Answered step by step

Verified Expert Solution

Question

1 Approved Answer

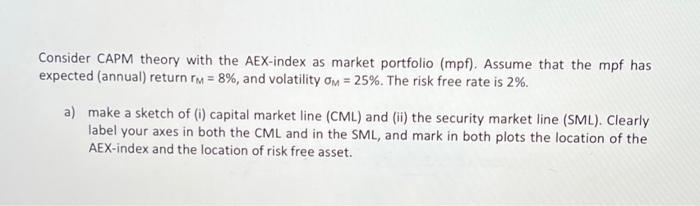

Consider CAPM theory with the AEX-index as market portfolio (mpf). Assume that the mpf has expected (annual) return rM = 8%, and volatility oM

Consider CAPM theory with the AEX-index as market portfolio (mpf). Assume that the mpf has expected (annual) return rM = 8%, and volatility oM = 25%. The risk free rate is 2%. a) make a sketch of (i) capital market line (CML) and (ii) the security market line (SML). Clearly label your axes in both the CML and in the SML, and mark in both plots the location of the AEX-index and the location of risk free asset.

Step by Step Solution

★★★★★

3.50 Rating (177 Votes )

There are 3 Steps involved in it

Step: 1

m stP soo indey CML 91 SAPSO0 index ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started