Answered step by step

Verified Expert Solution

Question

1 Approved Answer

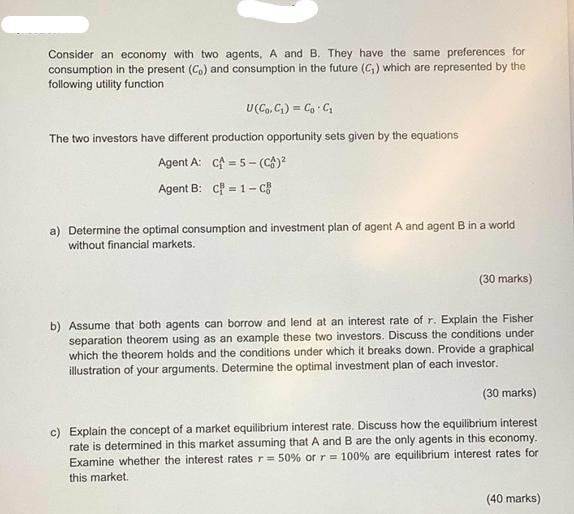

Consider an economy with two agents, A and B. They have the same preferences for consumption in the present (Co) and consumption in the

Consider an economy with two agents, A and B. They have the same preferences for consumption in the present (Co) and consumption in the future (C) which are represented by the following utility function U(Co. C)= Co C The two investors have different production opportunity sets given by the equations Agent A: C5-(C) Agent B: C1-C a) Determine the optimal consumption and investment plan of agent A and agent B in a world without financial markets. (30 marks) b) Assume that both agents can borrow and lend at an interest rate of r. Explain the Fisher separation theorem using as an example these two investors. Discuss the conditions under which the theorem holds and the conditions under which it breaks down. Provide a graphical illustration of your arguments. Determine the optimal investment plan of each investor. (30 marks) c) Explain the concept of a market equilibrium interest rate. Discuss how the equilibrium interest rate is determined in this market assuming that A and B are the only agents in this economy. Examine whether the interest rates r = 50 % or r= 100% are equilibrium interest rates for this market. (40 marks)

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a In a world without financial markets both agents A and B have to rely on their own production opportunity sets to determine their optimal consumption and investment plans Using the utility ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started