Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider an economy in which a government is running persistent fiscal deficits DEF = DEF > 0 Vt. Furthermore, assume the government has reached

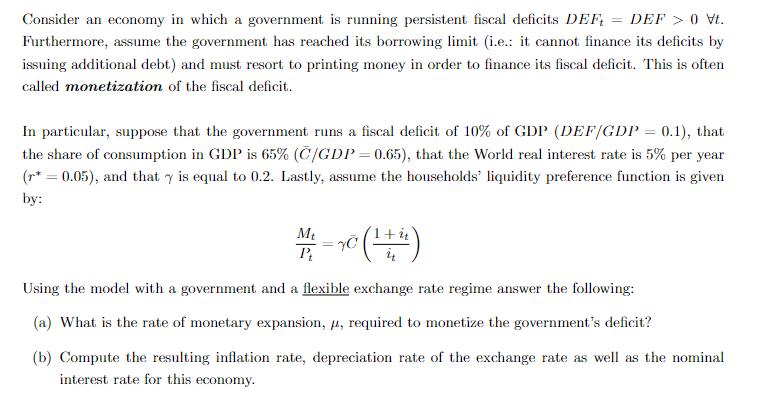

Consider an economy in which a government is running persistent fiscal deficits DEF = DEF > 0 Vt. Furthermore, assume the government has reached its borrowing limit (i.e.: it cannot finance its deficits by issuing additional debt) and must resort to printing money in order to finance its fiscal deficit. This is often called monetization of the fiscal deficit. In particular, suppose that the government runs a fiscal deficit of 10% of GDP (DEF/GDP = 0.1), that the share of consumption in GDP is 65% (C/GDP = 0.65), that the World real interest rate is 5% per year (r= 0.05), and that y is equal to 0.2. Lastly, assume the households' liquidity preference function is given by: Mt M = 10 ( + i) Pt Using the model with a government and a flexible exchange rate regime answer the following: (a) What is the rate of monetary expansion, , required to monetize the government's deficit? (b) Compute the resulting inflation rate, depreciation rate of the exchange rate as well as the nominal interest rate for this economy.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a To monetize the governments deficit the government needs to print money to purchase the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started