Question

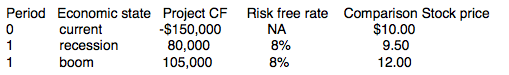

Consider a two-period investment project. The following table describes the cash flows and the comparison stock prices in time 0 and time 1. In addition,

Consider a two-period investment project.

The following table describes the cash flows and the comparison stock prices in time 0 and time 1.

In addition, if there is a boom in the first time period, the present value of cash flows in time 2 (but measured at time 1) is $102,000 and if there is a recession in the first time period, the present value of cash flows in time 2 (but measured at time 1) is $80,000.

(a) Using the ARBITRAGE PROCEDURE, what is the net-present value of this project? Should the investment project go ahead?

(b) How would your answer to part (a) change if an outside investor were to offer $50,000 for 50% ownership of the project at the end of time period 1?

(c) What is the minimum offer that the company would be prepared to accept from an outside investor for 50% ownership of the project at the end of time period 1?

Period Economic state Project CF current -$150,000 80,000 recession boom 105,000 0 1 Risk free rate Comparison Stock price 8% 8% $10.00 9.50 12.00

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

aThe net present value of the project is 30000 The investment project should go ahead bIf an outside ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started