Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a two-period economy that has at the beginning of period 1 external wealth of -100. GDP in both periods is 120. The interest

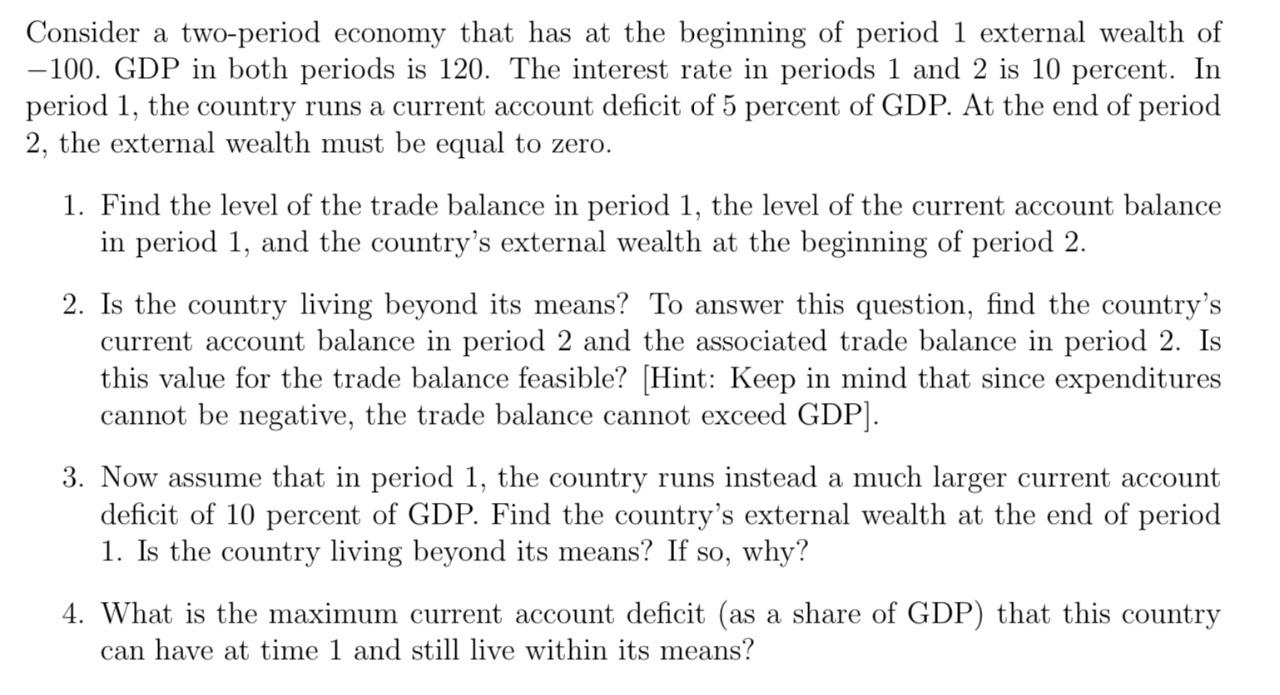

Consider a two-period economy that has at the beginning of period 1 external wealth of -100. GDP in both periods is 120. The interest rate in periods 1 and 2 is 10 percent. In period 1, the country runs a current account deficit of 5 percent of GDP. At the end of period 2, the external wealth must be equal to zero. 1. Find the level of the trade balance in period 1, the level of the current account balance in period 1, and the country's external wealth at the beginning of period 2. 2. Is the country living beyond its means? To answer this question, find the country's current account balance in period 2 and the associated trade balance in period 2. Is this value for the trade balance feasible? [Hint: Keep in mind that since expenditures cannot be negative, the trade balance cannot exceed GDP]. 3. Now assume that in period 1, the country runs instead a much larger current account deficit of 10 percent of GDP. Find the country's external wealth at the end of period 1. Is the country living beyond its means? If so, why? 4. What is the maximum current account deficit (as a share of GDP) that this country can have at time 1 and still live within its means?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sure I can help you analyze and solve the problems in the image 1 Finding the trade balance current account balance and external wealth at the beginning of period 2 Trade Balance The current account d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started