Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider an economy inhabited by H households, which are identical in every respect so that we can talk in terms of a representative household.

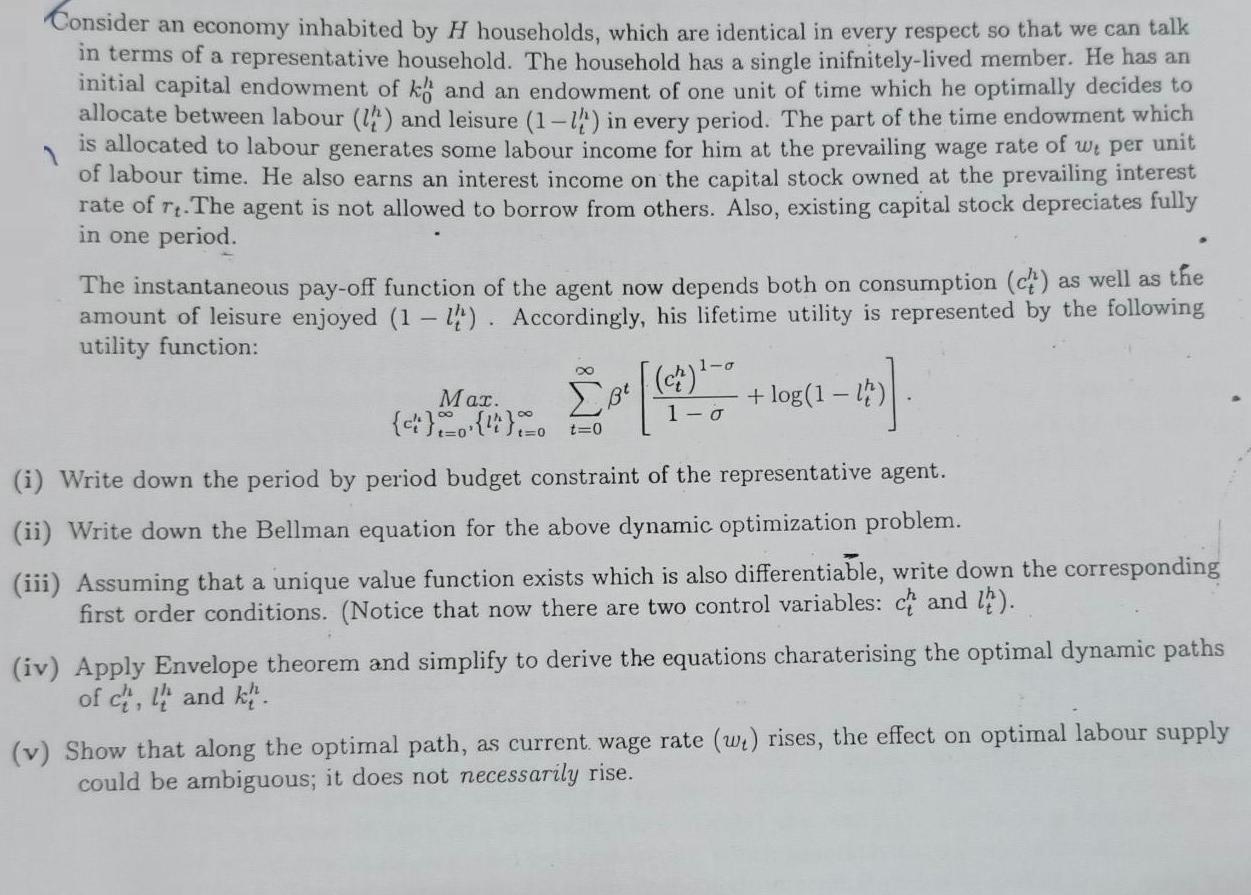

Consider an economy inhabited by H households, which are identical in every respect so that we can talk in terms of a representative household. The household has a single inifnitely-lived member. He has an initial capital endowment of k and an endowment of one unit of time which he optimally decides to allocate between labour (1) and leisure (1-1) in every period. The part of the time endowment which is allocated to labour generates some labour income for him at the prevailing wage rate of we per unit of labour time. He also earns an interest income on the capital stock owned at the prevailing interest rate of rt.The agent is not allowed to borrow from others. Also, existing capital stock depreciates fully in one period. The instantaneous pay-off function of the agent now depends both on consumption (c) as well as the amount of leisure enjoyed (1-1). Accordingly, his lifetime utility is represented by the following utility function: Mar. {4}_0{4}=0 t=0 1-o (ch) 1-0 (-3]. + log(1 (i) Write down the period by period budget constraint of the representative agent. (ii) Write down the Bellman equation for the above dynamic optimization problem. (iii) Assuming that a unique value function exists which is also differentiable, write down the corresponding first order conditions. (Notice that now there are two control variables: cand ). (iv) Apply Envelope theorem and simplify to derive the equations charaterising the optimal dynamic paths of ch, land kh. (v) Show that along the optimal path, as current. wage rate (w) rises, the effect on optimal labour supply could be ambiguous; it does not necessarily rise.

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 P1xQ1p2xQ2m Bread x10juice x 020 The budget constraints shows the various combinations of the two ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started