Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a two-step Binomial market model with four scenarios = {w, W2, W3, W4}, a risk-free security whose prices are B(0) 100, B(1) =

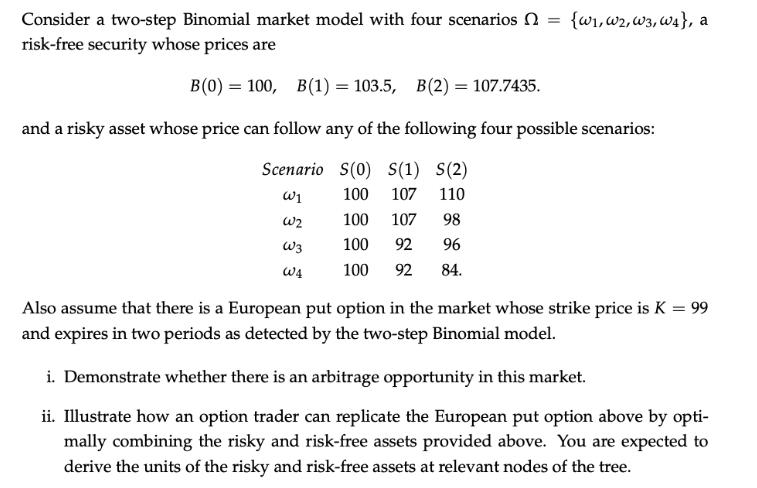

Consider a two-step Binomial market model with four scenarios = {w, W2, W3, W4}, a risk-free security whose prices are B(0) 100, B(1) = 103.5, B(2) = 107.7435. and a risky asset whose price can follow any of the following four possible scenarios: Scenario S(0) S(1) S(2) W1 100 107 110 W2 100 107 98 W3 100 92 96 W4 100 92 84. Also assume that there is a European put option in the market whose strike price is K = 99 and expires in two periods as detected by the two-step Binomial model. i. Demonstrate whether there is an arbitrage opportunity in this market. ii. Illustrate how an option trader can replicate the European put option above by opti- mally combining the risky and risk-free assets provided above. You are expected to derive the units of the risky and risk-free assets at relevant nodes of the tree.

Step by Step Solution

★★★★★

3.37 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

i To determine if there is an arbitrage opportunity in the market we need to check if there exists a portfolio of assets that guarantees a riskless profit We can construct a replicating portfolio for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started