Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider an rural economy with two types of risk-neutral farmers: safe and risky. Each has a project that requires a $100 investment. The only

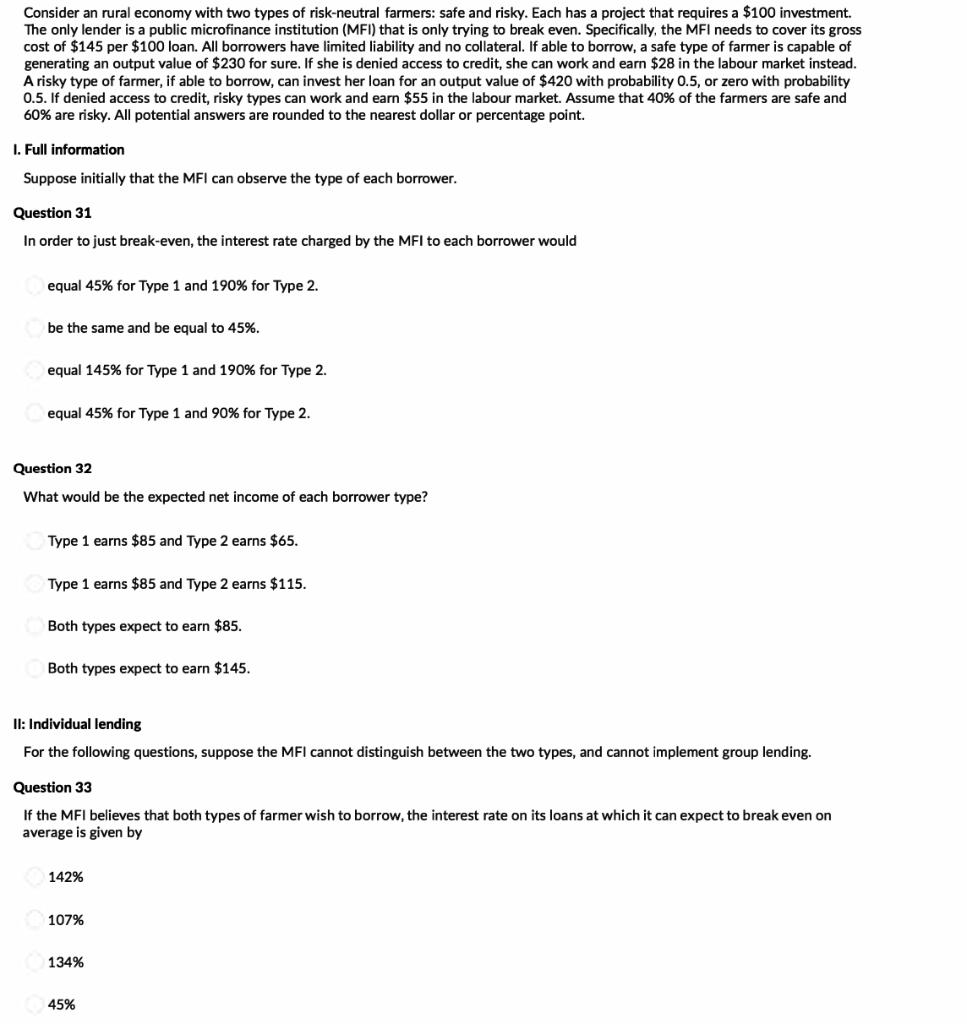

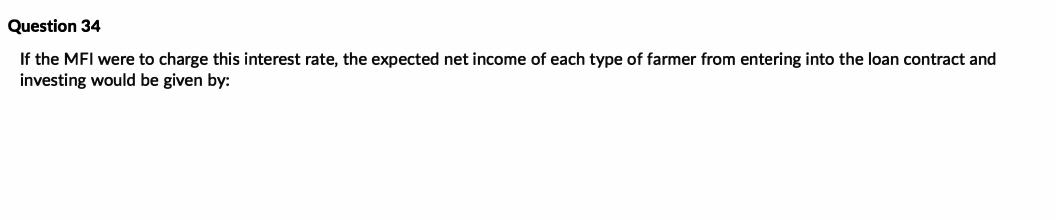

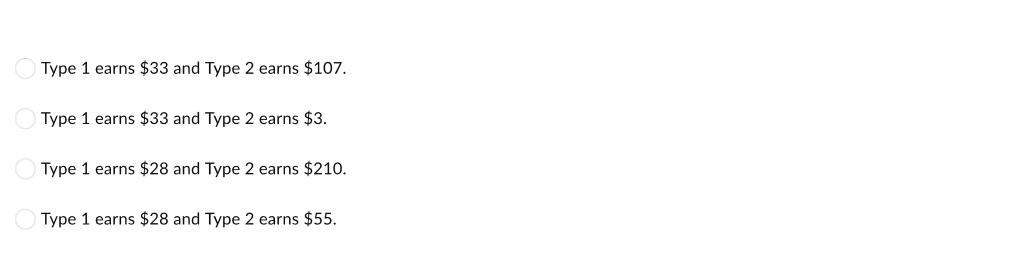

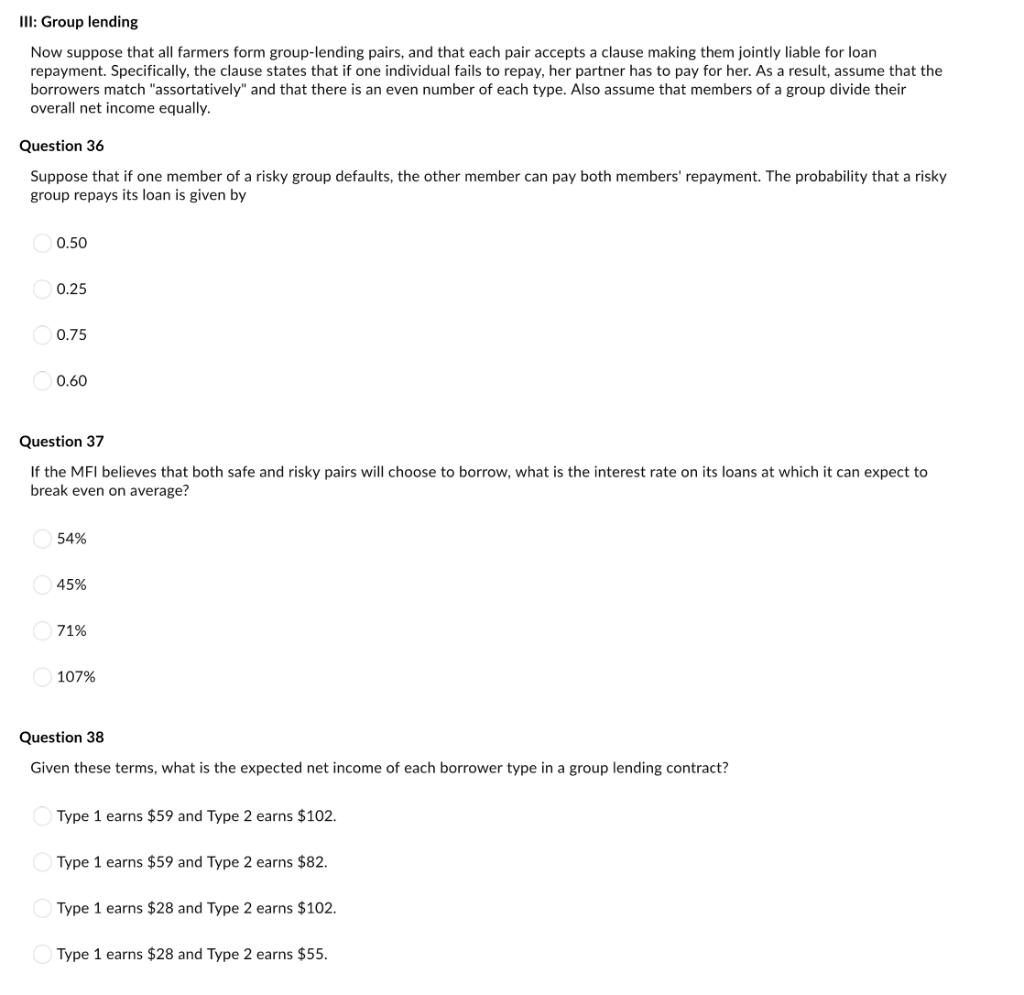

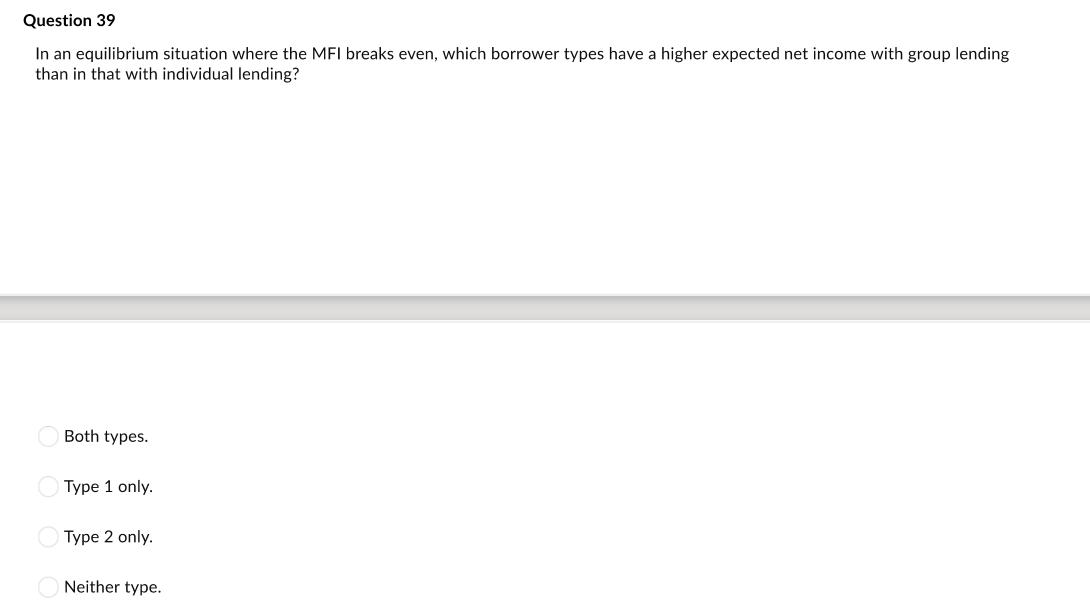

Consider an rural economy with two types of risk-neutral farmers: safe and risky. Each has a project that requires a $100 investment. The only lender is a public microfinance institution (MFI) that is only trying to break even. Specifically, the MFI needs to cover its gross cost of $145 per $100 loan. All borrowers have limited liability and no collateral. If able to borrow, a safe type of farmer is capable of generating an output value of $230 for sure. If she is denied access to credit, she can work and earn $28 in the labour market instead. A risky type of farmer, if able to borrow, can invest her loan for an output value of $420 with probability 0.5, or zero with probability 0.5. If denied access to credit, risky types can work and earn $55 in the labour market. Assume that 40% of the farmers are safe and 60% are risky. All potential answers are rounded to the nearest dollar or percentage point. I. Full information Suppose initially that the MFI can observe the type of each borrower. Question 31 In order to