Answered step by step

Verified Expert Solution

Question

1 Approved Answer

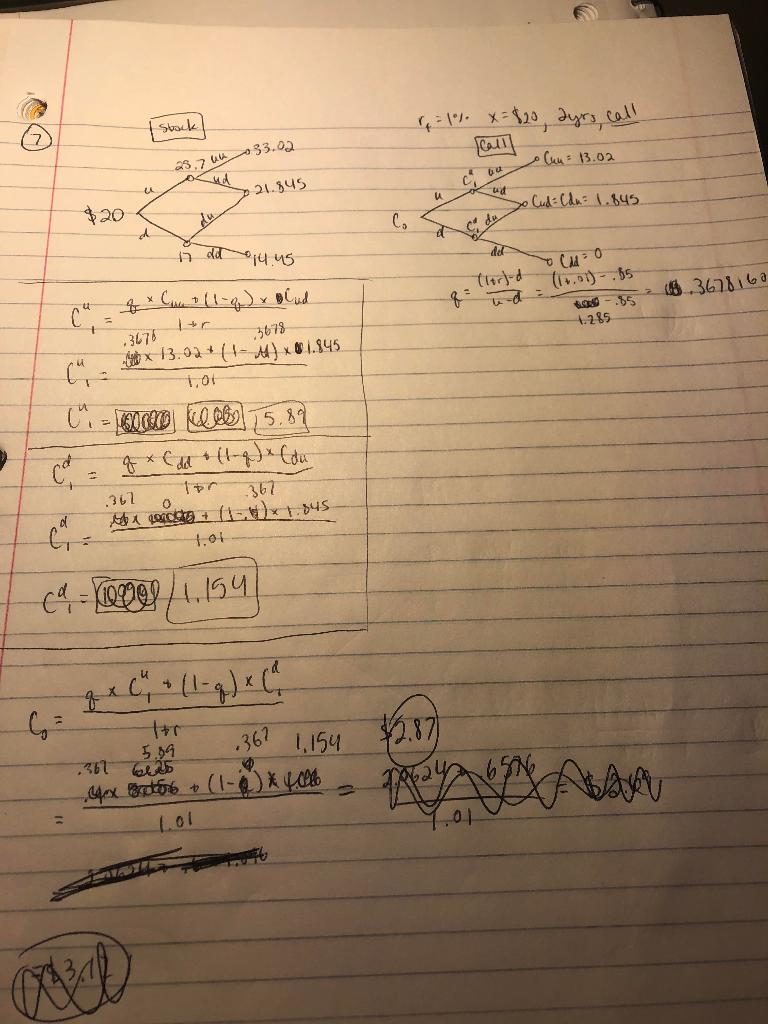

Consider a two-period binomial tree with the following characteristics: Each period is one year The current price of a non-dividend paying stock is $20 per

Consider a two-period binomial tree with the following characteristics:

- Each period is one year

- The current price of a non-dividend paying stock is $20 per share

- The stock can rise by 28.5% each year (i.e., u = 1.285)

- The stock can decline by 15% each year (i.e., d=0.85)

- The risk-free interest rate is 1% per annum

What is the price of an American call option on this stock with a strike price of $20 that matures in two years from today?

Group of answer choices

1.76

3.09

3.41

2.57

2.17

Stock re=1% X=820, dyrs, call Fall Cun 13.02 23.7 33.02 60 21.845 u Cud (du= 1.845 C. 14.45 dd o dd 0 ( 6 3678160 ch 1.285 q (1-q) x plud .3076 x 13.02*11- * 1.845 1,01 ci - boo kilele 15.89 qx (ded tq) x (du .362 tur 367 u pengta +.845 1.01 64-10098 1.154 qxC (1-q) x (2 tr 5.14 25 36? 1,154 $7.87 2624 Grex (-X 40% Bayou Lol 01

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started