Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider an airline company. The company has a contract they cannot get out of for a year. The agreement requires them to pay for

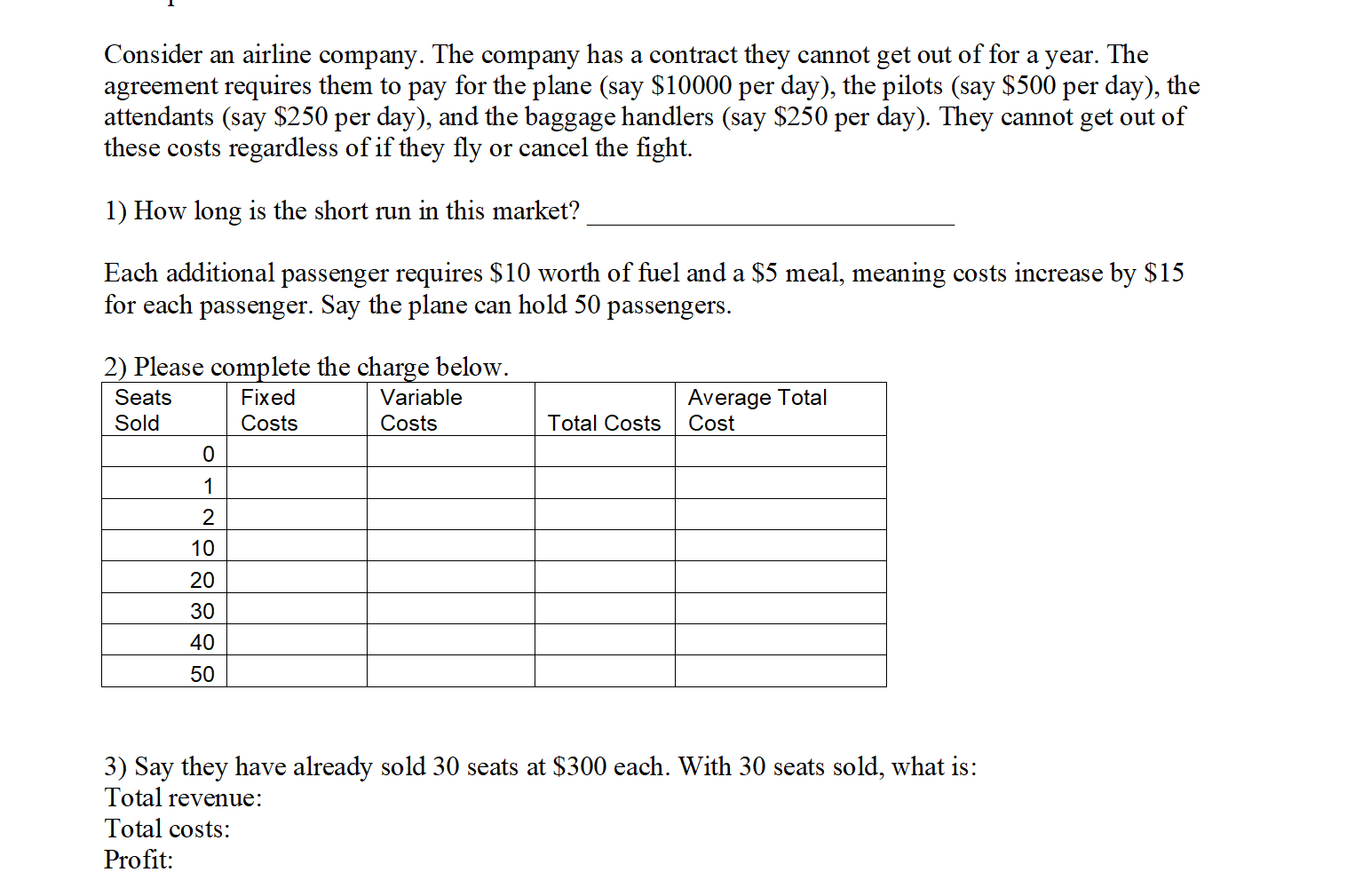

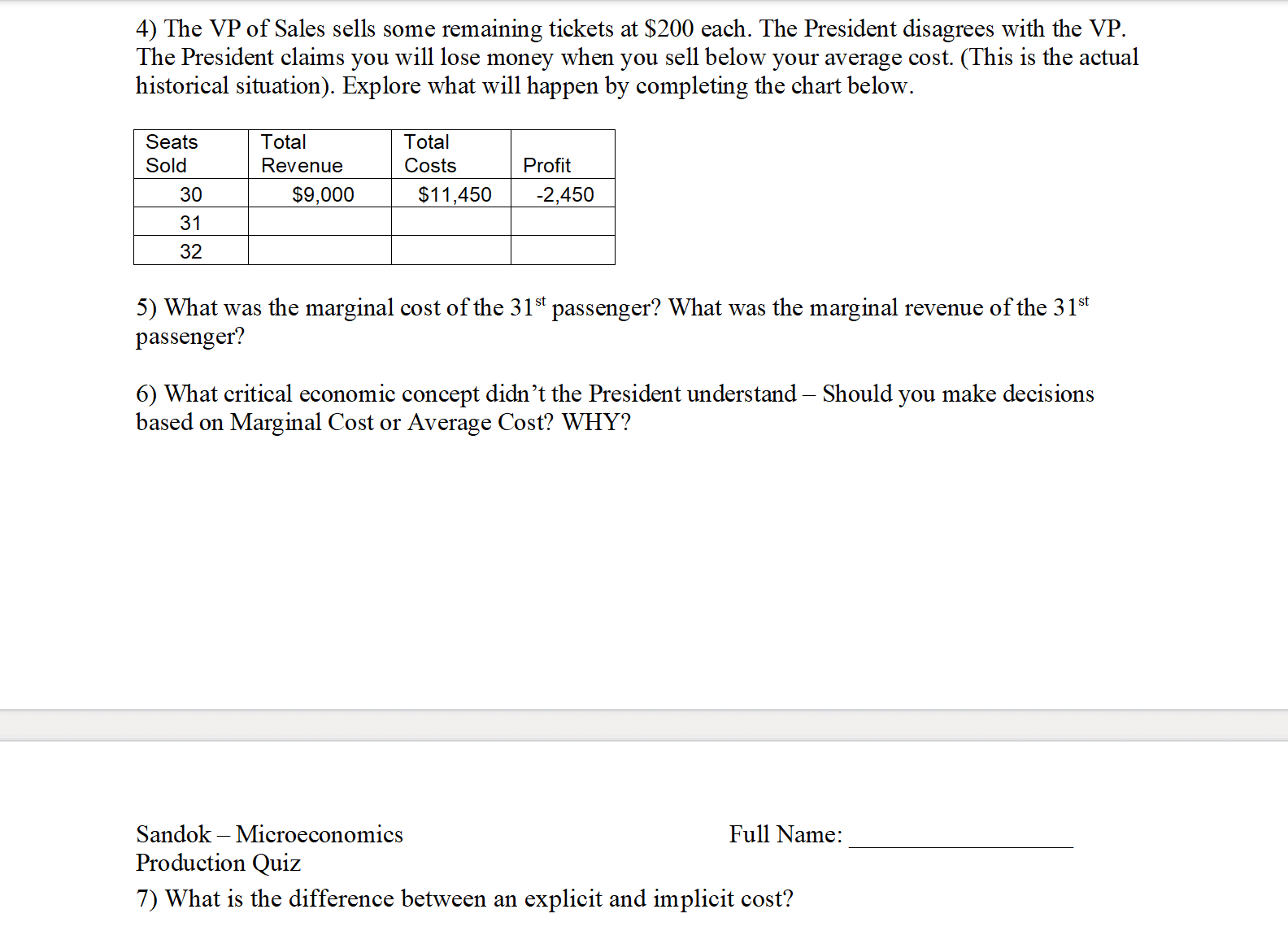

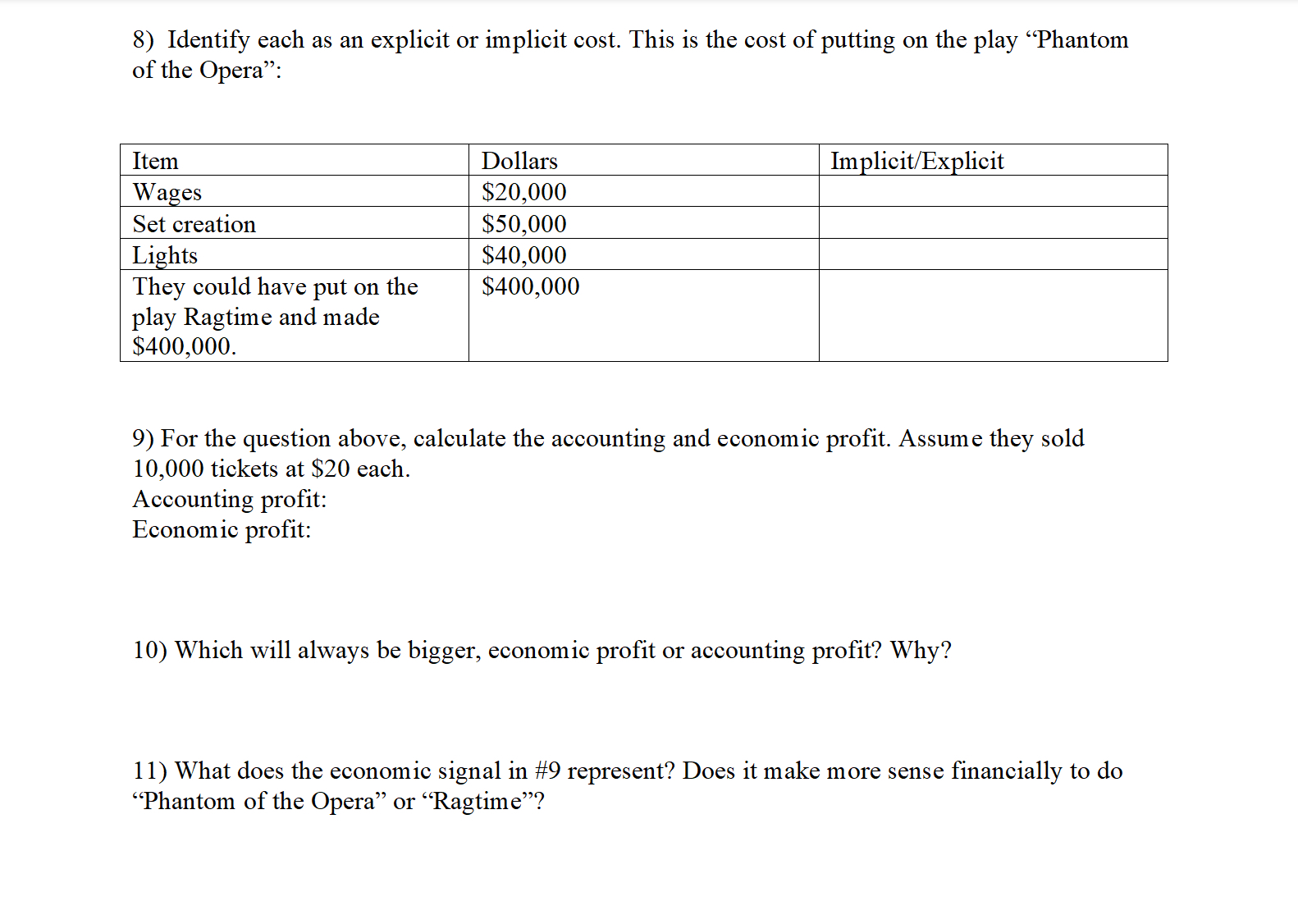

Consider an airline company. The company has a contract they cannot get out of for a year. The agreement requires them to pay for the plane (say $10000 per day), the pilots (say $500 per day), the attendants (say $250 per day), and the baggage handlers (say $250 per day). They cannot get out of these costs regardless of if they fly or cancel the fight. 1) How long is the short run in this market? Each additional passenger requires $10 worth of fuel and a $5 meal, meaning costs increase by $15 for each passenger. Say the plane can hold 50 passengers. 