Answered step by step

Verified Expert Solution

Question

1 Approved Answer

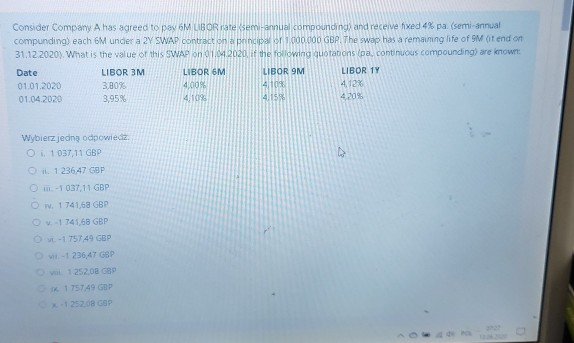

Consider Company A has agreed to pay 6M LIBOR rate Semi-annual compounding and receive fixed 4% pa. (semi-annual compunding) each 6M under a 2Y SWAP

Consider Company A has agreed to pay 6M LIBOR rate Semi-annual compounding and receive fixed 4% pa. (semi-annual compunding) each 6M under a 2Y SWAP contract on a principal o 1000.000 GBPL The swap has a remaining life of SM at end on 31.12.2020) What is the value of this SWAP on 01.04.2020. If the following quotations (pa, continuous compounding) are known Date LIBOR 3M LIBOR 6M LIBOR 9M LIBOR TY 01.01.2020 3,80% 4008 4108 01.04.2020 3,95% 4109 4.15% 4209 412 Wybierz jedn odpowiedz. Oi, 1 037,11 GBP 1 23647 COP -1037,11 GBP W 1 741,68 GBP OV-1 741,68 GBP - 1 757 49 GBP -1 236,47 GSP 125208 689 4 || 125208 GBP - Consider Company A has agreed to pay 6M LIBOR rate Semi-annual compounding and receive fixed 4% pa. (semi-annual compunding) each 6M under a 2Y SWAP contract on a principal o 1000.000 GBPL The swap has a remaining life of SM at end on 31.12.2020) What is the value of this SWAP on 01.04.2020. If the following quotations (pa, continuous compounding) are known Date LIBOR 3M LIBOR 6M LIBOR 9M LIBOR TY 01.01.2020 3,80% 4008 4108 01.04.2020 3,95% 4109 4.15% 4209 412 Wybierz jedn odpowiedz. Oi, 1 037,11 GBP 1 23647 COP -1037,11 GBP W 1 741,68 GBP OV-1 741,68 GBP - 1 757 49 GBP -1 236,47 GSP 125208 689 4 || 125208 GBP

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started