just break-even, the interest rate charged by the MFI to each borrower would equal 45% for Type 1 and 190 % for Type 2. be the same and be equal to 45%. equal 145% for Type 1 and 190 % for Type 2. equal 45% for Type 1 and 90% for Type 2. Question 32 What would be the expected net income of each borrower type? Type 1 earns $85 and Type 2 earns $65. Type 1 earns $85 and Type 2 earns $115. Both types expect to earn $85. Both types expect to earn $145. II: Individual lending For the following questions, suppose the MFI cannot distinguish between the two types, and cannot implement group lending. Question 33 If the MFI believes that both types of farmer wish to borrow, the interest rate on its loans at which it can expect to break even on average is given by 142% 107% 134% 45% Question 34 If the MFI were to charge this interest rate, the expected net income of each type of farmer from entering into the loan contract and investing would be given by: Type 1 earns $33 and Type 2 earns $107. Type 1 earns $33 and Type 2 earns $3. Type 1 earns $28 and Type 2 earns $210. Type 1 earns $28 and Type 2 earns $55. Question 35 Given your answers above, what is the lowest interest rate that MFI could in fact charge and still break even on average? 142% 190% 90% 45% III: Group lending Now suppose that all farmers form group-lending pairs, and that each pair accepts a clause making them jointly liable for loan repayment. Specifically, the clause states that if one individual fails to repay, her partner has to pay for her. As a result, assume that the borrowers match "assortatively" and that there is an even number of each type. Also assume that members of a group divide their overall net income equally. Question 36 Suppose that if one member of a risky group defaults, the other member can pay both members' repayment. The probability that a risky group repays its loan is given by 0.50 0.25 0.75 0.60 Question 37 If the MFI believes that both safe and risky pairs will choose to borrow, what is the interest rate on its loans at which it can expect to break even on average? 54% 45% 71% 107% Question 38 Given these terms, what is the expected net income of each borrower type in a group lending contract? Type 1 earns $59 and Type 2 earns $102. Type 1 earns $59 and Type 2 earns $82. Type 1 earns $28 and Type 2 earns $102. Type 1 earns $28 and Type 2 earns $55. Question 39 In an equilibrium situation where the MFI breaks even, which borrower types have a higher expected net income with group lending than in that with individual lending? Both types. Type 1 only. Type 2 only. Neither type.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below SOLUTION II Individual Lending Question 33 If the MFI believes that both types of farmer wish to borrow the interest rate on its loans at w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started