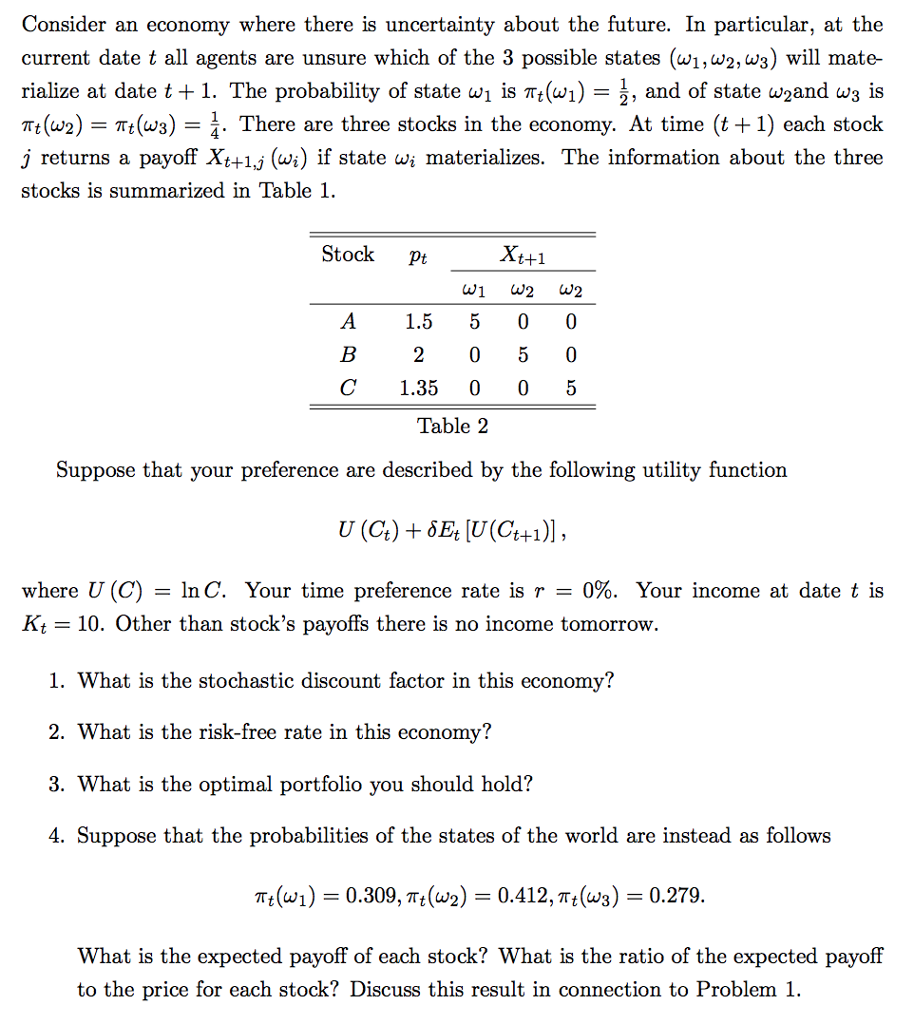

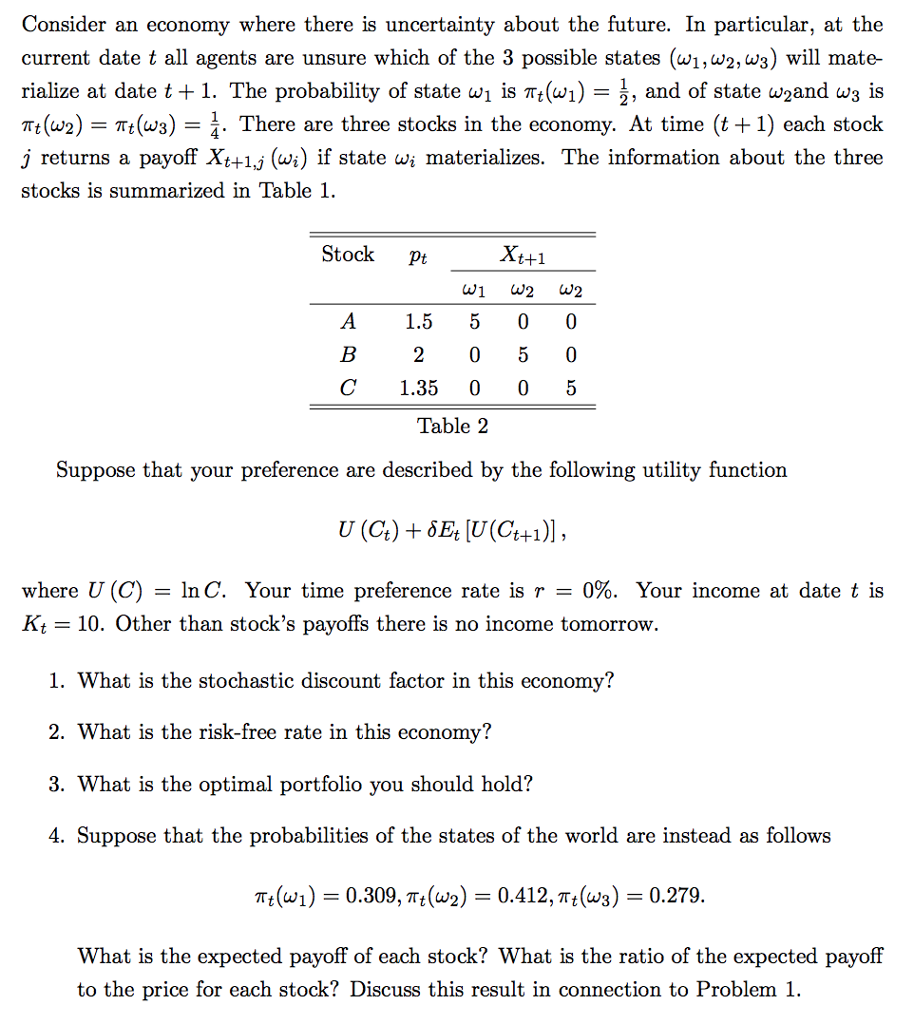

Consider an economy where there is uncertainty about the future. In particular, at the current date t all agents are unsure which of the 3 possible states (wl,w2,W3) will mate- rialize at date t + 1. The probability of state ! is (w1) = , and of state 2and 3 is Rt(w2) = t(ws) = . There are three stocks in the economy. At time (t + 1) each stock j returns a payoff Xt+1 (wi) if state wi materializes. The information about the three stocks is summarized in Table 1. Stock Pt t+1 A 1.5 5 00 20 5 0 C 1.35 0 05 Table 2 Suppose that your preference are described by the following utility function where U (C) = Inc. Your time preference rate is r-0%. Your income at date t is 10. Other than stock's payoffs there is no income tomorrow. 1. What is the stochastic discount factor in this economy? 2. What is the risk-free rate in this economy? 3. What is the optimal portfolio you should hold? 4. Suppose that the probabilities of the states of the world are instead as follows (a, 1) 0.309. TIt(w2) 0.412,T(os) = 0.279. What is the expected payoff of each stock? What is the ratio of the expected payoff to the price for each stock? Discuss this result in connection to Problem 1. Consider an economy where there is uncertainty about the future. In particular, at the current date t all agents are unsure which of the 3 possible states (wl,w2,W3) will mate- rialize at date t + 1. The probability of state ! is (w1) = , and of state 2and 3 is Rt(w2) = t(ws) = . There are three stocks in the economy. At time (t + 1) each stock j returns a payoff Xt+1 (wi) if state wi materializes. The information about the three stocks is summarized in Table 1. Stock Pt t+1 A 1.5 5 00 20 5 0 C 1.35 0 05 Table 2 Suppose that your preference are described by the following utility function where U (C) = Inc. Your time preference rate is r-0%. Your income at date t is 10. Other than stock's payoffs there is no income tomorrow. 1. What is the stochastic discount factor in this economy? 2. What is the risk-free rate in this economy? 3. What is the optimal portfolio you should hold? 4. Suppose that the probabilities of the states of the world are instead as follows (a, 1) 0.309. TIt(w2) 0.412,T(os) = 0.279. What is the expected payoff of each stock? What is the ratio of the expected payoff to the price for each stock? Discuss this result in connection to Problem 1