Answered step by step

Verified Expert Solution

Question

1 Approved Answer

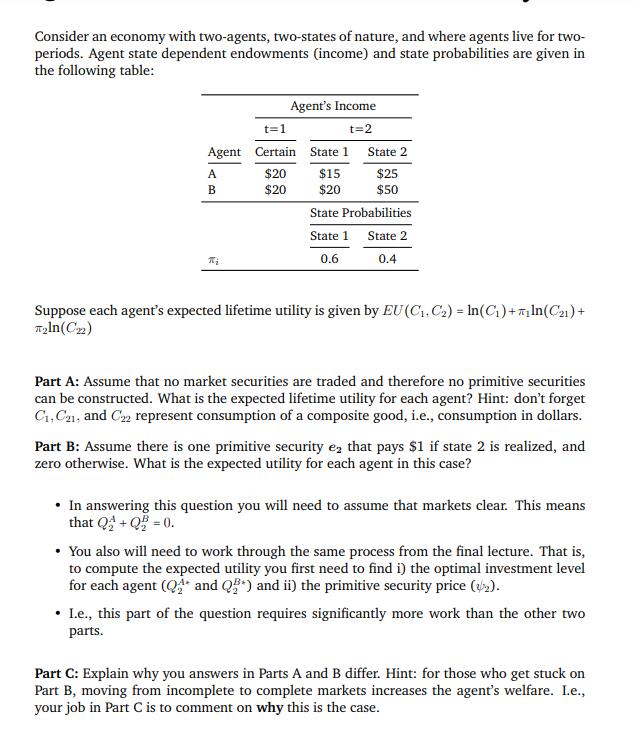

Consider an economy with two-agents, two-states of nature, and where agents live for two- periods. Agent state dependent endowments (income) and state probabilities are

Consider an economy with two-agents, two-states of nature, and where agents live for two- periods. Agent state dependent endowments (income) and state probabilities are given in the following table: Agent A B Ri Agent's Income t=2 t=1 Certain $20 $20 State 1 State 2 $15 $25 $20 $50 State Probabilities State 1. 0.6 State 2 0.4 Suppose each agent's expected lifetime utility is given by EU (C, C) = ln(C) + ln(C1) + Tln(C22) Part A: Assume that no market securities are traded and therefore no primitive securities can be constructed. What is the expected lifetime utility for each agent? Hint: don't forget C,C21, and C22 represent consumption of a composite good, i.e., consumption in dollars. Part B: Assume there is one primitive security e that pays $1 if state 2 is realized, and zero otherwise. What is the expected utility for each agent in this case? In answering this question you will need to assume that markets clear. This means that Q + Q = 0. You also will need to work through the same process from the final lecture. That is, to compute the expected utility you first need to find i) the optimal investment level for each agent (Q* and Q5*) and ii) the primitive security price (2). I.e., this part of the question requires significantly more work than the other two parts. Part C: Explain why you answers in Parts A and B differ. Hint: for those who get stuck on Part B, moving from incomplete to complete markets increases the agent's welfare. L.e., your job in Part C is to comment on why this is the case.

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Part A Agent As expected lifetime utility is EUC1 C2 ln20 06ln15 04...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started