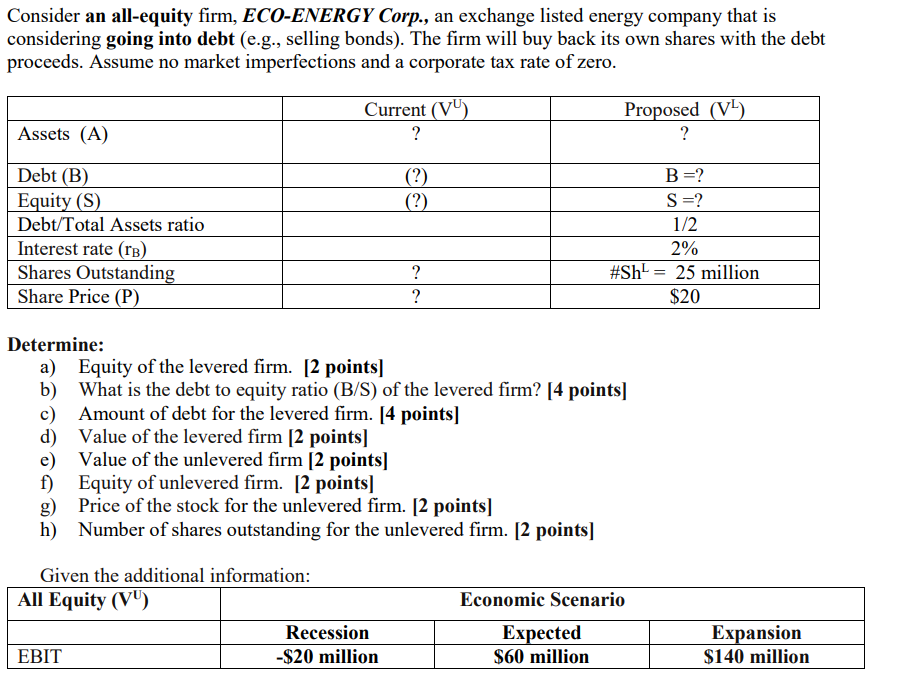

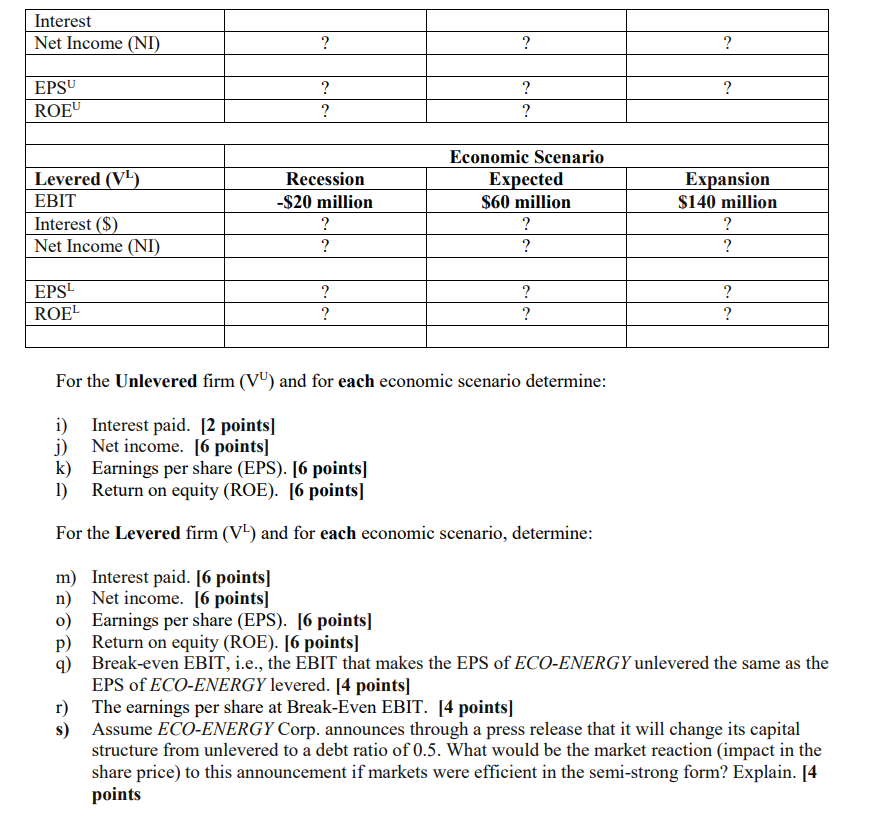

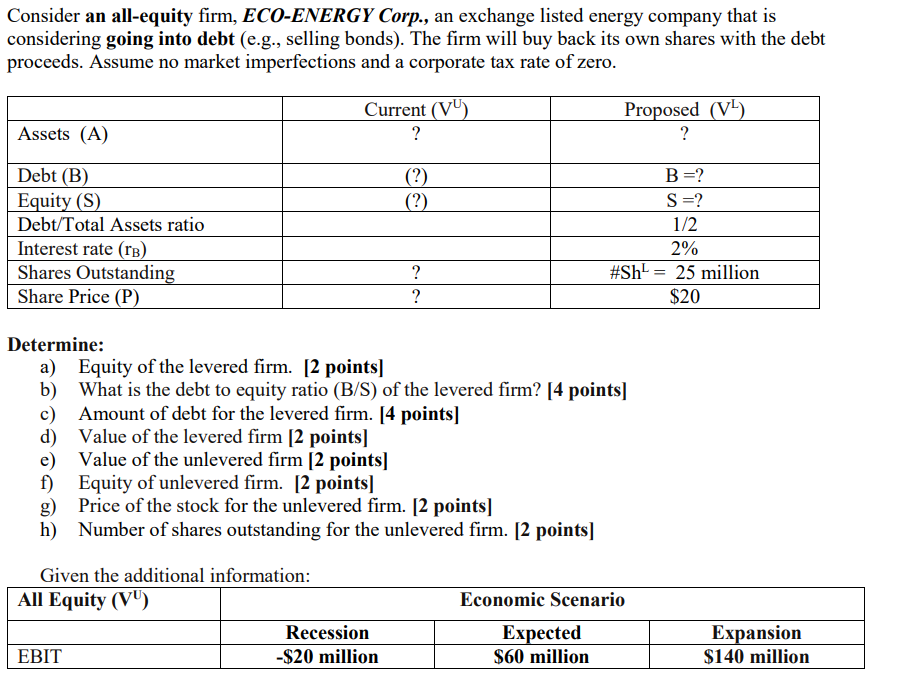

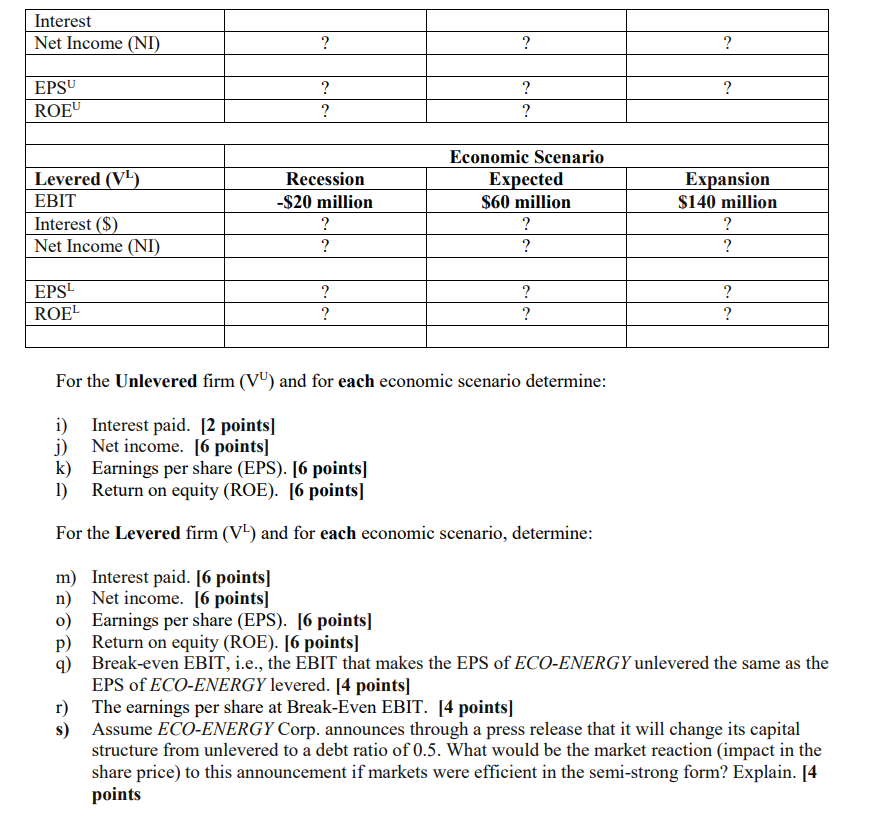

Consider an all-equity firm, ECO-ENERGY Corp., an exchange listed energy company that is considering going into debt (e.g., selling bonds). The firm will buy back its own shares with the debt proceeds. Assume no market imperfections and a corporate tax rate of zero. Determine: a) Equity of the levered firm. [2 points] b) What is the debt to equity ratio (B/S) of the levered firm? [4 points] c) Amount of debt for the levered firm. [4 points] d) Value of the levered firm [2 points] e) Value of the unlevered firm [ 2 points] f) Equity of unlevered firm. [2 points] g) Price of the stock for the unlevered firm. [2 points] h) Number of shares outstanding for the unlevered firm. [2 points] For the Unlevered firm (VU) and for each economic scenario determine: i) Interest paid. [2 points] j) Net income. [6 points] k) Earnings per share (EPS). [6 points] 1) Return on equity (ROE). [6 points] For the Levered firm (VL) and for each economic