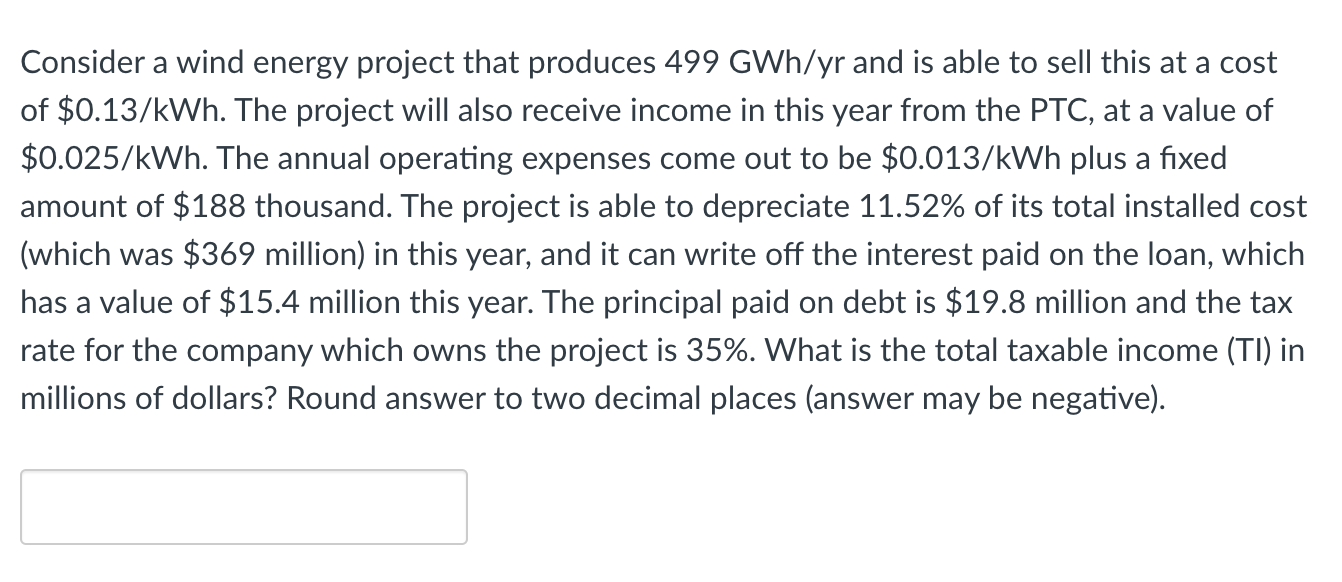

Question: Consider a wind energy project that produces 4 9 9 G W h y r and is able to sell this at a cost of

Consider a wind energy project that produces and is able to sell this at a cost

of $ The project will also receive income in this year from the PTC at a value of

$ The annual operating expenses come out to be $ plus a fixed

amount of $ thousand. The project is able to depreciate of its total installed cost

which was $ million in this year, and it can write off the interest paid on the loan, which

has a value of $ million this year. The principal paid on debt is $ million and the tax

rate for the company which owns the project is What is the total taxable income TI in

millions of dollars? Round answer to two decimal places answer may be negative

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock