Answered step by step

Verified Expert Solution

Question

1 Approved Answer

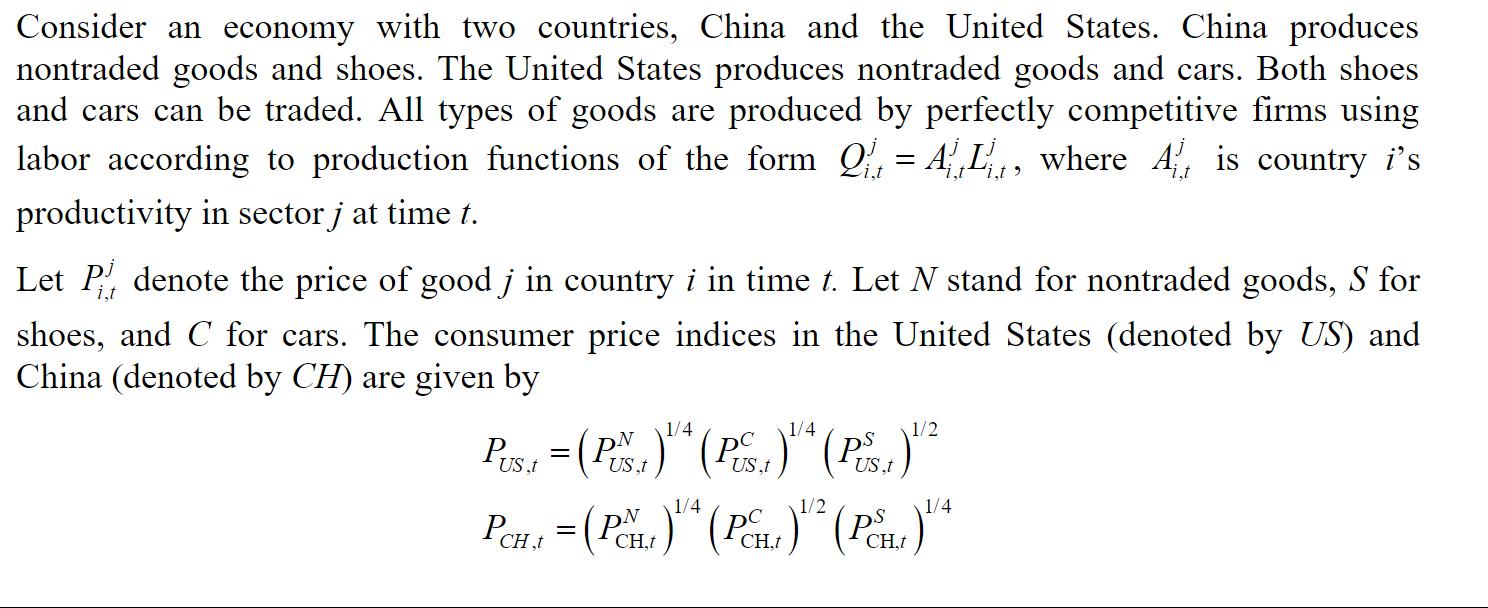

Consider an economy with two countries, China and the United States. China produces nontraded goods and shoes. The United States produces nontraded goods and

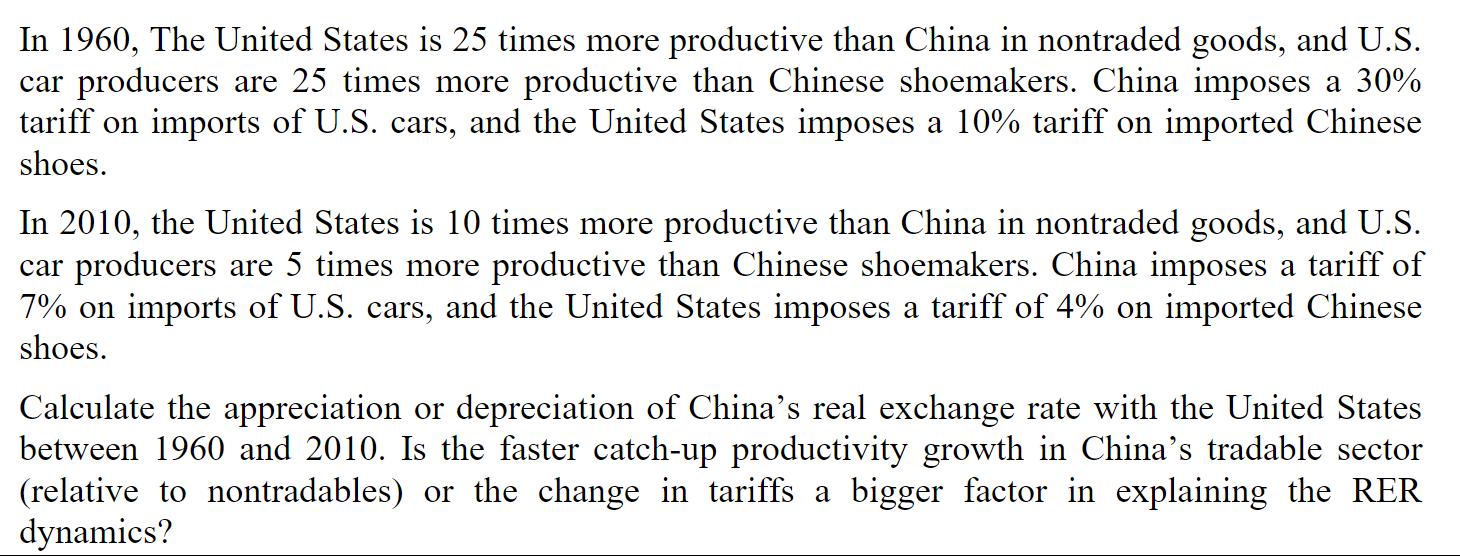

Consider an economy with two countries, China and the United States. China produces nontraded goods and shoes. The United States produces nontraded goods and cars. Both shoes and cars can be traded. All types of goods are produced by perfectly competitive firms using labor according to production functions of the form QAL, where 4, is country i's productivity in sector j at time t. i,t i,t = Let P denote the price of good j in country i in time t. Let N stand for nontraded goods, S for shoes, and C for cars. The consumer price indices in the United States (denoted by US) and China (denoted by CH) are given by 1/4 1/4 1/2 PUS.1 = (P1) (Ps.) (P.) 2 US,t 1/4 US,t 1/2 PCH = (POL) (PG)" (PG) CH,t 1/4 In 1960, The United States is 25 times more productive than China in nontraded goods, and U.S. car producers are 25 times more productive than Chinese shoemakers. China imposes a 30% tariff on imports of U.S. cars, and the United States imposes a 10% tariff on imported Chinese shoes. In 2010, the United States is 10 times more productive than China in nontraded goods, and U.S. car producers are 5 times more productive than Chinese shoemakers. China imposes a tariff of 7% on imports of U.S. cars, and the United States imposes a tariff of 4% on imported Chinese shoes. Calculate the appreciation or depreciation of China's real exchange rate with the United States between 1960 and 2010. Is the faster catch-up productivity growth in China's tradable sector (relative to nontradables) or the change in tariffs a bigger factor in explaining the RER dynamics?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the appreciation or depreciation of Chinas real exchange rate RER with the United States between 1960 and 2010 we need to compare the RER values in these two years The RER is calculated u...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started