Answered step by step

Verified Expert Solution

Question

1 Approved Answer

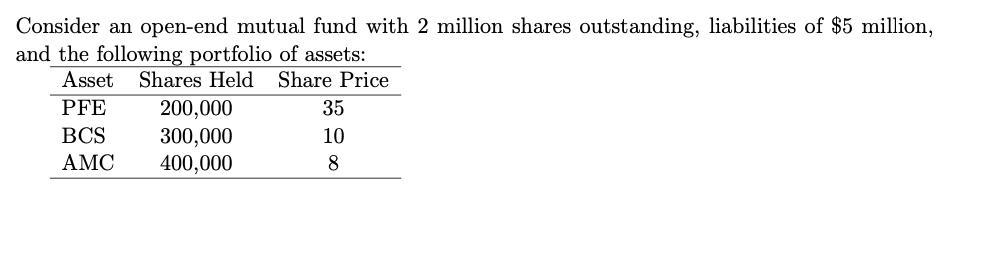

Consider an open-end mutual fund with 2 million shares outstanding, liabilities of $5 million, and the following portfolio of assets: Asset Shares Held Share

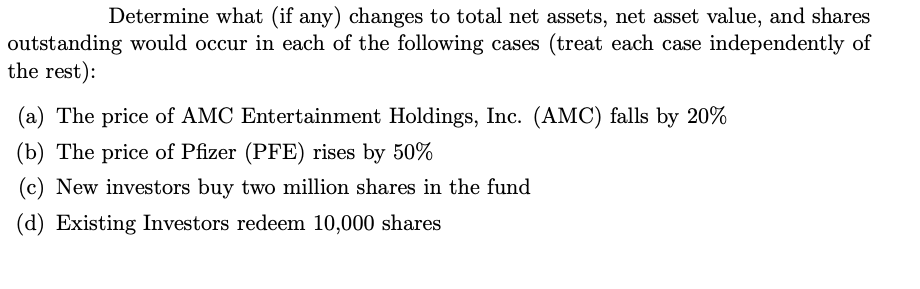

Consider an open-end mutual fund with 2 million shares outstanding, liabilities of $5 million, and the following portfolio of assets: Asset Shares Held Share Price PFE BCS AMC 200,000 300,000 400,000 35 10 8 Determine what (if any) changes to total net assets, net asset value, and shares outstanding would occur in each of the following cases (treat each case independently of the rest): (a) The price of AMC Entertainment Holdings, Inc. (AMC) falls by 20% (b) The price of Pfizer (PFE) rises by 50% (c) New investors buy two million shares in the fund (d) Existing Investors redeem 10,000 shares

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a If the price of AMC falls by 20 the total net assets would decrease as the value of the funds hold...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started