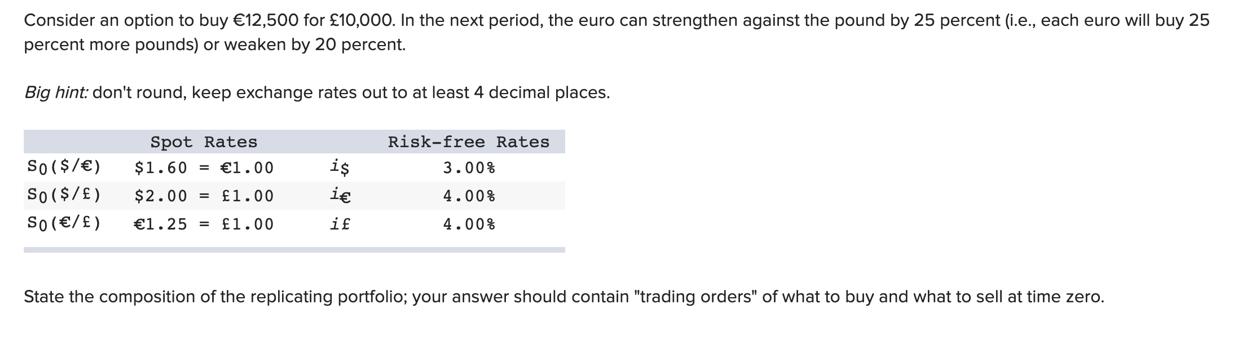

Consider an option to buy 12,500 for 10,000. In the next period, the euro can strengthen against the pound by 25 percent (i.e., each

Consider an option to buy 12,500 for 10,000. In the next period, the euro can strengthen against the pound by 25 percent (i.e., each euro will buy 25 percent more pounds) or weaken by 20 percent. Big hint: don't round, keep exchange rates out to at least 4 decimal places. So ($/ ) So ($/ ) So (/ ) Spot Rates $1.60 1.00 $2.00 1.00 1.25= 1.00 i i if Risk-free Rates 3.00% 4.00% 4.00% State the composition of the replicating portfolio; your answer should contain "trading orders" of what to buy and what to sell at time zero.

Step by Step Solution

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Lets analyze the two scenarios Scenario 1 Euro strengthens against the pound by 25 In this case each ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started