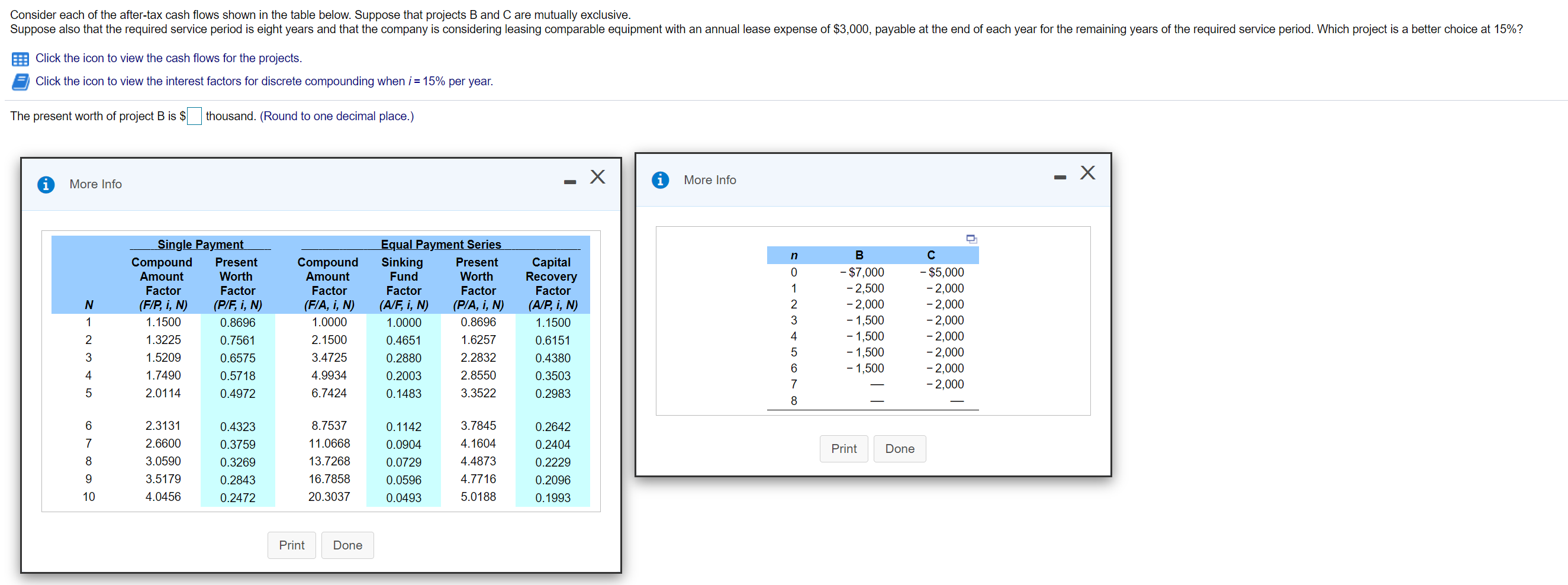

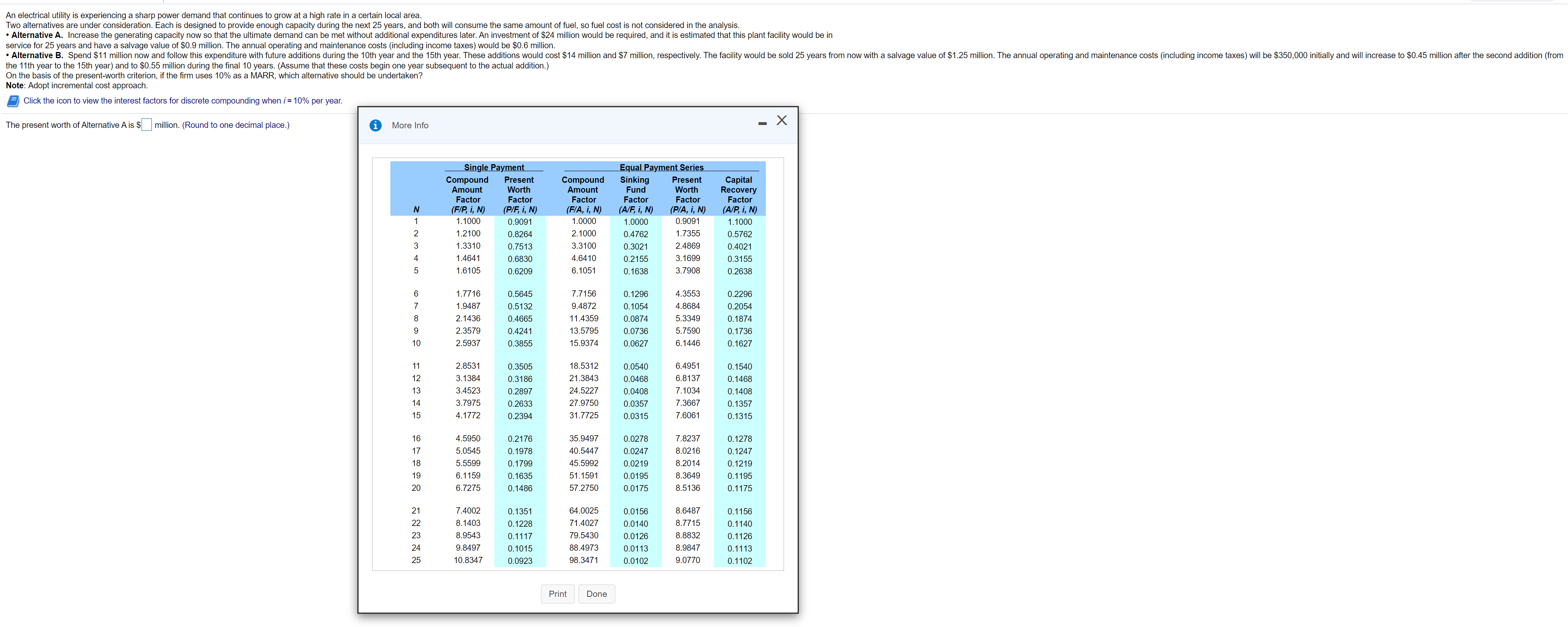

Consider each of the alter-tax cash "mus shmun in the lable below. Suppose that projects 5 and C are mutually exclusive. Suppose also mat the required service period is eight years and that the company is considering leasing comparable equipment with an annual lease expense of $3,000, payable at the end of each year tor the remaining years at me required service period. which project is a better choice at 15%? a Click the icon to View the cash ows for the projects. a Click the icon to View the interest factors for discrete compounding when i=15% per year. The present worth of project B is 35 thousand. (Round to one decimal place.) o More Info 1 .0000 2.1500 3.4725 4.9934 6.7424 8.7537 \"'06\" Print ' ' Done 13.7268 16.7558 20.5037 Print ' Done ' An electrical utility is experiencing a sharp power demand that continues to grow at a high rate in a certain local area. Two alternatives are under consideration. Each is designed to provide enough capacity during the next 25 years, and both will consume the same amount of fuel, so fuel cost is not considered in the analysis. . Alternative A. Increase the generating capacity now so that the ultimate demand can be met without additional expenditures later. An investment of $24 million would be required, and it is estimated that this plant facility would be in service for 25 years and have a salvage value of $0.9 million. The annual operating and maintenance costs (including income taxes) would be $0.6 million. . Alternative B. Spend $11 million now and follow this expenditure with future additions during the 10th year and the 15th year. These additions would cost $14 million and $7 million, respectively. The facility would be sold 25 years from now with a salvage value of $1.25 million. The annual operating and maintenance costs (including income