Consider an agent with the following utility function: U = E(rp) 0.005A Consider that this agent...

Fantastic news! We've Found the answer you've been seeking!

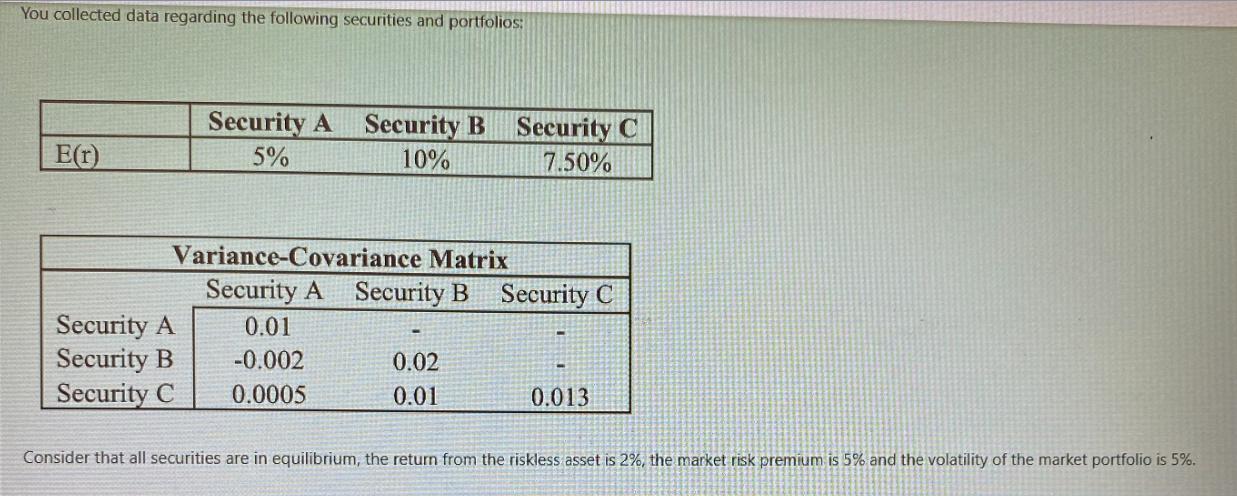

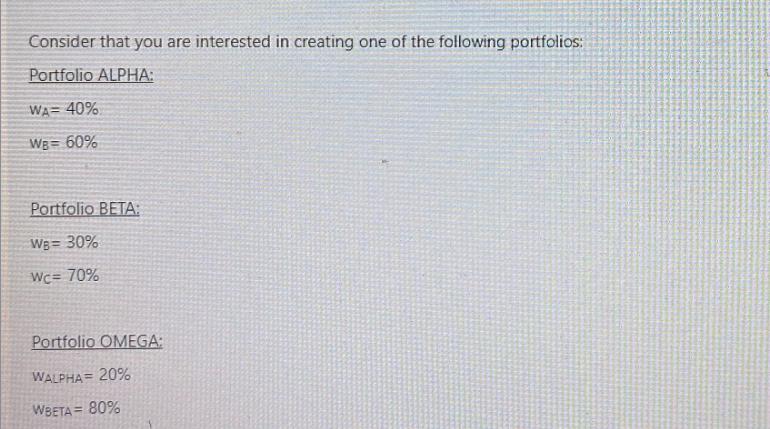

Question:

Related Book For

Behavioral Finance Psychology Decision-Making and Markets

ISBN: 978-0324661170

1st edition

Authors: Lucy Ackert

Posted Date: