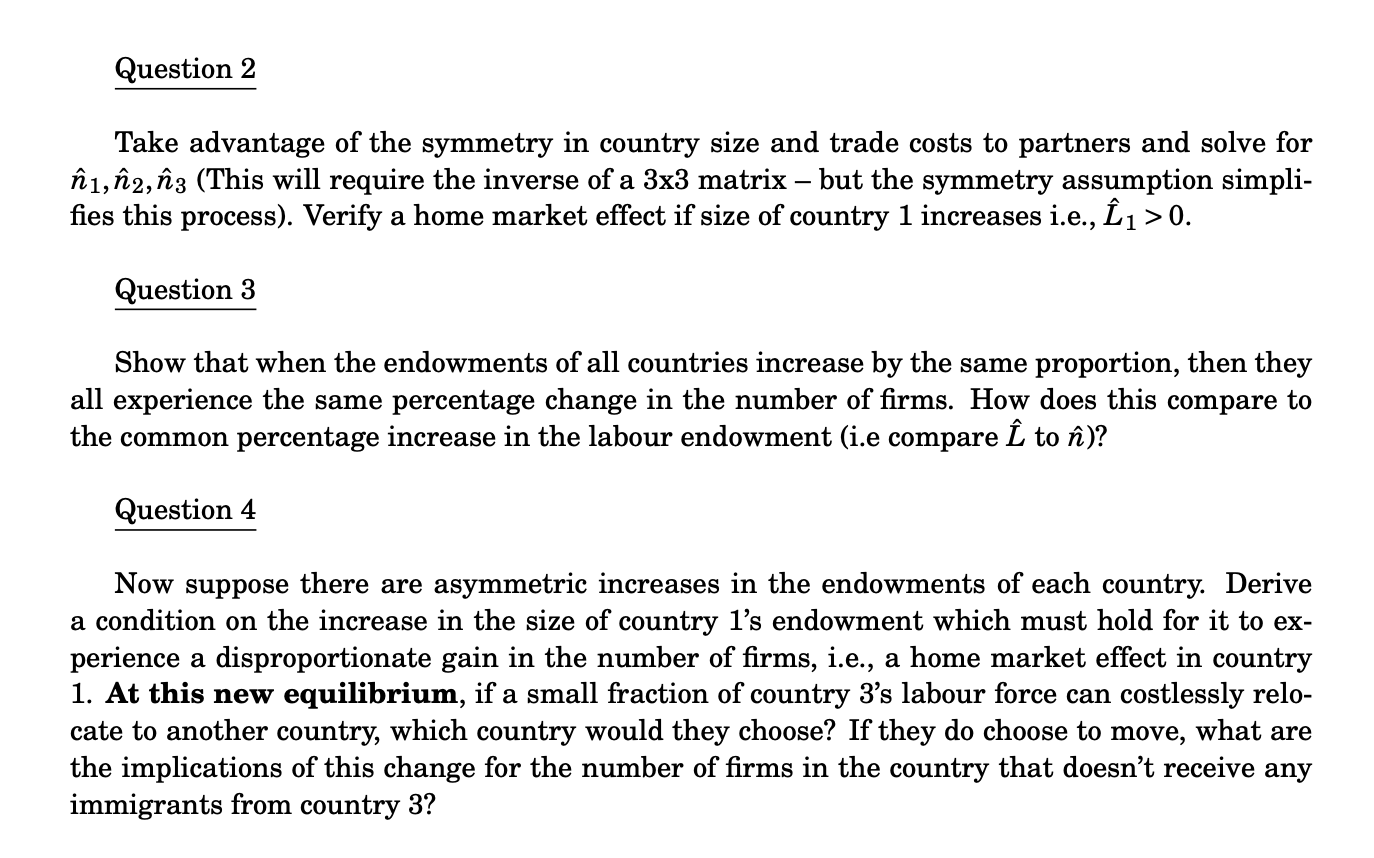

Consider a two sector model where the Y sector produces a homogeneous good and the Q sector produces a differentiated manufactured good. The representative consumer has the following preferences over these two goods: U=(2Y)21(2Q)21whereQ=[ici]1/ Given income (m) and prices (py,P), the demand for each sector and variety is then: y=2pym,Q=2Pm,ci=P1piEQ where P=[ipi1]11 and EQ=2m. These products are produced using only labour (which is also the numeraire) with the following cost functions: lqlY=F+q=qY Imagine the world consists of three symmetric countries, i{1,2,3}. For simplicity assume that the labour endowment in each countries is unity (which implies m=1 ). Iceberg trade costs, , are applied to any trade between countries in the differentiated good but trade is free in the Y sector. Question 1 We are interested in exploring the home market effect and its properties with more than two countries. As a first step verify that: L^i=i1n^1+i2n^2+i3n^3 where ii=P1nip1,ij=P1nj(tp)1 and the first subscript indicates the location of consumption while the second denotes the location of production. Take advantage of the symmetry in country size and trade costs to partners and solve for n^1,n^2,n^3 (This will require the inverse of a 3x3 matrix - but the symmetry assumption simplifies this process). Verify a home market effect if size of country 1 increases i.e., L^1>0. Question 3 Show that when the endowments of all countries increase by the same proportion, then they all experience the same percentage change in the number of firms. How does this compare to the common percentage increase in the labour endowment (i.e compare L^ to n^ )? Question 4 Now suppose there are asymmetric increases in the endowments of each country. Derive a condition on the increase in the size of country 1's endowment which must hold for it to experience a disproportionate gain in the number of firms, i.e., a home market effect in country 1. At this new equilibrium, if a small fraction of country 3's labour force can costlessly relocate to another country, which country would they choose? If they do choose to move, what are the implications of this change for the number of firms in the country that doesn't receive any immigrants from country 3 ? Consider a two sector model where the Y sector produces a homogeneous good and the Q sector produces a differentiated manufactured good. The representative consumer has the following preferences over these two goods: U=(2Y)21(2Q)21whereQ=[ici]1/ Given income (m) and prices (py,P), the demand for each sector and variety is then: y=2pym,Q=2Pm,ci=P1piEQ where P=[ipi1]11 and EQ=2m. These products are produced using only labour (which is also the numeraire) with the following cost functions: lqlY=F+q=qY Imagine the world consists of three symmetric countries, i{1,2,3}. For simplicity assume that the labour endowment in each countries is unity (which implies m=1 ). Iceberg trade costs, , are applied to any trade between countries in the differentiated good but trade is free in the Y sector. Question 1 We are interested in exploring the home market effect and its properties with more than two countries. As a first step verify that: L^i=i1n^1+i2n^2+i3n^3 where ii=P1nip1,ij=P1nj(tp)1 and the first subscript indicates the location of consumption while the second denotes the location of production. Take advantage of the symmetry in country size and trade costs to partners and solve for n^1,n^2,n^3 (This will require the inverse of a 3x3 matrix - but the symmetry assumption simplifies this process). Verify a home market effect if size of country 1 increases i.e., L^1>0. Question 3 Show that when the endowments of all countries increase by the same proportion, then they all experience the same percentage change in the number of firms. How does this compare to the common percentage increase in the labour endowment (i.e compare L^ to n^ )? Question 4 Now suppose there are asymmetric increases in the endowments of each country. Derive a condition on the increase in the size of country 1's endowment which must hold for it to experience a disproportionate gain in the number of firms, i.e., a home market effect in country 1. At this new equilibrium, if a small fraction of country 3's labour force can costlessly relocate to another country, which country would they choose? If they do choose to move, what are the implications of this change for the number of firms in the country that doesn't receive any immigrants from country 3