Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a world that only consists of the three stocks shown in the following table: a. Calculate the total value of all shares outstanding

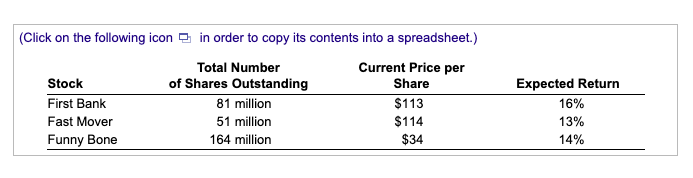

Consider a world that only consists of the three stocks shown in the following table: a. Calculate the total value of all shares outstanding currently. b. What fraction of the total value outstanding does each stock make up? c. You hold the market portfolio, that is, you have picked portfolio weights equal to the answer to part b with each stock's weight is equal to its contribution to the fraction of the total value of all stocks. What is the expected return of your portfolio? a. Calculate the total value of all shares outstanding currently. The total value of all shares outstanding currently is $ million. (Round to the nearest integer.) (Click on the following icon in order to copy its contents into a spreadsheet.) Stock First Bank Fast Mover Funny Bone Total Number of Shares Outstanding 81 million 51 million 164 million Current Price per Share Expected Return $113 16% $114 13% $34 14% You would like to estimate the weighted average cost of capital for a new airline business. Based on its industry asset beta, you have already estimated an unlevered cost of capital for the firm of 8%. However, the new business will be 22% debt financed, and you anticipate its debt cost of capital will be 6%. If its corporate tax rate is 34%, what is your estimate of its WACC? The equity cost of capital is %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Total value of shares outstanding can be computed by using the formula Number of shares outstandin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started