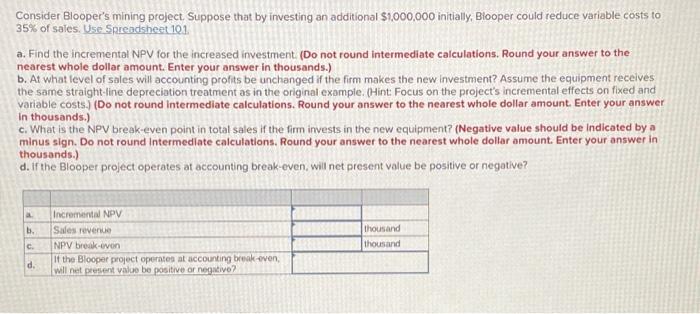

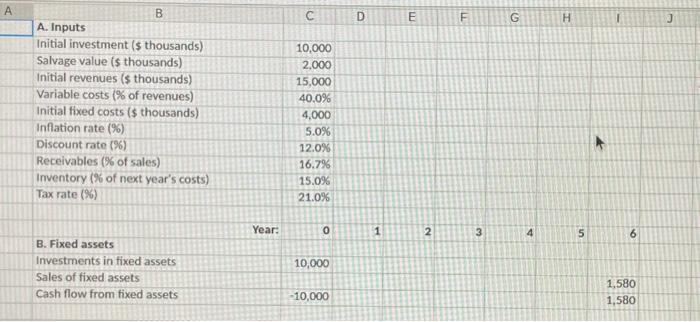

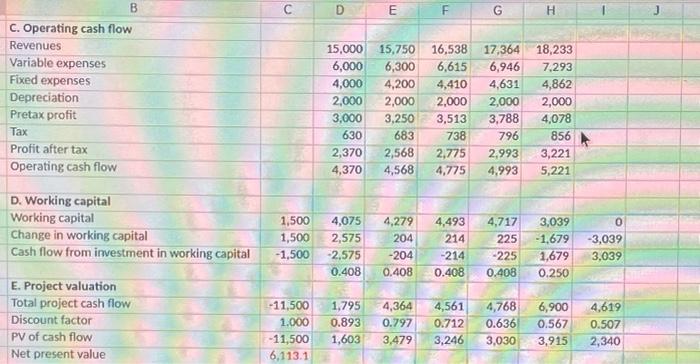

Consider Blooper's mining project. Suppose that by investing an additional $1,000,000 initially, Blooper could reduce variable costs to 35% of sales. Use Spreadsheet 101 a. Find the incremental NPV for the increased investment (Do not round intermediate calculations. Round your answer to the nearest whole dollar amount. Enter your answer in thousands.) b. At what level of sales will accounting profits be unchanged if the firm makes the new investment? Assume the equipment receives the same straight-line depreciation treatment as in the original example. (Hint: Focus on the project's incremental effects on fixed and variable costs.) (Do not round Intermediate calculations. Round your answer to the nearest whole dollar amount Enter your answer in thousands.) c. What is the NPV break-even point in total sales if the firm invests in the new equipment? (Negative value should be indicated by a minus sign. Do not round Intermediate calculations. Round your answer to the nearest whole dollar amount. Enter your answer in thousands.) d. If the Blooper project operates at accounting break-even, will net present value be positive or negative? b. Increment NPV Sales revenue NPV break-evon If the Blooper project operates at accounting break-even, wil net present value be positive or negativo? thousand thousand d. D E E F G H B A. Inputs Initial investment (s thousands) Salvage value is thousands) Initial revenues (s thousands) Variable costs (% of revenues) Initial fixed costs ($ thousands) Inflation rate (96) Discount rate (96) Receivables (% of sales) Inventory (% of next year's costs) Tax rate (9) 10,000 2.000 15,000 40.0% 4,000 5.0% 12.0% 16.7% 15.096 21.0% Year: 0 N 3 4 5 6 B. Fixed assets Investments in fixed assets Sales of fixed assets Cash flow from fixed assets 10,000 -10,000 1.580 1,580 B DO E G H C. Operating cash flow Revenues Variable expenses Fixed expenses Depreciation Pretax profit Tax Profit after tax Operating cash flow 15,000 6,000 4,000 2,000 3,000 630 2,370 4,370 15,750 6,300 4,200 2,000 3,250 683 2,568 4,568 16,538 6,615 4,410 2,000 3,513 738 2,775 4,775 17,364 6,946 4,631 2,000 3,788 796 2.993 4,993 18,233 7.293 4,862 2,000 4,078 856 3,221 5,221 D. Working capital Working capital Change in working capital Cash flow from investment in working capital 0 1,500 1,500 -1,500 4,075 2,575 -2,575 0.408 4,279 204 -204 0.408 4,493 214 -214 0.408 4,717 225 -225 0.408 3,039 -1.679 1,679 0.250 -3,039 3,039 E. Project valuation Total project cash flow Discount factor PV of cash flow Net present value - 11.500 1.000 -11,500 6,113.1 1,795 0.893 1,603 4,364 0.797 3,479 4,561 