taxes) will be $350,000 initially and will increase to $0.45 million after the second addition (from the 11th year to the 15th year) and to $0.55 million during the final 10 years. (Assume that these costs begin one year subsequent to the actual addition.) On the basis of the present-worth criterion, if the firm uses 10% as a MARR, which alternative should be undertaken? Note: Adopt incremental cost approach. Click the icon to view the interest factors for discrete compounding when i = 10% per year. The present worth of Alternative A is $ |million. (Round to one decimal place.) i More Info - X Single Payment Equal Payment Series Compound Present Compound Sinking Present Capital Amount Worth Amoun Fund Worth Recovery Factor Factor Factor Factor Factor Factor F/P, i, N) (P/F, i, N) F/A, i, N) A/F, i, N P/A, i, N) A/P, i, N) 1.1000 0.9091 1.0000 1.0000 0.9091 1.1000 1.2100 0.8264 2.1000 0.4762 1.7355 0.5762 AWN- 1.3310 0.7513 3.3100 0.3021 2.4869 0.4021 1.4641 0.6830 4.6410 0.2155 3.169 0.3155 1.6105 0.6209 6.1051 0.1638 3,7908 0.2638 1.7716 0.5645 7.7156 .1296 1.3553 0.2296 1.9487 0.5132 9.4872 . 1054 4.868 0.205 2.1436 0.4665 11.4359 0.0874 5.3349 0. 1874 2.3579 0.4241 13.5795 0.0736 5.759 0. 1736 2.5937 0.3855 15.9374 0.0627 6.1446 0. 1627 2.8531 0.3505 18.5312 0.0540 6.4951 0. 1540 3.1384 0.3186 21.3843 0.0468 6.813 0.1468 3.452 0.2897 24.5227 0.0408 7.1034 0.1408 3.7975 0.2633 27.9750 0.0357 7.3667 0.1357 4.1772 0.2394 31.7725 0.0315 7.6061 0.1315 4.5950 0.217 35.9497 0.0278 7.823 0. 1278 5.0545 0.1978 10.5447 0.0247 .021 0.1247 5.55 0. 1799 45.5992 .0219 8.2014 .121 5.1159 0. 1635 51.1591 0.0195 8.3649 0. 1195 6.7275 0. 1486 57.2750 0.0175 8.5136 0.1175 7.4002 0.1351 64.0025 0.0156 8.6487 0.1156 8.1403 0.1228 1.4027 0.0140 8.7715 0.1140 8.9543 0.1117 79.5430 0.0126 8.8832 0.1126 .8497 .101 88.4973 0.0113 8.9847 0.1113 10.8347 0.0923 98.3471 0.0102 9.0770 0.1102 Print Done