Answered step by step

Verified Expert Solution

Question

1 Approved Answer

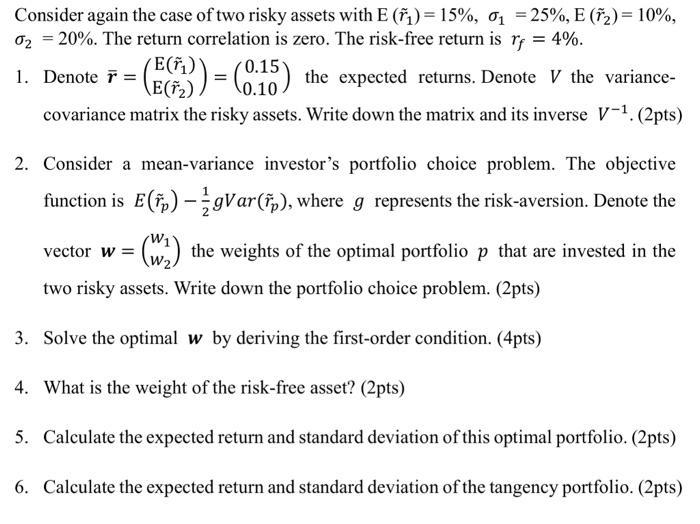

Consider again the case of two risky assets with E () = 15%, 0 = 25%, E (*) = 10%, 02 = 20%. The

Consider again the case of two risky assets with E () = 15%, 0 = 25%, E (*) = 10%, 02 = 20%. The return correlation is zero. The risk-free return is rf = 4%. 1. Denote 7 = (E(2)) = (0.15)) the expected returns. Denote V the variance- () covariance matrix the risky assets. Write down the matrix and its inverse V-1. (2pts) 2. Consider a mean-variance investor's portfolio choice problem. The objective function is E(F)-gVar (fp), where g represents the risk-aversion. Denote the the weights of the optimal portfolio p that are invested in the two risky assets. Write down the portfolio choice problem. (2pts) 3. Solve the optimal w by deriving the first-order condition. (4pts) vector w= W 4. What is the weight of the risk-free asset? (2pts) 5. Calculate the expected return and standard deviation of this optimal portfolio. (2pts) 6. Calculate the expected return and standard deviation of the tangency portfolio. (2pts)

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 Denote 1 015 the expected returns Denote V the variance E2 covariance matrix the risky assets Write down the matrix and its inverse V1 2pts The vari...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started