2) Please complete the charge below. Seats Fixed Sold Costs 0 1 10 30 40 50 202829 Variable Costs Total Costs Average Total Cost 3) Say they have already sold 30 seats at $300 each. With 30 seats sold, what is: Total revenue: Total costs: Profit: 4) The VP of Sales sells some remaining tickets at $200 each. The President disagrees with the VP. The President claims you will lose money when you sell below your average cost. (This is the actual historical situation). Explore what will happen by completing the chart below. Seats Sold 30 Total Revenue $9,000 Total Costs $11,450 Profit -2,450 31 32 5) What was the marginal cost of the 31st passenger? What was the marginal revenue of the 31st passenger? 6) What critical economic concept didn't the President understand Should you make decisions based on Marginal Cost or Average Cost? WHY? Sandok Microeconomics Production Quiz Full Name: 7) What is the difference between an explicit and implicit cost? 8) Identify each as an explicit or implicit cost. This is the cost of putting on the play Phantom of the Opera": Item Dollars Wages $20,000 Set creation $50,000 Lights $40,000 They could have put on the $400,000 play Ragtime and made $400,000. Implicit/Explicit 9) For the question above, calculate the accounting and economic profit. Assume they sold 10,000 tickets at $20 each. Accounting profit: Economic profit: 10) Which will always be bigger, economic profit or accounting profit? Why? 11) What does the economic signal in #9 represent? Does it make more sense financially to do "Phantom of the Opera or Ragtime"?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 In this scenario the short run would be the duration of the contract which is one year Du...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started