Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a two-period model similar to what we studied in Chapter 9 A consumer has income y in the current period and income in

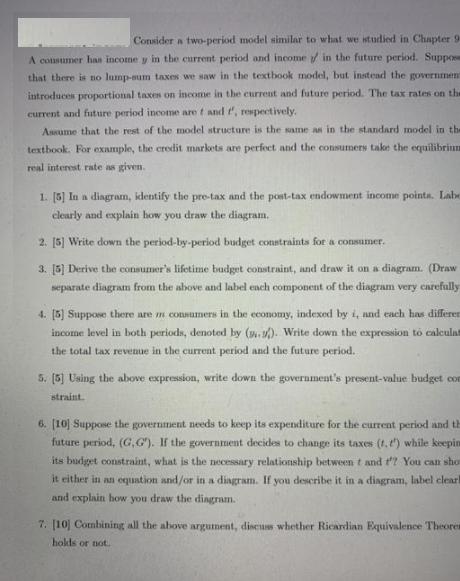

Consider a two-period model similar to what we studied in Chapter 9 A consumer has income y in the current period and income in the future period. Suppos that there is no lump-sum taxes we saw in the textbook model, but instead the government introduces proportional taxes on income in the current and future period. The tax rates on the current and future period income are f and f, respectively. Assume that the rest of the model structure is the same as in the standard model in the textbook. For example, the credit markets are perfect and the consumers take the equilibrium real interest rate as given. 1. [5] In a diagram, identify the pre-tax and the post-tax endowment income points. Labe clearly and explain how you draw the diagram. 2. [5] Write down the period-by-period budget constraints for a consumer. 3. [5] Derive the consumer's lifetime budget constraint, and draw it on a diagram. (Draw separate diagram from the above and label each component of the diagram very carefully 4. [5] Suppose there are in consumers in the economy, indexed by i, and each has differen income level in both periods, denoted by (.). Write down the expression to calculat the total tax revenue in the current period and the future period. 5. [5] Using the above expression, write down the government's present-value budget con straint. 6. [10] Suppose the government needs to keep its expenditure for the current period and th future period, (G,G). If the government decides to change its taxes (t.t) while keepin its budget constraint, what is the necessary relationship between t and t'? You can sho it either in an equation and/or in a diagram. If you describe it in a diagram, label clearl and explain how you draw the diagram. 7. [10] Combining all the above argument, discuss whether Ricardian Equivalence Theorer holds or not.

Step by Step Solution

★★★★★

3.43 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

The pretax endowment income points are y 0 and 0 y The posttax endowment income points are y1t 0 and 0 y1t To draw the diagram we place current period ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started