0.712 3,246 4,768 0.636 3,030 6,900 0.567 3,915 4,619 0.507 2,340 Consider Blooper's mining project. Suppose that by investing an additional $1,000,000 initially, Blooper could reduce variable costs to 35% of sales. Use Spreadsheet 101 a. Find the incremental NPV for the increased investment (Do not round intermediate calculations. Round your answer to the nearest whole dollar amount. Enter your answer in thousands.) b. At what level of sales will accounting profits be unchanged if the firm makes the new investment? Assume the equipment receives the same straight-line depreciation treatment as in the original example. (Hint: Focus on the project's incremental effects on fixed and variable costs.) (Do not round Intermediate calculations. Round your answer to the nearest whole dollar amount Enter your answer in thousands.) c. What is the NPV break-even point in total sales if the firm invests in the new equipment? (Negative value should be indicated by a minus sign. Do not round Intermediate calculations. Round your answer to the nearest whole dollar amount. Enter your answer in thousands.) d. If the Blooper project operates at accounting break-even, will net present value be positive or negative? b. Increment NPV Sales revenue NPV break-evon If the Blooper project operates at accounting break-even, wil net present value be positive or negativo? thousand thousand d. D E E F G H B A. Inputs Initial investment (s thousands) Salvage value is thousands) Initial revenues (s thousands) Variable costs (% of revenues) Initial fixed costs ($ thousands) Inflation rate (96) Discount rate (96) Receivables (% of sales) Inventory (% of next year's costs) Tax rate (9) 10,000 2.000 15,000 40.0% 4,000 5.0% 12.0% 16.7% 15.096 21.0% Year: 0 N 3 4 5 6 B. Fixed assets Investments in fixed assets Sales of fixed assets Cash flow from fixed assets 10,000 -10,000 1.580 1,580 B DO E G H C. Operating cash flow Revenues Variable expenses Fixed expenses Depreciation Pretax profit Tax Profit after tax Operating cash flow 15,000 6,000 4,000 2,000 3,000 630 2,370 4,370 15,750 6,300 4,200 2,000 3,250 683 2,568 4,568 16,538 6,615 4,410 2,000 3,513 738 2,775 4,775 17,364 6,946 4,631 2,000 3,788 796 2.993 4,993 18,233 7.293 4,862 2,000 4,078 856 3,221 5,221 D. Working capital Working capital Change in working capital Cash flow from investment in working capital 0 1,500 1,500 -1,500 4,075 2,575 -2,575 0.408 4,279 204 -204 0.408 4,493 214 -214 0.408 4,717 225 -225 0.408 3,039 -1.679 1,679 0.250 -3,039 3,039 E. Project valuation Total project cash flow Discount factor PV of cash flow Net present value - 11.500 1.000 -11,500 6,113.1 1,795 0.893 1,603 4,364 0.797 3,479 4,561 0.712 3,246 4,768 0.636 3,030 6,900 0.567 3,915 4,619 0.507 2,340