Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider an economy with two risky assets and a risk-free bond. Suppose the CAPM model correctly describes the asset returns, the expected return of

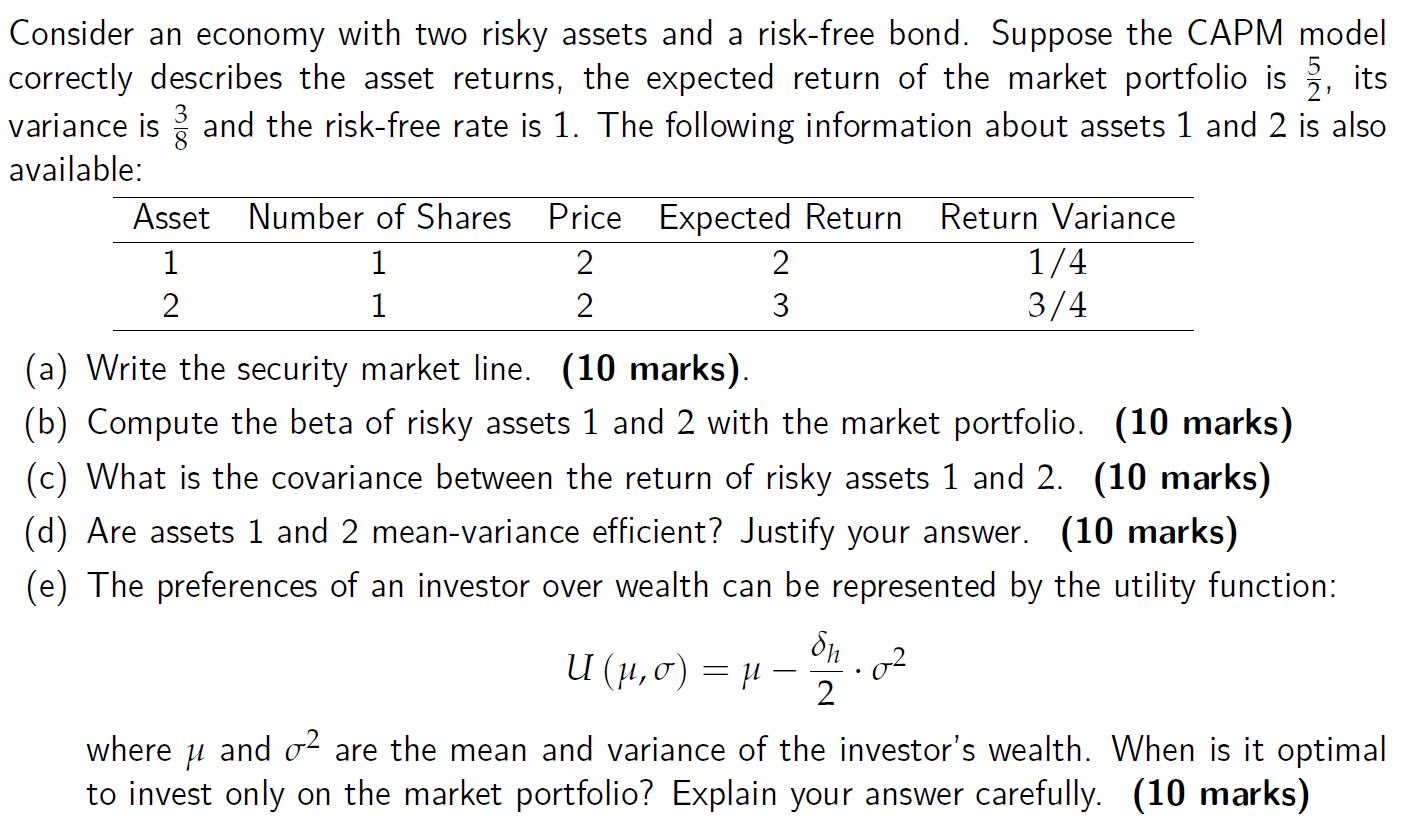

Consider an economy with two risky assets and a risk-free bond. Suppose the CAPM model correctly describes the asset returns, the expected return of the market portfolio is 5, its variance is 3 and the risk-free rate is 1. The following information about assets 1 and 2 is also available: Asset Number of Shares Price Expected Return Return Variance 1 2 2 1/4 2 2 3 3/4 1 1 (a) Write the security market line. (10 marks). (b) Compute the beta of risky assets 1 and 2 with the market portfolio. (10 marks) (c) What is the covariance between the return of risky assets 1 and 2. (10 marks) (d) Are assets 1 and 2 mean-variance efficient? Justify your answer. (10 marks) (e) The preferences of an investor over wealth can be represented by the utility function: U (,) = 02 2 where and 2 are the mean and variance of the investor's wealth. When is it optimal to invest only on the market portfolio? Explain your answer carefully. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

b To compute the beta of risky assets 1 and 2 with the market portfolio we need to use the following formula Beta Covarianceasset market Variancemarket First lets calculate the expected return and var...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started