Consider an economy that adopts a fixed exchange rate regime and that possesses the vol- ume of reserves R>0, administered by the central bank

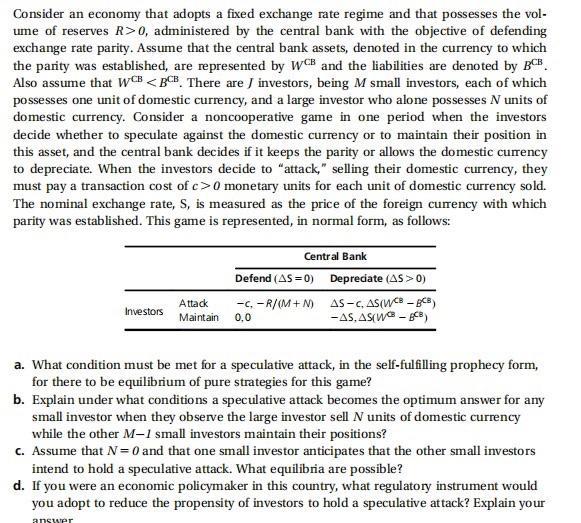

Consider an economy that adopts a fixed exchange rate regime and that possesses the vol- ume of reserves R>0, administered by the central bank with the objective of defending exchange rate parity. Assume that the central bank assets, denoted in the currency to which the party was established, are represented by WCB and the liabilities are denoted by BCB Also assume that WCB 0 monetary units for each unit of domestic currency sold. The nominal exchange rate, S, is measured as the price of the foreign currency with which parity was established. This game is represented, in normal form, as follows: Investors Attack Maintain Central Bank Defend (AS=0) -C, -R/(M+N) 0,0 Depreciate (AS > 0) AS-C, AS(WCB - BCB) -AS, AS(WB-BCB) a. What condition must be met for a speculative attack, in the self-fulfilling prophecy form, for there to be equilibrium of pure strategies for this game? b. Explain under what conditions a speculative attack becomes the optimum answer for any small investor when they observe the large investor sell N units of domestic currency while the other M-1 small investors maintain their positions? c. Assume that N = 0 and that one small investor anticipates that the other small investors intend to hold a speculative attack. What equilibria are possible? d. If you were an economic policymaker in this country, what regulatory instrument would you adopt to reduce the propensity of investors to hold a speculative attack? Explain your answer

Step by Step Solution

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

aThere must be a speculative attack if the central bank does not defend the parity A speculative attack is a situation where investors believe that a ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started