scenario, determine: m) Interest paid. [6 points] n) Net income. [6 points] o) Earnings per share (EPS). [6 points] p) Return on equity (ROE). [6 points] q) Break-even EBIT, i.e., the EBIT that makes the EPS of ECO-ENERGY unlevered the same as the EPS of ECOENERGY levered. [4 points] r) The earnings per share at Break-Even EBIT. [4 points] s) Assume ECO-ENERGY Corp. announces through a press release that it will change its capital structure from unlevered to a debt ratio of 0.5 . What would be the market reaction (impact in the share price) to this announcement if markets were efficient in the semi-strong form? Explain. [4 points Consider an all-equity firm, ECO-ENERGY Corp., an exchange listed energy company that is considering going into debt (e.g., selling bonds). The firm will buy back its own shares with the debt proceeds. Assume no market imperfections and a corporate tax rate of zero. Determine: a) Equity of the levered firm. [2 points] b) What is the debt to equity ratio (B/S) of the levered firm? [4 points] c) Amount of debt for the levered firm. [4 points] d) Value of the levered firm [2 points] e) Value of the unlevered firm [ 2 points] f) Equity of unlevered firm. [2 points] g) Price of the stock for the unlevered firm. [2 points] h) Number of shares outstanding for the unlevered firm. [2 points] For the Unlevered firm (VU) and for each economic scenario determine: i) Interest paid. [2 points] j) Net income. [6 points] k) Earnings per share (EPS). [6 points] 1) Return on equity (ROE). [6 points] For the Levered firm (VL) and for each economic scenario, determine: m) Interest paid. [6 points] n) Net income. [6 points] o) Earnings per share (EPS). [6 points] p) Return on equity (ROE). [6 points] q) Break-even EBIT, i.e., the EBIT that makes the EPS of ECO-ENERGY unlevered the same as the EPS of ECOENERGY levered. [4 points] r) The earnings per share at Break-Even EBIT. [4 points] s) Assume ECO-ENERGY Corp. announces through a press release that it will change its capital structure from unlevered to a debt ratio of 0.5 . What would be the market reaction (impact in the share price) to this announcement if markets were efficient in the semi-strong form? Explain. [4 points